Global Hermetic Packaging Market - Key Trends and Drivers Summarized

Is Hermetic Packaging the Silent Guardian of Advanced Electronics and Sensitive Components?

Hermetic packaging is an essential technology in protecting sensitive electronic components and medical devices from environmental exposure, but why is it so critical? Hermetic packaging involves sealing devices in airtight enclosures to prevent moisture, gases, and contaminants from compromising their functionality. In industries such as aerospace, defense, medical devices, and telecommunications, components are exposed to harsh environments that can degrade their performance over time. For instance, moisture can corrode electronic circuits, while extreme temperatures can cause material expansion or contraction, leading to failure.The primary purpose of hermetic packaging is to create a barrier that maintains the integrity and reliability of sensitive components, such as microelectromechanical systems (MEMS), sensors, optical devices, and semiconductor chips. These packages are typically made from materials like metals, glass, or ceramics, which offer superior resistance to environmental factors compared to traditional plastic packaging. Hermetic packaging is particularly crucial for mission-critical applications, such as in space exploration or military equipment, where failure of a single component could lead to catastrophic consequences. As technology advances and devices become more complex and miniaturized, the demand for reliable hermetic packaging continues to grow, ensuring that critical systems remain protected and functional in the most demanding environments.

How Has Technology Advanced Hermetic Packaging?

Technological advancements have significantly enhanced the capabilities and applications of hermetic packaging, making it more versatile, durable, and effective at protecting sensitive components. One of the major innovations in hermetic packaging is the development of advanced sealing techniques, such as laser welding and glass-to-metal or ceramic-to-metal sealing. These methods create a robust, airtight seal that ensures long-term protection from environmental factors like humidity, dust, and corrosive chemicals. Laser welding, in particular, allows for precise and clean sealing, which is crucial for maintaining the integrity of microelectronics and other delicate components without damaging them during the packaging process.Miniaturization has also driven significant innovation in hermetic packaging. As devices like sensors, MEMS, and implantable medical devices shrink in size, packaging needs to offer the same level of protection while occupying less space. This has led to the development of new materials and design approaches, such as multilayer ceramic packages and thin-film encapsulation, which provide high levels of hermeticity in compact forms. These advancements are especially important in industries like medical implants, where devices must be small enough to be safely implanted in the body, while still requiring robust protection against bodily fluids and tissue.

Additionally, the integration of advanced materials into hermetic packaging has improved performance across various applications. For instance, ceramic and glass packages provide superior thermal stability and resistance to harsh chemicals compared to traditional materials like plastic. This makes them ideal for use in high-temperature or chemically aggressive environments, such as in aerospace or oil and gas exploration. The use of composite materials that combine the benefits of different materials, such as metal for structural strength and glass for optical clarity, has further expanded the range of applications for hermetic packaging. With continuous advancements in materials science and sealing technologies, hermetic packaging is evolving to meet the increasingly complex demands of modern electronics and sensitive devices.

Why Is Hermetic Packaging Critical for High-Reliability Applications?

Hermetic packaging is crucial for high-reliability applications because it provides unparalleled protection for electronic and optical components that must function flawlessly in extreme environments. In industries such as aerospace, defense, and medical devices, where failure is not an option, the integrity of hermetic packaging ensures that sensitive components remain unaffected by moisture, gases, and contaminants. In aerospace and military applications, for example, components must endure intense environmental conditions such as extreme temperatures, vibration, and exposure to radiation. Hermetic packaging shields these components from degradation, allowing satellites, aircraft, and defense systems to operate reliably over long periods.In the medical field, hermetic packaging is indispensable for protecting implantable devices, such as pacemakers, cochlear implants, and insulin pumps. These devices are implanted in the body for years and must remain functional despite constant exposure to bodily fluids, tissue, and various chemical environments. Hermetic packaging prevents moisture and biological contaminants from reaching the sensitive electronics within these devices, ensuring they perform without failure and minimizing the risk of infection or malfunction. The high level of reliability that hermetic packaging provides is essential for patient safety and the long-term success of medical implants.

Similarly, in telecommunications and optical networking, hermetic packaging protects critical components like laser diodes, photodetectors, and fiber-optic transceivers. These components are responsible for transmitting and receiving data across vast distances, often under high-frequency and high-temperature conditions. Any failure in these components could disrupt communication systems or result in significant data loss. Hermetic packaging guarantees that these devices remain insulated from humidity and other environmental factors, preserving their performance and ensuring the reliability of global communication networks. In all these high-reliability applications, hermetic packaging is the unsung hero, safeguarding the functionality of mission-critical systems and devices in the harshest of environments.

What Factors Are Driving the Growth of the Hermetic Packaging Market?

The growth of the hermetic packaging market is driven by several key factors, including the increasing demand for reliable electronics in harsh environments, advancements in packaging technology, and the expanding use of sensitive devices in critical sectors like aerospace, defense, and medical devices. One of the primary drivers is the rising need for durable electronic components in extreme conditions. As industries like aerospace, automotive, and oil and gas continue to push the boundaries of technology, the components used in these sectors must be able to withstand high temperatures, moisture, and exposure to corrosive materials. Hermetic packaging provides the level of protection needed to ensure the long-term reliability of these components.Advancements in microelectronics and the miniaturization of devices are also fueling market growth. As sensors, semiconductors, and MEMS become smaller and more complex, there is a growing need for compact yet effective packaging solutions that can provide airtight seals without compromising the device's functionality. The development of innovative materials, such as multilayer ceramics and glass composites, is enabling the creation of smaller, lighter hermetic packages that can be used in applications ranging from medical implants to next-generation military equipment. These innovations are expanding the use of hermetic packaging in sectors where space and weight are critical considerations.

The medical device industry is another major factor driving the growth of the hermetic packaging market. As demand for implantable medical devices such as pacemakers, neurostimulators, and drug delivery systems continues to rise, so does the need for packaging that can protect these devices inside the human body. Hermetic packaging plays a critical role in ensuring that these devices are not compromised by bodily fluids or tissue, enabling them to function safely and effectively over long periods. The increasing focus on patient safety and the need for long-lasting, reliable medical implants are expected to drive further demand for hermetic packaging solutions in the healthcare sector.

Additionally, the expanding use of hermetic packaging in the semiconductor and telecommunications industries is contributing to market growth. In semiconductor manufacturing, the rise of high-performance computing, artificial intelligence, and 5G networks has created a growing demand for components that can operate at high frequencies and temperatures. Hermetic packaging ensures the protection of semiconductors and optical devices from environmental degradation, enabling these components to deliver high performance and reliability. As the global rollout of 5G networks accelerates and demand for high-speed data transmission grows, the need for robust hermetic packaging solutions in telecommunications is expected to rise.

Lastly, increasing investments in research and development (R&D) and government initiatives in defense and aerospace sectors are boosting market growth. Governments around the world are investing heavily in the development of advanced military and aerospace technologies, which require high-reliability components capable of withstanding extreme conditions. Hermetic packaging is essential for protecting these components in defense systems, satellites, and space exploration missions. As defense budgets grow and space exploration expands with both government and private sector participation, the demand for high-performance hermetic packaging is set to increase, further driving market growth in the coming years.

Report Scope

The report analyzes the Hermetic Packaging market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Ceramic-to-Metal Sealing, Glass-to-Metal Sealing, Passivation Glass, Transponder Glass, Reed Glass); End-Use (Military & Defense, Aeronautics & Space, Automotive, Energy & Nuclear Safety, Telecom, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ceramic-to-Metal Sealing segment, which is expected to reach US$2.4 Billion by 2030 with a CAGR of 5.3%. The Glass-to-Metal Sealing segment is also set to grow at 4.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $1.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hermetic Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hermetic Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hermetic Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMETEK, Inc., Amkor Technology, Inc., Egide SA, Kyocera Corporation, Legacy Technologies Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Hermetic Packaging market report include:

- AMETEK, Inc.

- Amkor Technology, Inc.

- Egide SA

- Kyocera Corporation

- Legacy Technologies Inc.

- Materion Corporation

- Micross Components

- SCHOTT AG

- Teledyne Microelectronic Technologies

- Texas Instruments, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMETEK, Inc.

- Amkor Technology, Inc.

- Egide SA

- Kyocera Corporation

- Legacy Technologies Inc.

- Materion Corporation

- Micross Components

- SCHOTT AG

- Teledyne Microelectronic Technologies

- Texas Instruments, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 271 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

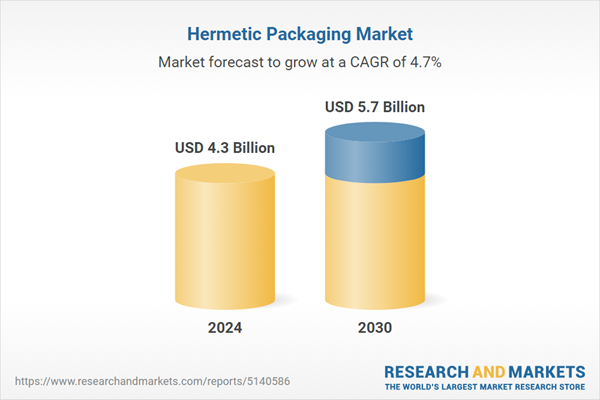

| Estimated Market Value ( USD | $ 4.3 Billion |

| Forecasted Market Value ( USD | $ 5.7 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |