What Are Motorcycle Anti-Lock Braking Systems (ABS) and How Do They Prevent Accidents?

Motorcycle Anti-Lock Braking Systems (ABS) are critical safety features designed to prevent the wheels of a motorcycle from locking up during an emergency stop, thereby maintaining tractive contact with the road surface and allowing the rider to maintain control over steering. ABS works by automatically controlling the brake pressure during an abrupt stop, reducing the braking distance and helping to avoid skidding. This system is especially crucial on wet or slippery roads where the risk of losing control is higher. As motorcycles are inherently less stable than four-wheeled vehicles, ABS plays a significant role in enhancing rider safety, making it an essential component in modern motorcycle manufacturing.How Is Technology Advancing Motorcycle ABS?

The advancement in electronics and sensor technology has significantly improved the effectiveness and reliability of motorcycle ABS. Modern systems are equipped with more precise sensors and faster microcontrollers that provide real-time data processing to make immediate adjustments to brake pressure. These technological improvements have led to the development of smaller, lighter, and more efficient ABS units, which are easier to integrate into a variety of motorcycle models without impacting performance or aesthetics. Additionally, the integration of ABS with other motorcycle stability systems is a growing trend, providing a comprehensive safety net for riders.What Trends Influence the Global Adoption of Motorcycle ABS?

Increasing global awareness of motorcycle safety, coupled with stringent safety regulations in many countries, is driving the adoption of ABS technology. In regions like Europe and parts of Asia, the installation of ABS is mandated for all new motorcycles above a certain engine size, a move aimed at reducing the high rate of motorcycle accidents. The consumer demand for safer motorcycles is also influencing manufacturers to voluntarily include ABS even in markets where it is not yet mandated. Furthermore, the growing popularity of motorcycling as a recreational activity in emerging markets is boosting demand for motorcycles equipped with advanced safety features, including ABS.What Drives the Growth in the Motorcycle ABS Market?

The growth in the motorcycle ABS market is driven by several factors. Increasing safety regulations and a growing awareness among consumers about the benefits of ABS are primary catalysts. As road safety becomes a higher priority globally, governments are more likely to implement regulations that promote the adoption of safety-enhancing technologies. Technological advancements that have made ABS more accessible and cost-effective are also critical, as they allow smaller and mid-sized motorcycles, which constitute a significant market segment in emerging economies, to be equipped with ABS. Additionally, insurance companies often offer lower premiums for motorcycles equipped with safety features like ABS, encouraging manufacturers to integrate these systems into their models.Report Scope

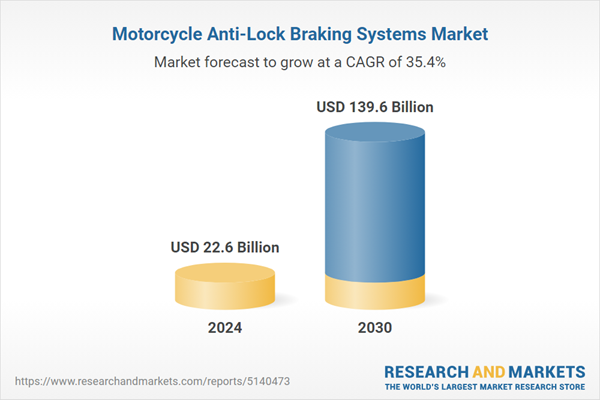

The report analyzes the Motorcycle Anti-Lock Braking Systems market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Dual-Channel ABS, Single-Channel ABS).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dual-Channel ABS segment, which is expected to reach US$105 Billion by 2030 with a CAGR of 36.9%. The Single-Channel ABS segment is also set to grow at 31.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7 Billion in 2024, and China, forecasted to grow at an impressive 32.8% CAGR to reach $18.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Motorcycle Anti-Lock Braking Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Motorcycle Anti-Lock Braking Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Motorcycle Anti-Lock Braking Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aisin Seiki Co., Ltd., Bosch Mobility Solutions, Bwi Group, Continental AG, Hitachi Automotive Systems Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Motorcycle Anti-Lock Braking Systems market report include:

- Aisin Seiki Co., Ltd.

- Bosch Mobility Solutions

- Bwi Group

- Continental AG

- Hitachi Automotive Systems Ltd.

- Honda Motor Co., Ltd.

- Johnson Electric Group

- NXP Semiconductors NV

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aisin Seiki Co., Ltd.

- Bosch Mobility Solutions

- Bwi Group

- Continental AG

- Hitachi Automotive Systems Ltd.

- Honda Motor Co., Ltd.

- Johnson Electric Group

- NXP Semiconductors NV

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 22.6 Billion |

| Forecasted Market Value ( USD | $ 139.6 Billion |

| Compound Annual Growth Rate | 35.4% |

| Regions Covered | Global |