Global Trade Finance Market - Key Trends & Drivers Summarized

What Is Trade Finance and Why Is It Important?

Trade finance refers to the financial instruments and products used to facilitate international trade and commerce. These instruments include letters of credit, trade credit insurance, export financing, and factoring, among others. Trade finance is crucial for mitigating the risks associated with international trade, such as currency fluctuations, non-payment, and political instability. By providing financial support and risk mitigation, trade finance enables businesses to engage in cross-border transactions with confidence, promoting global trade and economic growth.How Does Trade Finance Function in Global Trade?

Trade finance functions by providing liquidity and risk mitigation to exporters and importers. For example, a letter of credit ensures that the exporter receives payment upon fulfilling the terms of the contract, while the importer benefits from the assurance that the goods will be delivered as agreed. Trade credit insurance protects exporters against the risk of non-payment by foreign buyers. Export financing provides working capital to exporters to fulfill large orders, while factoring allows businesses to sell their receivables to improve cash flow. These financial instruments and services support the smooth functioning of global trade by addressing the financial challenges and risks associated with cross-border transactions.What Are the Challenges and Opportunities in Trade Finance Development?

The development and use of trade finance present several challenges and opportunities. One major challenge is the complexity and regulatory requirements of international trade, which can vary significantly across countries and regions. Additionally, small and medium-sized enterprises (SMEs) often face difficulties accessing trade finance due to perceived higher risks and lack of collateral. On the opportunity side, advancements in financial technology (fintech) are enhancing the efficiency and accessibility of trade finance services. Blockchain technology, for example, is being explored for its potential to increase transparency and reduce the risk of fraud in trade finance transactions. Furthermore, the growing volume of global trade and the increasing need for supply chain financing are driving demand for innovative trade finance solutions.What Is Driving the Growth in the Trade Finance Market?

The growth in the trade finance market is driven by several factors. Firstly, the increasing volume of international trade and globalization is boosting demand for trade finance services. Secondly, advancements in financial technology (fintech) are enhancing the efficiency and accessibility of trade finance, making it easier for businesses to engage in cross-border transactions. Thirdly, the growing need for supply chain financing, driven by complex global supply chains, is encouraging the adoption of trade finance solutions. Additionally, supportive government policies and international trade agreements are promoting global trade and facilitating access to trade finance. Finally, the expansion of emerging markets and the increasing participation of SMEs in international trade are further driving market growth.Report Scope

The report analyzes the Trade Finance market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Commercial Letters of Credit, Guarantees, Standby Letters of Credit, Other Product Types); Provider (Banks, Trade Finance Houses, Other Providers).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Commercial Letters of Credit segment, which is expected to reach US$31.1 Billion by 2030 with a CAGR of a 5.8%. The Guarantees segment is also set to grow at 5.9% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Trade Finance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Trade Finance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Trade Finance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

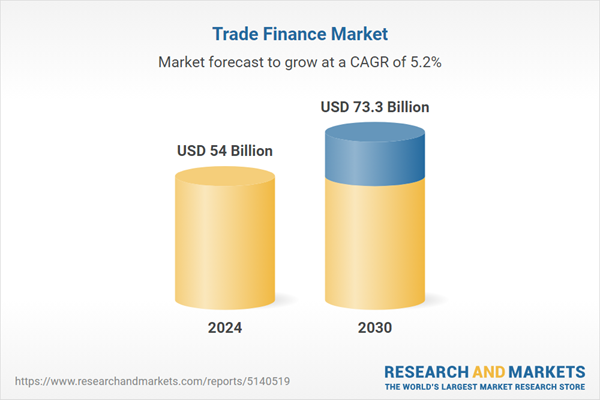

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Afreximbank, AlAhli Bank, ANZ, Bank of Communication, BNP Paribas and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 93 companies featured in this Trade Finance market report include:

- Afreximbank

- AlAhli Bank

- ANZ

- Bank of Communication

- BNP Paribas

- China Exim Bank

- Citigroup Inc

- Commerzbank

- Credit Agricole

- EBRD

- Export-Import Bank of India

- HSBC

- ICBC

- JPMorgan Chase and Co

- Mizuho Financial Group

- MUFG

- Standard Chartered

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Afreximbank

- AlAhli Bank

- ANZ

- Bank of Communication

- BNP Paribas

- China Exim Bank

- Citigroup Inc

- Commerzbank

- Credit Agricole

- EBRD

- Export-Import Bank of India

- HSBC

- ICBC

- JPMorgan Chase and Co

- Mizuho Financial Group

- MUFG

- Standard Chartered

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 333 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 54 Billion |

| Forecasted Market Value ( USD | $ 73.3 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |