Global OLED Microdisplays Market - Key Trends & Drivers Summarized

What Are OLED Microdisplays, and Why Are They Important?

OLED microdisplays are small, high-resolution screens used in applications that require compact, lightweight, and power-efficient displays, such as augmented reality (AR) and virtual reality (VR) headsets, camera viewfinders, and wearable devices. These microdisplays leverage OLED technology, where each pixel emits its own light, resulting in deep blacks, high contrast ratios, and vibrant colors. Unlike traditional LCDs, OLED microdisplays do not require a backlight, making them thinner, more efficient, and capable of producing a wider color gamut. With the rise of AR, VR, and other immersive technologies, OLED microdisplays are increasingly favored for their superior visual performance, compact size, and ability to provide a seamless user experience in devices that demand high-resolution, low-latency displays.How is Technology Shaping the OLED Microdisplay Market?

Technological advancements are significantly enhancing the capabilities of OLED microdisplays. Higher pixel densities and faster refresh rates are improving visual clarity and reducing motion blur, making OLED microdisplays ideal for AR and VR applications, where sharp, smooth images are essential for an immersive experience. Additionally, advances in resolution, with microdisplays now offering full-HD and even 4K capabilities, have made them suitable for use in advanced optics and military applications. The integration of OLED microdisplays with head-mounted displays (HMDs) for AR and VR is a key area of development, particularly as industries such as healthcare, defense, and gaming push for more immersive and accurate visualization tools. Flexible and transparent OLED microdisplays are also emerging, allowing for innovative applications in wearable technology and smart glasses, where display transparency and lightweight design are critical. These innovations are not only expanding the use cases for OLED microdisplays but also improving user comfort and device functionality.What Are the Key Applications of OLED Microdisplays?

OLED microdisplays are used across a wide range of applications where high-quality, compact displays are required. In consumer electronics, these microdisplays are found in camera viewfinders and wearable devices, offering crisp images and superior color accuracy. However, the most significant growth area for OLED microdisplays is in AR and VR headsets, which rely on high-resolution, low-latency displays to deliver immersive experiences for gaming, simulations, and training. The defense and aerospace sectors are also key users of OLED microdisplays, particularly for head-mounted displays (HMDs) used by pilots and soldiers to enhance situational awareness. Medical imaging, where precise and high-quality visuals are essential, is another growing application for OLED microdisplays, especially in devices like surgical AR glasses. The combination of compact form factor, high resolution, and energy efficiency makes OLED microdisplays increasingly attractive across these diverse industries.What is Driving the Growth in the OLED Microdisplays Market?

The growth in the OLED microdisplays market is driven by several factors, particularly the increasing demand for AR and VR technologies across industries such as gaming, healthcare, and defense. As AR and VR applications become more mainstream, the need for high-performance, compact displays with superior image quality has surged, positioning OLED microdisplays as a key technology. Technological advancements, such as the development of ultra-high-resolution and low-latency displays, have further accelerated adoption in these sectors. Additionally, the rise of wearable technologies, including smart glasses and fitness devices, has fueled demand for OLED microdisplays that offer lightweight, flexible, and power-efficient solutions. The growing focus on miniaturization and the need for portable, high-quality displays in consumer electronics, such as camera viewfinders, is also contributing to market growth. Lastly, the defense and aerospace industries' increasing reliance on AR systems for training and operational purposes has driven demand for OLED microdisplays that offer exceptional clarity and low power consumption in mission-critical environments.Report Scope

The report analyzes the OLED Microdisplays market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Near-to-Eye (NTE), Projection, Other Segments); End-Use (Consumer Electronics, Military & Defense, Automotive, Industrial, Medical, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Near-to-Eye (NTE) Microdisplays segment, which is expected to reach US$758.6 Million by 2030 with a CAGR of 21.7%. The Projection Microdisplays segment is also set to grow at 28.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $159.1 Million in 2024, and China, forecasted to grow at an impressive 24% CAGR to reach $315.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global OLED Microdisplays Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global OLED Microdisplays Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global OLED Microdisplays Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as eMagin Corporation, Kopin Corporation, Microoled, Raystar Optronics, Inc., Sony Semiconductor Solution Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this OLED Microdisplays market report include:

- eMagin Corporation

- Kopin Corporation

- Microoled

- Raystar Optronics, Inc.

- Sony Semiconductor Solution Corporation

- WINSTAR Display Co., Ltd.

- Wisechip Semiconductor Inc.

- Yunnan Olightek Opto-Electronic Technology Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- eMagin Corporation

- Kopin Corporation

- Microoled

- Raystar Optronics, Inc.

- Sony Semiconductor Solution Corporation

- WINSTAR Display Co., Ltd.

- Wisechip Semiconductor Inc.

- Yunnan Olightek Opto-Electronic Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 226 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

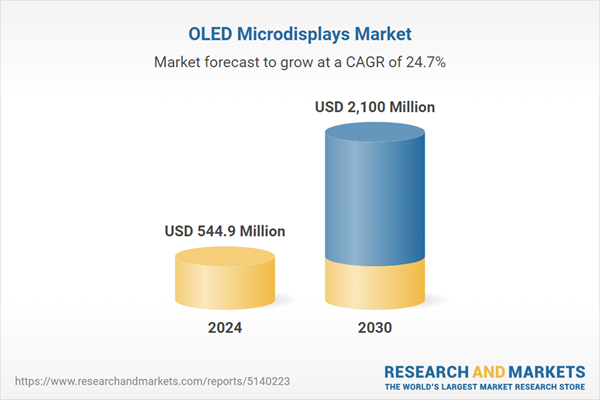

| Estimated Market Value ( USD | $ 544.9 Million |

| Forecasted Market Value ( USD | $ 2100 Million |

| Compound Annual Growth Rate | 24.7% |

| Regions Covered | Global |