Global N-Methyldiethanolamine (N-MDEA) Market - Key Trends & Drivers Summarized

What Is N-Methyldiethanolamine (N-MDEA), and Why Is It So Crucial in Modern Industrial Applications?

N-Methyldiethanolamine (N-MDEA) is a chemical compound primarily used as a solvent and intermediate in various industrial processes. It is an organic amine that features high stability, low volatility, and excellent absorption properties, making it particularly effective in gas treatment and chemical production. N-MDEA is most commonly used in the removal of acid gases such as hydrogen sulfide (H2S) and carbon dioxide (CO2) from natural gas, synthesis gas, and refinery gas streams. Beyond gas treatment, N-MDEA serves as a catalyst, surfactant, and corrosion inhibitor in industries like chemical manufacturing, textiles, pharmaceuticals, and coatings.The importance of N-MDEA lies in its ability to efficiently absorb and separate acidic components from gas streams, supporting cleaner and more environmentally friendly industrial processes. It is widely utilized in the oil and gas sector for gas sweetening, where it plays a critical role in ensuring that natural gas meets pipeline specifications and environmental standards. The chemical’s low energy requirements for regeneration make it a cost-effective and sustainable choice for industrial gas processing. As industries increasingly emphasize energy efficiency, emissions control, and sustainable operations, N-MDEA has become an essential component in gas treatment and other chemical processes.

How Are Technological Advancements Shaping the N-Methyldiethanolamine (N-MDEA) Market?

Technological advancements have significantly improved the production, efficiency, and application of N-MDEA, driving innovation across various sectors that rely on gas treatment and chemical processing. One of the major developments is the optimization of gas sweetening processes using blended amines that include N-MDEA. By combining N-MDEA with other amines like monoethanolamine (MEA) or diethanolamine (DEA), process engineers can enhance absorption rates, reduce corrosion, and minimize the formation of harmful byproducts, improving overall efficiency. These blended solutions allow for more effective removal of both hydrogen sulfide and carbon dioxide, supporting compliance with increasingly stringent environmental regulations in natural gas processing and refining.The development of advanced regeneration techniques has further improved the cost-effectiveness and energy efficiency of N-MDEA in gas treatment. Enhanced regeneration methods, such as vacuum distillation and low-temperature stripping, enable more efficient recovery of N-MDEA, reducing the amount of heat required to regenerate the solvent and cutting down operational costs. These innovations have made N-MDEA-based gas treatment systems more sustainable by lowering energy consumption and minimizing emissions, aligning with broader trends toward greener industrial practices.

Advancements in chemical manufacturing processes have expanded the use of N-MDEA beyond gas treatment. In coatings and textiles, N-MDEA is used as a neutralizing agent and pH regulator, improving the performance of surfactants and enhancing the stability of formulations. In pharmaceuticals, N-MDEA serves as a chemical intermediate for the synthesis of active pharmaceutical ingredients (APIs) and specialty chemicals. The chemical’s versatility, combined with its ability to form stable emulsions and promote efficient reactions, has increased its adoption in diverse applications, making it a valuable component in industrial chemical processing. These innovations not only enhance the capabilities of N-MDEA but also support its role as a key chemical in modern sustainable practices across multiple industries.

What Are the Emerging Applications of N-Methyldiethanolamine (N-MDEA) Across Different Industries?

N-MDEA is finding expanding applications across various industries, driven by its excellent absorption, neutralization, and catalytic properties. In the oil and gas industry, N-MDEA is primarily used for gas sweetening, where it helps remove hydrogen sulfide and carbon dioxide from natural gas streams. Its selective absorption properties allow for efficient removal of H2S while minimizing CO2 uptake, making it ideal for refineries and gas processing plants. The ability of N-MDEA to be regenerated with lower energy requirements compared to other amines makes it a cost-effective choice for continuous operations, reducing the overall carbon footprint of gas treatment facilities.In the chemical manufacturing sector, N-MDEA is used as a neutralizing agent, catalyst, and intermediate in various processes. It plays a key role in the production of surfactants, which are used in detergents, emulsifiers, and wetting agents across different applications, from household cleaning products to industrial formulations. Its effectiveness in pH regulation also makes it valuable in the formulation of coatings, adhesives, and sealants, where maintaining consistent pH levels is crucial for product performance and stability.

In the water treatment industry, N-MDEA is used to control pH levels and prevent corrosion in water distribution systems. Its compatibility with other water treatment chemicals and its ability to form stable emulsions make it suitable for use in industrial water treatment processes. Additionally, N-MDEA is employed in the production of specialty chemicals, where it serves as a building block for synthesizing quaternary ammonium compounds and other chemical derivatives used in personal care, pharmaceuticals, and agrochemicals.

The expanding applications of N-MDEA across these industries highlight its versatility and effectiveness in supporting efficient chemical processes, reducing emissions, and enhancing product performance. As industries continue to seek sustainable, energy-efficient, and high-performance chemical solutions, N-MDEA remains a valuable and adaptable component in diverse manufacturing and processing operations.

What Drives Growth in the N-Methyldiethanolamine (N-MDEA) Market?

The growth in the N-MDEA market is driven by several factors, including increasing demand for natural gas processing, rising emphasis on emissions control, and advancements in chemical manufacturing. One of the primary growth drivers is the global rise in natural gas production, as industries transition toward cleaner energy sources. As natural gas is seen as a bridge fuel in the energy transition, the need for effective gas sweetening agents like N-MDEA has increased to ensure that gas meets pipeline specifications and regulatory requirements. N-MDEA’s selective absorption properties, low regeneration energy, and compatibility with blended amine systems make it a preferred choice in gas treatment plants, supporting cleaner and more efficient natural gas processing.The growing focus on emissions control and environmental regulations has further fueled demand for N-MDEA. As industries face stricter regulations on greenhouse gas emissions, the use of efficient solvents like N-MDEA in gas treatment and flue gas desulfurization has become essential. N-MDEA not only aids in meeting environmental standards but also helps reduce operational costs by lowering energy requirements for solvent regeneration. This dual benefit of compliance and cost-effectiveness has made N-MDEA a critical component in industrial strategies aimed at reducing emissions and achieving sustainability goals.

Advancements in chemical production and formulation have also contributed to market growth by expanding the use of N-MDEA in specialty chemicals, coatings, and pharmaceuticals. Improved production techniques, such as better synthesis and purification methods, have increased the availability and quality of N-MDEA, making it more suitable for high-performance applications. In the coatings industry, for instance, N-MDEA’s role as a neutralizing agent and stabilizer has made it a valuable ingredient in the production of waterborne coatings, which are increasingly preferred for their lower environmental impact compared to solvent-based alternatives.

Increasing investments in refining and gas processing infrastructure, particularly in emerging markets, have also driven the adoption of N-MDEA. As countries invest in expanding their refining capacities and natural gas processing facilities, the demand for efficient gas treatment solutions has grown. Additionally, government support for cleaner energy production, coupled with policies encouraging the reduction of emissions from industrial processes, has boosted the use of N-MDEA in global markets.

With ongoing innovations in gas treatment technology, chemical manufacturing, and sustainable practices, the N-MDEA market is poised for continued growth. These trends, combined with increasing demand for efficient, versatile, and environmentally friendly chemical solutions, make N-MDEA a vital component in modern industrial processes across energy, chemical, and manufacturing sectors.

SCOPE OF STUDY:

The report analyzes the N-Methyldiethanolamine market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: End-Use (Oil & Gas, Textile, Paints & Coatings, Medical, Other End-Uses)

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oil & Gas segment, which is expected to reach US$496.1 Million by 2030 with a CAGR of a 4.4%. The Textile segment is also set to grow at 5.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $196.9 Million in 2024, and China, forecasted to grow at an impressive 7.1% CAGR to reach $214.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global N-Methyldiethanolamine Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global N-Methyldiethanolamine Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global N-Methyldiethanolamine Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amines & Plasticizers Ltd., BASF SE, Dow, Inc., DuPont de Nemours, Inc., Eastman Chemical Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this N-Methyldiethanolamine market report include:

- Amines & Plasticizers Ltd.

- BASF SE

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Huntsman Corporation

- INEOS Group

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amines & Plasticizers Ltd.

- BASF SE

- Dow, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Huntsman Corporation

- INEOS Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

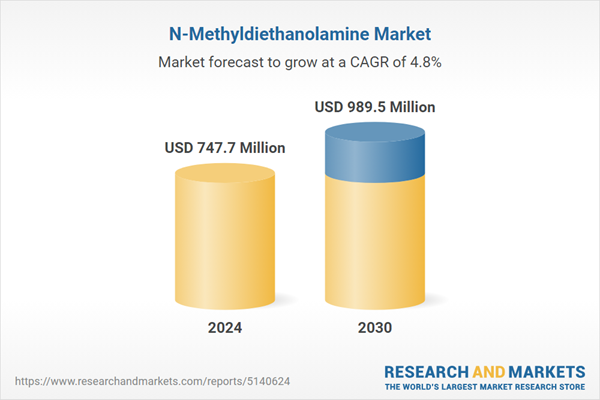

| Estimated Market Value ( USD | $ 747.7 Million |

| Forecasted Market Value ( USD | $ 989.5 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |