Global Organic Polymer Electronics Market - Key Trends & Drivers Summarized

What Are Organic Polymer Electronics, and Why Are They Important?

Organic polymer electronics refer to a class of electronic devices and materials based on organic polymers (carbon-based compounds) rather than traditional inorganic materials like silicon. These polymers are used in various applications, including organic light-emitting diodes (OLEDs), organic photovoltaic cells (OPVs), organic field-effect transistors (OFETs), and flexible electronics. Organic polymers offer unique advantages such as flexibility, lightweight properties, and the ability to be produced at a lower cost through printing technologies. The ability of these materials to be processed at low temperatures also allows for their integration into flexible substrates, enabling innovations in bendable screens, wearable devices, and smart textiles. As consumer electronics move toward more versatile, flexible, and sustainable solutions, organic polymer electronics are becoming a cornerstone of next-generation technologies.How Is Technology Shaping the Organic Polymer Electronics Industry?

Technological advancements are transforming the organic polymer electronics industry by improving the efficiency, stability, and performance of organic electronic materials. One of the most significant innovations is in the development of high-performance organic semiconductors that offer improved charge mobility and stability, crucial for the performance of devices like OLEDs and OFETs. Innovations in printing techniques, such as roll-to-roll processing, are enabling the large-scale, low-cost manufacturing of organic electronic components, making them more commercially viable for consumer electronics and energy applications. Additionally, advancements in organic photovoltaic technology are increasing the energy conversion efficiency of solar cells, making organic materials a competitive alternative to traditional silicon-based solar panels. Research into new organic polymer blends and hybrid materials that combine the flexibility of organic polymers with the conductivity of inorganic materials is also expanding the potential applications of organic polymer electronics in areas such as biocompatible devices and medical sensors.Where Are Organic Polymer Electronics Most Widely Used?

Organic polymer electronics are primarily used in the display, energy, and sensor markets. In the display market, OLED technology has become a major application for organic polymers, particularly in smartphones, televisions, and flexible screens. OLED displays are valued for their high contrast ratios, vivid colors, and energy efficiency. In the energy sector, organic photovoltaic cells (OPVs) are gaining attention as a promising alternative to traditional solar panels, particularly in flexible and lightweight applications. OPVs can be integrated into building materials, textiles, and even portable electronics, offering a versatile solution for renewable energy generation. In the field of sensors and transistors, organic field-effect transistors (OFETs) are used in flexible and wearable devices for health monitoring, environmental sensing, and smart textiles. The ability of organic polymers to be printed onto flexible substrates opens up a wide range of applications in wearable technology, foldable electronics, and bio-integrated devices.What Is Driving the Growth of the Organic Polymer Electronics Market?

The growth in the organic polymer electronics market is driven by several factors, most notably the increasing demand for flexible, lightweight, and energy-efficient electronics. The rapid adoption of OLED displays in smartphones, TVs, and wearable devices is a key driver, as these displays offer superior performance and flexibility compared to traditional LCDs. The shift toward renewable energy sources, coupled with advancements in organic photovoltaic technology, is another significant growth factor, as OPVs offer a lightweight, flexible alternative to conventional solar panels. The rising trend of wearable technology and the Internet of Things (IoT) is driving the demand for flexible sensors and transistors, where organic polymer electronics play a critical role in enabling bendable, stretchable, and biocompatible devices. Additionally, the push for sustainable manufacturing processes and materials is contributing to market growth, as organic polymers are viewed as more environmentally friendly compared to traditional electronic materials. Finally, ongoing research and development in organic semiconductor materials and printing technologies are enhancing the performance and scalability of organic polymer electronics, making them more competitive in the global electronics market.Report Scope

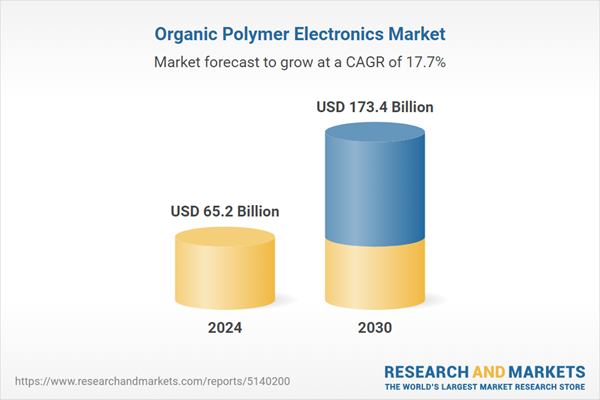

The report analyzes the Organic Polymer Electronics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Display, System Components, Organic Photovoltaics, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Display Application segment, which is expected to reach US$113.9 Billion by 2030 with a CAGR of 19.1%. The System Components Application segment is also set to grow at 15.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $16.8 Billion in 2024, and China, forecasted to grow at an impressive 24.9% CAGR to reach $48.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Organic Polymer Electronics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Organic Polymer Electronics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Organic Polymer Electronics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BOE Technology Group Co., Ltd., FlexEnable Ltd., Heliatek GmbH, Koninklijke Philips NV, LG Display Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 51 companies featured in this Organic Polymer Electronics market report include:

- BOE Technology Group Co., Ltd.

- FlexEnable Ltd.

- Heliatek GmbH

- Koninklijke Philips NV

- LG Display Co., Ltd.

- Novaled GmbH

- Samsung Display Co., Ltd.

- Sony Corporation of America

- Sumitomo Chemical Co., Ltd.

- Universal Display Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BOE Technology Group Co., Ltd.

- FlexEnable Ltd.

- Heliatek GmbH

- Koninklijke Philips NV

- LG Display Co., Ltd.

- Novaled GmbH

- Samsung Display Co., Ltd.

- Sony Corporation of America

- Sumitomo Chemical Co., Ltd.

- Universal Display Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 228 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 65.2 Billion |

| Forecasted Market Value ( USD | $ 173.4 Billion |

| Compound Annual Growth Rate | 17.7% |

| Regions Covered | Global |