Global Shipbroking Market - Key Trends and Drivers Summarized

Why Is Shipbroking Integral to the Global Shipping Industry?

Shipbroking plays a vital role in the global shipping industry by facilitating the buying, selling, and chartering of vessels, thereby connecting shipowners with charterers, cargo owners, and traders. It acts as an intermediary in maritime transactions, negotiating deals, providing market intelligence, and offering advisory services on freight rates, contracts, and compliance. The surge in global trade volumes, driven by increased consumption, industrialization, and economic growth in emerging markets, has heightened the demand for shipbroking services. With the shipping industry dealing with significant market volatility, fluctuating freight rates, and complex regulatory frameworks, shipbrokers provide critical expertise and insights to navigate these challenges, making them indispensable for stakeholders seeking to optimize logistics and transportation strategies.How Are Technological Innovations Shaping the Future of Shipbroking?

Technological innovations are significantly shaping the future of shipbroking by enhancing efficiency, transparency, and decision-making. The integration of digital platforms, AI-driven analytics, and blockchain technology is transforming traditional shipbroking practices, enabling real-time market intelligence, automated freight matching, and secure contract management. The rise of online freight marketplaces and digital freight forwarders is driving the shift towards a more digitalized and data-driven ecosystem, allowing stakeholders to access comprehensive market data, vessel positions, and freight rates with greater ease and speed. Moreover, predictive analytics and smart contracts are streamlining transaction processes, reducing paperwork, and mitigating risks associated with disputes and delays. This digital transformation is enabling shipbrokers to offer more value-added services, such as route optimization, risk management, and environmental compliance advisory, enhancing their competitive edge in the market.Which Market Segments Are Leading the Adoption of Shipbroking Services?

Types of shipbroking services include chartering, sale and purchase, and project cargo brokerage, with chartering being the most widely adopted due to its critical role in bulk shipping, tankers, and container markets. Applications of shipbroking span dry bulk, liquid bulk, container shipping, offshore shipping, and specialized segments like LNG and heavy lift, with dry bulk and liquid bulk leading the market due to the high volume of commodities traded globally. Services provided by shipbrokers encompass market analysis, vessel valuation, contract negotiation, and maritime consultancy, with market analysis and contract negotiation being the largest segments due to the need for accurate market insights and efficient deal structuring. Geographically, Asia-Pacific, Europe, and North America are the leading markets for shipbroking services due to the presence of major shipping hubs, established trade routes, and high demand for maritime logistics, while emerging markets in the Middle East and Africa are also witnessing growth driven by expanding maritime trade and port infrastructure development.What Are the Key Drivers of Growth in the Shipbroking Market?

The growth in the shipbroking market is driven by several factors, including increasing global trade volumes, technological advancements in digital platforms and AI, and the rising emphasis on real-time market intelligence and data analytics. The development of integrated shipping services offering chartering, sale, and purchase with enhanced transparency, client engagement, and value-added services is driving market adoption among shipowners, charterers, and traders. The focus on sustainable shipping, green freight, and regulatory compliance is expanding the market reach among LNG, offshore, and dry bulk segments. The growing use of automated freight matching, predictive analytics, and smart contracts, coupled with the demand for specialized shipbroking services in emerging markets, is creating new opportunities for market growth. Additionally, the increasing investments in R&D for digital freight platforms, blockchain solutions, and maritime consultancy are further supporting market expansion.Report Scope

The report analyzes the Shipbroking market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Bulker, Tanker, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bulker Application segment, which is expected to reach US$974.5 Million by 2030 with a CAGR of 4%. The Tanker Application segment is also set to grow at 2.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $381.5 Million in 2024, and China, forecasted to grow at an impressive 5.5% CAGR to reach $348 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Shipbroking Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Shipbroking Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Shipbroking Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Braemar Shipping Services Plc, CLARKSON PLC, Denholm Coates, Howe Robinson Partners Pte Ltd., IFCHOR S.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Shipbroking market report include:

- Braemar Shipping Services Plc

- CLARKSON PLC

- Denholm Coates

- Howe Robinson Partners Pte Ltd.

- IFCHOR S.A.

- Mitsubishi Corporation

- Port of Antwerp

- Samsung Heavy Industries Co., Ltd.

- Simpson Spence Young Ltd.

- SPI Marine

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Braemar Shipping Services Plc

- CLARKSON PLC

- Denholm Coates

- Howe Robinson Partners Pte Ltd.

- IFCHOR S.A.

- Mitsubishi Corporation

- Port of Antwerp

- Samsung Heavy Industries Co., Ltd.

- Simpson Spence Young Ltd.

- SPI Marine

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 297 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

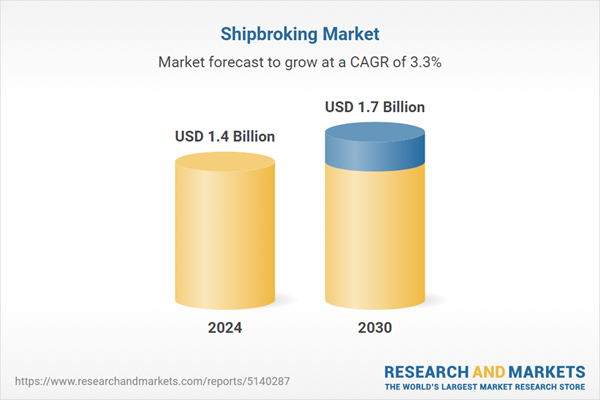

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 1.7 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |