Global Automotive Thermal Systems Market - Key Trends & Drivers Summarized

How Are Automotive Thermal Systems Evolving with the Rise of Electric Vehicles?

The automotive thermal systems market is undergoing a transformation due to the rapid adoption of electric vehicles (EVs) and hybrid vehicles. Thermal systems are critical for managing the temperature of various vehicle components, including engines, batteries, and passenger cabins. In EVs, efficient thermal management is essential to maintain battery performance, optimize range, and ensure passenger comfort. This has led to the development of innovative thermal management solutions such as liquid-cooled batteries, heat pumps, and advanced HVAC systems tailored specifically for electric and hybrid vehicles. The demand for these solutions is growing as automakers focus on enhancing the efficiency and reliability of their EV models.What Technological Innovations Are Shaping the Future of Automotive Thermal Systems?

Technological innovations are significantly shaping the future of automotive thermal systems, with advancements in materials science, electronics, and energy management. The use of phase-change materials (PCMs) and thermoelectric modules in thermal systems is enhancing energy efficiency and reducing overall vehicle weight. Furthermore, the integration of intelligent sensors and AI-driven control systems allows for dynamic adjustment of thermal management processes, optimizing energy use based on real-time conditions. The development of integrated thermal management systems that combine heating, ventilation, and cooling functions is another significant trend, particularly in electric vehicles, where space and energy efficiency are critical.How Is the Growing Focus on

Automotive Thermal Systems Market - Key Trends & Drivers Summarized*How Is the Growing Focus on Energy Efficiency Impacting Automotive Thermal Systems?

The rising emphasis on energy efficiency is significantly impacting the automotive thermal systems market, particularly with the shift towards electric vehicles (EVs) and hybrids. Effective thermal management is crucial for these vehicles to optimize battery performance, enhance range, and ensure passenger comfort. As a result, there has been a surge in demand for advanced thermal management solutions, such as heat pumps and liquid cooling systems, specifically designed for electric and hybrid vehicles. These systems help in maintaining optimal operating temperatures, ensuring the longevity and reliability of critical vehicle components.What Role Do New Materials and Technologies Play in Modern Thermal Systems?

The automotive thermal systems market is being reshaped by innovative materials and technologies aimed at improving efficiency and reducing weight. Phase-change materials (PCMs), thermoelectric modules, and lightweight composites are increasingly being integrated into thermal systems to enhance energy storage and heat dissipation. Advanced sensors and AI-driven control systems enable dynamic and precise management of thermal environments, optimizing energy use under varying driving conditions. Furthermore, the development of integrated thermal management systems, combining heating, ventilation, and cooling, addresses the compact space requirements and efficiency needs of modern vehicles, particularly electric models.How Are Consumer Preferences and Regulations Influencing Market Demand?

Consumer demand for enhanced comfort, safety, and energy-efficient vehicles is a significant factor driving the automotive thermal systems market. The trend towards electric and hybrid vehicles, spurred by environmental awareness and regulatory mandates, is leading to a growing need for innovative thermal solutions that maintain battery health and optimize vehicle performance. Stringent emission standards in regions such as Europe and North America are pushing automakers to adopt cutting-edge thermal management systems that contribute to overall vehicle efficiency. Additionally, the increased focus on climate control features in luxury and passenger vehicles is further stimulating market growth.What Factors Are Driving the Growth in the Automotive Thermal Systems Market?

The growth in the automotive thermal systems market is driven by several factors, including the increasing adoption of electric and hybrid vehicles, advancements in material science and thermal technologies, and stringent regulatory standards aimed at reducing emissions. The demand for efficient battery thermal management systems in EVs is a major growth driver, as these systems are crucial for maintaining battery performance and longevity. Consumer preference for enhanced climate control and comfort features, along with the automotive industry's focus on lightweight, energy-efficient designs, are also contributing to the expansion of the market.Report Scope

The report analyzes the Automotive Thermal Systems market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (HVAC, Powertrain Cooling, Fluid Transport, Other Applications); End-Use (Internal Combustion Engine Vehicles (ICEVs), Electric Vehicles (EVs)).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the HVAC Application segment, which is expected to reach US$27.8 Billion by 2030 with a CAGR of a 6.2%. The Powertrain Cooling Application segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13.5 Billion in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $15.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Thermal Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Thermal Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Thermal Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Daikin Industries Ltd., Gentherm, Inc., Lennox International, Inc., MAHLE GmbH, Polyvlies Franz Beyer GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Automotive Thermal Systems market report include:

- Daikin Industries Ltd.

- Gentherm, Inc.

- Lennox International, Inc.

- MAHLE GmbH

- Polyvlies Franz Beyer GmbH & Co. KG

- Sanden Holdings Corporation

- Valeo SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Daikin Industries Ltd.

- Gentherm, Inc.

- Lennox International, Inc.

- MAHLE GmbH

- Polyvlies Franz Beyer GmbH & Co. KG

- Sanden Holdings Corporation

- Valeo SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 247 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

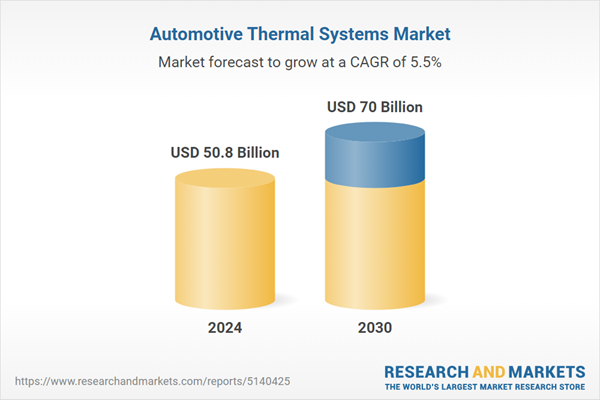

| Estimated Market Value ( USD | $ 50.8 Billion |

| Forecasted Market Value ( USD | $ 70 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |