Global Minimally Invasive Surgery (MIS) Market - Key Trends & Drivers Summarized

What Is Minimally Invasive Surgery, and Why Is It So Crucial in Modern Healthcare?

Minimally Invasive Surgery (MIS) is a surgical approach that uses specialized techniques, tools, and instruments to perform procedures through small incisions or natural body openings. Unlike traditional open surgery, which involves large cuts, MIS involves techniques like laparoscopy, endoscopy, robotic-assisted surgery, and interventional radiology. These methods minimize tissue damage, reduce pain, and enable faster recovery for patients. Common applications of MIS include gallbladder removal, hernia repair, orthopedic procedures, cardiac interventions, and cosmetic surgeries.The importance of minimally invasive surgery lies in its ability to provide faster recovery, reduced hospital stays, fewer complications, and better patient outcomes compared to open surgery. MIS has revolutionized surgical care, improving patient safety and comfort while lowering healthcare costs through shorter hospital stays and quicker returns to normal activity. As patients and healthcare providers seek better outcomes with less trauma, MIS has become a crucial component of modern surgical strategies across various medical specialties, from orthopedics and cardiology to gastroenterology and gynecology.

How Are Technological Advancements Shaping the Minimally Invasive Surgery Market?

Technological advancements have significantly enhanced the precision, effectiveness, and safety of Minimally Invasive Surgery, driving innovation across various medical fields. One of the major developments is the rise of robotic-assisted surgery, which provides surgeons with greater dexterity, enhanced visualization, and improved control. Robotic systems like the da Vinci Surgical System and newer platforms from companies like Medtronic and Stryker enable precise, complex movements with minimal invasiveness, making them suitable for intricate procedures such as urologic, gynecologic, and cardiac surgeries.Advancements in endoscopic and laparoscopic equipment have further improved the capabilities of MIS. High-definition cameras, 3D imaging, and miniature instruments have enhanced surgeons' ability to visualize internal structures clearly and perform delicate procedures through small incisions. The development of single-incision laparoscopic surgery (SILS) and natural orifice transluminal endoscopic surgery (NOTES) has reduced the number of incisions needed, further minimizing tissue damage and postoperative pain.

The integration of augmented reality (AR) and artificial intelligence (AI) has also shaped the minimally invasive surgery market. AR overlays imaging data onto real-time views of the surgical field, guiding surgeons with enhanced accuracy during procedures. AI algorithms are used to analyze surgical videos, improve decision-making, and even predict complications, supporting better surgical outcomes. Additionally, advancements in energy-based devices, like radiofrequency and laser ablation, have improved the precision of tissue dissection, coagulation, and ablation, making MIS more effective in treating various conditions, from tumors to varicose veins. These technological innovations not only expand the capabilities of MIS but also align with broader trends toward precision medicine, patient-centered care, and reduced healthcare costs.

What Are the Emerging Applications of Minimally Invasive Surgery Across Different Specialties?

Minimally Invasive Surgery is finding expanding applications across various medical specialties, driven by the need for better patient outcomes, reduced recovery times, and lower healthcare costs. In cardiovascular surgery, MIS is used for procedures like angioplasty, stent placement, and heart valve repair or replacement. Techniques such as transcatheter aortic valve replacement (TAVR) allow for heart valve repairs through small incisions in the groin, reducing the need for open-heart surgery and supporting quicker recovery for patients, especially the elderly or those with high surgical risks.In orthopedics, MIS is used for joint replacement, spinal surgery, and fracture fixation. Arthroscopic techniques enable surgeons to repair damaged joints with minimal incisions, reducing recovery time and post-surgical pain. Robotic-assisted orthopedic surgery, such as robotic knee replacements, has improved the precision of bone cuts and implant placement, enhancing long-term outcomes and reducing revision rates.

In gynecology, minimally invasive techniques are employed for procedures like hysterectomy, fibroid removal, and treatment of endometriosis. Laparoscopic and robotic-assisted gynecologic surgeries offer less pain, fewer complications, and faster recovery compared to open surgery. In gastrointestinal surgery, procedures like laparoscopic cholecystectomy, colorectal resection, and bariatric surgery have become standard, offering better outcomes and shorter hospital stays.

In oncology, MIS is increasingly used for tumor resections, biopsies, and ablative therapies. Techniques like laparoscopic cancer surgery, robotic prostatectomy, and video-assisted thoracic surgery (VATS) allow for precise tumor removal with minimal disruption to surrounding tissues. In cosmetic and reconstructive surgery, minimally invasive methods, such as endoscopic brow lifts, laser liposuction, and scarless breast augmentation, offer aesthetic improvements with reduced scarring and quicker recovery times. The expanding applications of minimally invasive surgery across these specialties highlight its critical role in improving patient care, supporting faster recovery, and reducing healthcare costs in both acute and elective procedures.

What Drives Growth in the Minimally Invasive Surgery Market?

The growth in the Minimally Invasive Surgery market is driven by several factors, including rising patient demand for faster recovery, advancements in surgical technology, and increasing adoption across medical specialties. One of the primary growth drivers is the growing patient preference for less invasive procedures. Patients increasingly seek surgical options that offer faster recovery, less pain, and fewer complications, making MIS an attractive choice for a wide range of treatments. This demand is particularly strong among younger patients, active adults, and those looking to minimize disruption to their daily lives.The growing focus on healthcare cost reduction has further fueled the adoption of minimally invasive surgery. MIS reduces hospital stays, lowers the risk of complications, and enables quicker return to normal activities, all of which contribute to lower healthcare costs. As healthcare systems prioritize cost efficiency and value-based care, hospitals and surgical centers are adopting MIS to improve outcomes while managing expenses. Insurance companies and healthcare providers are also incentivizing MIS procedures as part of efforts to reduce overall healthcare expenditures.

Advancements in robotics, imaging, and AI have significantly contributed to the expansion of MIS. Robotic-assisted systems, high-definition imaging, and AI-enhanced decision support have improved the precision, safety, and outcomes of minimally invasive procedures, making them applicable to more complex surgeries. The integration of real-time imaging, AR, and AI into surgical workflows supports better decision-making and reduces the learning curve for surgeons, driving wider adoption across specialties.

Supportive regulatory frameworks

and training initiatives have also played a key role in driving growth. Government approvals, insurance reimbursements, and professional training programs have increased access to and confidence in minimally invasive techniques. Additionally, the increasing prevalence of chronic diseases, such as cardiovascular disorders, cancer, and obesity, has driven demand for minimally invasive surgical treatments, which offer effective intervention with reduced risks.With ongoing innovations in surgical devices, robotics, imaging, and patient-centric care, the minimally invasive surgery market is poised for continued growth. These trends, combined with increasing demand for better patient outcomes, reduced recovery times, and cost-effective care, make MIS a vital component of modern surgical strategies across various medical specialties.

Report Scope

The report analyzes the Minimally Invasive Surgery market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Device (Surgical Devices, Monitoring and Visualization Devices, Endoscopy Devices); Type of Surgery (Orthopedic Surgery, Cosmetic Surgery, Breast Surgery, Vascular Surgery, Thoracic Surgery, Gynecological Surgery, Bariatric Surgery, Cardiac Surgery, Gastrointestinal Surgery, Urological Surgery).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Surgical Devices segment, which is expected to reach US$70.4 Billion by 2030 with a CAGR of a 9.8%. The Monitoring and Visualization Devices segment is also set to grow at 8.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $22.3 Billion in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $20.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Minimally Invasive Surgery Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Minimally Invasive Surgery Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Minimally Invasive Surgery Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aesculap Implant Systems LLC, AKTORmed, Apple Medical, Ascent Ear Nose Throat Specialist Group Pte. Limited, Atlantic General Hospital and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 51 companies featured in this Minimally Invasive Surgery market report include:

- Aesculap Implant Systems LLC

- AKTORmed

- Apple Medical

- Ascent Ear Nose Throat Specialist Group Pte. Limited

- Atlantic General Hospital

- Aurora Spine, Inc.

- avatera

- Avitus Orthopaedics, Inc.

- Baylor College of Medicine

- Beacon Health System

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aesculap Implant Systems LLC

- AKTORmed

- Apple Medical

- Ascent Ear Nose Throat Specialist Group Pte. Limited

- Atlantic General Hospital

- Aurora Spine, Inc.

- avatera

- Avitus Orthopaedics, Inc.

- Baylor College of Medicine

- Beacon Health System

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

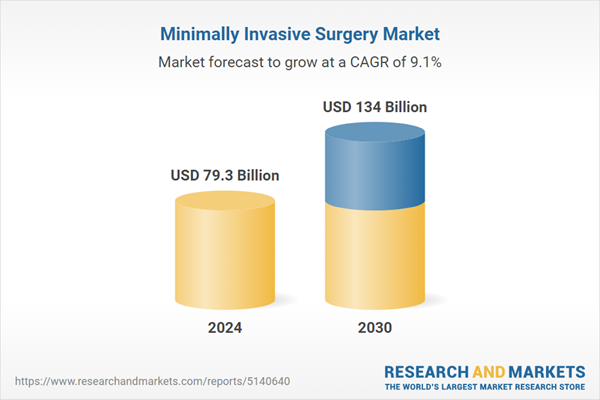

| Estimated Market Value ( USD | $ 79.3 Billion |

| Forecasted Market Value ( USD | $ 134 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |