Global Noble Gases Market - Key Trends & Drivers Summarized

What Are Noble Gases and Why Are They Crucial for Industrial and Scientific Applications?

Noble gases, also known as inert gases, are a group of chemical elements that include helium, neon, argon, krypton, xenon, and radon. These gases are characterized by their lack of reactivity under most conditions, making them valuable in a variety of industrial, medical, and scientific applications. Noble gases are used in processes where stable, non-reactive environments are required, such as in lighting, welding, cryogenics, and semiconductor manufacturing. Helium is critical for cooling applications, particularly in MRI machines, while argon is widely used in welding and as a protective atmosphere in metallurgy and manufacturing.The importance of noble gases lies in their unique physical and chemical properties, which make them indispensable in high-tech industries and scientific research. Their non-reactivity allows them to be used in environments where chemical stability is crucial, preventing unwanted reactions or contamination. Noble gases are also essential in the healthcare sector, where they are used in medical imaging, anesthesia, and radiation therapy.

How Is the Noble Gases Market Evolving?

The noble gases market is evolving in response to growing demand from the healthcare, electronics, and energy sectors. One of the key trends in the market is the increasing use of noble gases, particularly helium, in medical applications. Helium is critical for cooling superconducting magnets in MRI machines, which are essential for advanced medical diagnostics. As healthcare infrastructure expands globally, the demand for helium is rising, prompting concerns about helium shortages and the exploration of alternative sources.Another important trend is the growing demand for noble gases in semiconductor manufacturing. Argon and neon are used extensively in the production of microchips and semiconductors, which are critical for electronics, computing, and telecommunications. The expansion of the electronics industry, particularly with the rise of 5G technology and artificial intelligence (AI), is driving the need for noble gases in advanced manufacturing processes. In addition, there is a growing interest in the use of xenon and krypton in lighting and laser applications, where their unique properties are highly valuable.

Which Industries Are Leading the Adoption of Noble Gases?

The healthcare industry is one of the leading adopters of noble gases, with helium playing a vital role in cooling MRI machines and other medical imaging devices. Xenon is also used in anesthesia, offering an alternative to traditional anesthetics with fewer side effects. The electronics industry is another major consumer of noble gases, particularly argon and neon, which are used in semiconductor manufacturing, flat-panel displays, and fiber optics. The growing demand for smartphones, computers, and advanced electronics is driving the use of these gases in high-tech manufacturing.The aerospace and energy sectors also rely heavily on noble gases. Helium is used in rocket propulsion and as a pressurizing agent in spacecraft and launch vehicles, while argon is used in welding and metallurgy for high-strength alloys. Additionally, krypton and xenon are used in energy-efficient lighting, including high-intensity discharge (HID) lamps and LED technologies. The scientific research community, particularly in particle physics and cryogenics, also depends on noble gases for their stability and unique physical properties.

What Are the Key Growth Drivers in the Noble Gases Market?

The growth in the noble gases market is driven by several factors, starting with the increasing demand from the healthcare sector. As medical imaging technologies like MRI become more widespread, the demand for helium for cooling applications is rising. Another key driver is the expansion of the electronics industry, where noble gases are essential for semiconductor manufacturing, microchip production, and advanced display technologies. The rise of 5G networks, AI, and the Internet of Things (IoT) is further boosting demand for noble gases in the production of these components.The growing use of noble gases in energy-efficient lighting and clean energy technologies is also contributing to market growth. Krypton and xenon are used in advanced lighting solutions, while helium plays a role in nuclear fusion research and cryogenic energy storage. Additionally, the increasing need for noble gases in aerospace, particularly for space exploration and satellite launches, is driving demand. As industries seek more advanced materials and technologies, the unique properties of noble gases are becoming increasingly important across a wide range of applications.

Report Scope

The report analyzes the Noble Gases market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Helium, Argon, Neon, Krypton, Other Product Types); Application (Construction, Healthcare, Electronics, Energy & Power, Aerospace, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Helium segment, which is expected to reach US$2.3 Billion by 2030 with a CAGR of 6.6%. The Argon segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $795 Million in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Noble Gases Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Noble Gases Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Noble Gases Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide SA, Airgas, Inc., Ellenbarrie Industrial Gases Limited, Noble Energy Inc., Noble Gas Solutions and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Noble Gases market report include:

- Air Liquide SA

- Airgas, Inc.

- Ellenbarrie Industrial Gases Limited

- Noble Energy Inc.

- Noble Gas Solutions

- Praxair, Inc.

- The Linde Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide SA

- Airgas, Inc.

- Ellenbarrie Industrial Gases Limited

- Noble Energy Inc.

- Noble Gas Solutions

- Praxair, Inc.

- The Linde Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

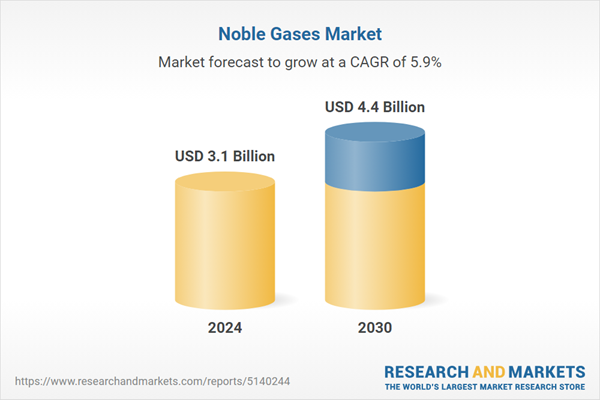

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 4.4 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |