Global Contactless Payments Market - Key Trends & Drivers Summarized

How Is The Shift Towards Digital Payments Accelerating The Contactless Payments Market?

The global contactless payments market is expanding rapidly, driven by a widespread shift towards digital payment methods. This shift is fueled by consumer preferences for faster, more secure, and convenient payment options. With the rise of e-commerce and digital wallets, consumers increasingly favor contactless transactions, which provide seamless experiences both online and in-store. The COVID-19 pandemic further accelerated this trend, as hygiene concerns prompted a move away from cash and contact-based payment methods towards contactless solutions such as Near-Field Communication (NFC) and Radio Frequency Identification (RFID) technologies. Financial institutions, retailers, and tech companies are all investing in expanding their contactless payment offerings to cater to this growing demand, enhancing the global financial ecosystem's efficiency and inclusivity.What Technological Developments Are Shaping The Future Of Contactless Payments?

Technological advancements are crucial in shaping the future of the contactless payments market. Innovations such as biometric authentication, blockchain technology, and tokenization are enhancing the security and reliability of contactless transactions. Biometric methods, including fingerprint and facial recognition, add an extra layer of security, making transactions more secure and reducing fraud risks. The integration of blockchain technology into payment systems promises greater transparency, traceability, and security in contactless transactions. Additionally, tokenization - replacing sensitive card information with unique digital identifiers - is gaining traction as it minimizes data theft and fraud during transactions. Moreover, the proliferation of wearable devices, such as smartwatches and rings equipped with payment capabilities, is providing consumers with more flexible payment options, further boosting the adoption of contactless payments.How Are Regulatory Changes And Consumer Preferences Driving Contactless Payments Adoption?

Regulatory changes and evolving consumer preferences are pivotal in driving the adoption of contactless payments. Governments and financial regulators worldwide are raising contactless transaction limits to encourage cashless transactions and foster financial inclusion. In regions like Europe and Asia-Pacific, where contactless payments are becoming the norm, regulatory bodies are mandating stronger security protocols and fraud prevention measures to build consumer trust. Meanwhile, consumers are increasingly seeking faster, more secure, and convenient payment methods. The desire for seamless user experiences is pushing financial service providers and merchants to enhance their contactless payment systems, offering added functionalities such as loyalty programs and digital receipts. These developments underscore the growing alignment of regulatory frameworks and consumer expectations in promoting the uptake of contactless payments.What Factors Are Driving The Growth Of The Contactless Payments Market?

The growth in the contactless payments market is driven by several factors, including rising consumer demand for convenience, advancements in payment technology, and supportive regulatory environments. A key driver is the increasing penetration of smartphones and wearable devices, which facilitate easy access to contactless payment methods. The COVID-19 pandemic significantly accelerated the adoption of contactless payments as businesses and consumers sought safer, touch-free payment options. Furthermore, the integration of contactless payment systems into public transportation networks, retail, and hospitality sectors is fostering greater usage. Continuous innovation in payment solutions, such as mobile wallets and biometric cards, is also driving market expansion. Additionally, financial inclusion initiatives by governments and financial institutions, particularly in developing regions, are making digital and contactless payments more accessible to the unbanked population, further fueling market growth.Report Scope

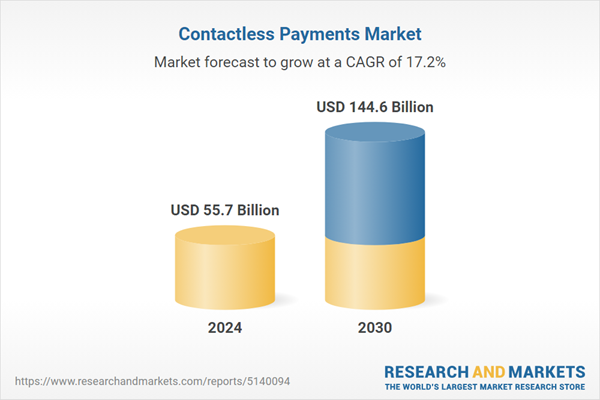

The report analyzes the Contactless Payments market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Device (Smartphone-Based, Card-Based); Application (Retail, Transportation, Healthcare, Hospitality, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Smartphone-Based Contactless Payments segment, which is expected to reach US$92.8 Billion by 2030 with a CAGR of a 18.9%. The Card-Based Contactless Payments segment is also set to grow at 14.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.7 Billion in 2024, and China, forecasted to grow at an impressive 23.2% CAGR to reach $36.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Contactless Payments Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Contactless Payments Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Contactless Payments Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Absolutely No Nonsense Admin Limited, Accomplish Financial Limited, Approvely, Inc., Arround Inc., Axepta S.p.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 72 companies featured in this Contactless Payments market report include:

- Absolutely No Nonsense Admin Limited

- Accomplish Financial Limited

- Approvely, Inc.

- Arround Inc.

- Axepta S.p.A.

- Banco San Juan Internacional, Inc.

- Barclays plc.

- Brush Industries, Inc.

- CELLI S.p.A.

- Dream Payments Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Absolutely No Nonsense Admin Limited

- Accomplish Financial Limited

- Approvely, Inc.

- Arround Inc.

- Axepta S.p.A.

- Banco San Juan Internacional, Inc.

- Barclays plc.

- Brush Industries, Inc.

- CELLI S.p.A.

- Dream Payments Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 209 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 55.7 Billion |

| Forecasted Market Value ( USD | $ 144.6 Billion |

| Compound Annual Growth Rate | 17.2% |

| Regions Covered | Global |