Global Cellulose Fibers Market - Key Trends & Drivers Summarized

What Innovations Are Leading the Way in the Cellulose Fibers Market?

The cellulose fibers market is experiencing significant growth, driven by innovations in sustainable and eco-friendly materials. As consumers and industries shift towards more sustainable practices, cellulose fibers, derived from natural sources like wood pulp and cotton, are gaining prominence. Advanced manufacturing techniques have improved the quality, texture, and functionality of these fibers, making them highly sought after in the textile, paper, and hygiene product industries. Innovations such as lyocell and modal fibers, which offer superior softness and durability, are finding increasing applications in high-performance clothing and home textiles. These advancements are reshaping the market landscape by meeting the growing demand for sustainable alternatives.Why Is There a Rising Demand for Cellulose Fibers Across Industries?

The demand for cellulose fibers is escalating due to the increasing need for sustainable and biodegradable materials in various industries. In the textile sector, the shift from synthetic to natural fibers is driven by both consumer preferences and regulatory pressures to reduce environmental impact. Cellulose fibers are also becoming essential in the production of hygiene products such as baby diapers and sanitary napkins, thanks to their high absorbency and hypoallergenic properties. Additionally, the paper and packaging industry is leveraging these fibers to produce eco-friendly products, aligning with the global push towards reducing plastic waste and promoting recyclable materials.How Are Environmental Regulations Shaping the Cellulose Fibers Market?

Environmental regulations and sustainability goals are major factors influencing the cellulose fibers market. Governments and international organizations are implementing stricter regulations to minimize pollution and promote sustainable materials. For instance, the European Union's policies on reducing plastic waste have accelerated the shift towards cellulose-based products. These regulations are compelling manufacturers to invest in sustainable fiber production methods, such as closed-loop processes that minimize environmental impact. As a result, companies are increasingly focusing on responsible sourcing and certification, such as the Forest Stewardship Council (FSC) certification, to align with sustainability standards and consumer expectations.What Drives the Growth of the Cellulose Fibers Market?

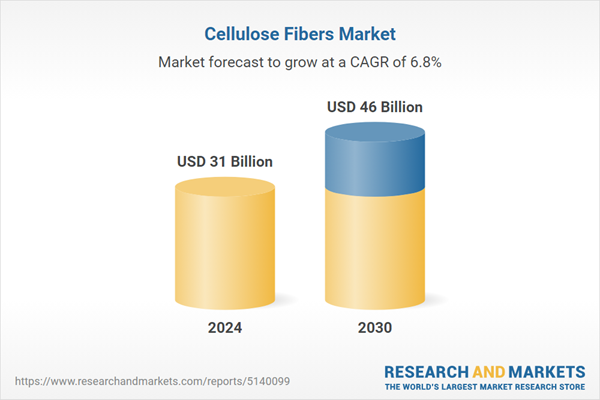

The growth in the cellulose fibers market is driven by several factors, including the increasing demand for sustainable and biodegradable products, regulatory support for eco-friendly materials, and technological advancements in fiber production. The fashion industry's shift towards sustainable practices, coupled with the rising awareness of environmental issues among consumers, is significantly contributing to market expansion. The increasing application of cellulose fibers in the hygiene and paper sectors, due to their superior performance characteristics, is also driving demand. Additionally, investments in research and development to improve the properties and applications of cellulose fibers are further boosting market growth. The convergence of these factors is fostering a robust growth trajectory for the cellulose fibers market.Report Scope

The report analyzes the Cellulose Fibers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Synthetic, Natural); End-Use (Textiles, Industrial, Hygiene, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Synthetic Cellulose Fibers segment, which is expected to reach US$26.4 Billion by 2030 with a CAGR of a 6.6%. The Natural Cellulose Fibers segment is also set to grow at 7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.1 Billion in 2024, and China, forecasted to grow at an impressive 11.1% CAGR to reach $11.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cellulose Fibers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cellulose Fibers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cellulose Fibers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Daicel Corporation, Grasim Industries Ltd., Lenzing AG, Sateri, Shandong Helon Textile Sci. & Tech. Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 56 companies featured in this Cellulose Fibers market report include:

- Daicel Corporation

- Grasim Industries Ltd.

- Lenzing AG

- Sateri

- Shandong Helon Textile Sci. & Tech. Co., Ltd.

- Tangshan Sanyou Group Xingda Chemical Fibre Co., Ltd.

- Thai Rayon Public Co., Ltd.

- Zhejiang Fulida Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Daicel Corporation

- Grasim Industries Ltd.

- Lenzing AG

- Sateri

- Shandong Helon Textile Sci. & Tech. Co., Ltd.

- Tangshan Sanyou Group Xingda Chemical Fibre Co., Ltd.

- Thai Rayon Public Co., Ltd.

- Zhejiang Fulida Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 31 Billion |

| Forecasted Market Value ( USD | $ 46 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |