Global Military Aerospace Simulation and Training Market - Key Trends & Drivers Summarized

What Is Military Aerospace Simulation and Training and How Does It Enhance Operational Readiness?

Military aerospace simulation and training involve the use of advanced simulation systems and technologies to train pilots and other crew members in the operation of military aircraft under various conditions. These systems provide realistic, immersive environments that mimic the dynamics of actual flight and combat scenarios, allowing trainees to hone their skills without the risks associated with real-life operations. The benefits include reduced training costs, lower risk of equipment damage, and the ability to simulate dangerous situations that cannot be safely replicated in real life. This training is crucial for maintaining high levels of readiness and operational effectiveness in military forces worldwide.Why Is There an Increasing Demand for High-Fidelity Aerospace Simulators?

The demand for high-fidelity aerospace simulators is increasing as military forces seek more efficient and effective training solutions amidst evolving combat requirements and technological advancements in aircraft. These simulators are essential for preparing pilots for the complexities of modern aerial warfare and next-generation aircraft technologies. High-fidelity simulators offer detailed, accurate representations of aircraft controls, systems, and flight physics, as well as synthetic environments that include potential real-world challenges such as adverse weather conditions and enemy actions. This level of realism ensures that trainees are well-prepared for any situation they might encounter in the field.How Are Technological Innovations Shaping the Aerospace Simulation and Training Industry?

Technological innovations are significantly shaping the aerospace simulation and training industry by enhancing the realism and effectiveness of training programs. Virtual reality (VR) and augmented reality (AR) technologies are being integrated into training systems to create more immersive and interactive training environments. Artificial intelligence (AI) is also playing a role, with adaptive learning systems that can customize training scenarios based on the trainee's performance, optimizing the learning process. Furthermore, the development of networked simulation systems allows for large-scale training exercises involving multiple participants from geographically dispersed locations, simulating complex joint operations scenarios.The Growth in the Military Aerospace Simulation and Training Market Is Driven by Several Factors

The growth in the Military Aerospace Simulation and Training market is driven by several factors, including the increasing complexity of military aircraft systems and the need for continual training for new and experienced pilots. As aircraft technology evolves, so too does the requirement for updated training programs that can effectively prepare military personnel for operation and combat. Additionally, the cost benefits of simulation-based training, which significantly reduces the need for fuel and aircraft maintenance, are a major driver. The integration of advanced technologies such as VR, AR, and AI into training systems is also facilitating more effective and engaging training solutions, further stimulating market growth.Report Scope

The report analyzes the Military Aerospace Simulation and Training market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Virtual, Live, Constructive); End-Use (Aviation, Army, Naval).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Virtual Simulation & Training segment, which is expected to reach US$8.5 Billion by 2030 with a CAGR of 5.2%. The Live Simulation & Training segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.8 Billion in 2024, and China, forecasted to grow at an impressive 4.6% CAGR to reach $2.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Military Aerospace Simulation and Training Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Military Aerospace Simulation and Training Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Military Aerospace Simulation and Training Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advanced Simulation Corporation, BAE Systems PLC, Bluedrop Training & Simulation, Boeing Company, CACI International, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Military Aerospace Simulation and Training market report include:

- Advanced Simulation Corporation

- BAE Systems PLC

- Bluedrop Training & Simulation

- Boeing Company

- CACI International, Inc.

- CAE, Inc.

- Cubic Corporation

- Flyit Simulators, Inc.

- L3 Link Training & Simulation

- Rockwell Collins, Inc.

- SYTRONICS, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Simulation Corporation

- BAE Systems PLC

- Bluedrop Training & Simulation

- Boeing Company

- CACI International, Inc.

- CAE, Inc.

- Cubic Corporation

- Flyit Simulators, Inc.

- L3 Link Training & Simulation

- Rockwell Collins, Inc.

- SYTRONICS, Inc.

Table Information

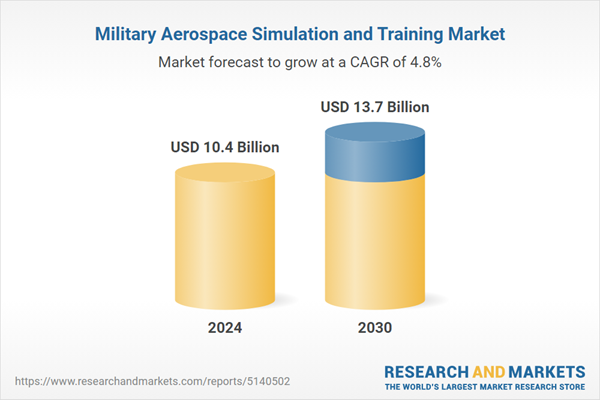

| Report Attribute | Details |

|---|---|

| No. of Pages | 243 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.4 Billion |

| Forecasted Market Value ( USD | $ 13.7 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |