Global Technology Spending on Core Administration in Healthcare Market - Key Trends & Drivers Summarized

What Is Technology Spending on Core Administration in Healthcare and Why Is It Crucial for Modern Healthcare Systems?

Technology spending on core administration in healthcare refers to the investments made by healthcare organizations in software, digital tools, and IT infrastructure aimed at optimizing core administrative functions such as claims management, patient registration, billing and revenue cycle management, provider management, and regulatory compliance. Core administration technologies are designed to streamline back-office operations, improve data accuracy, enhance patient engagement, and ensure compliance with healthcare regulations. These technologies include electronic health records (EHR) systems, practice management software, patient scheduling solutions, medical billing and coding tools, and healthcare analytics platforms. By leveraging these technologies, healthcare providers, payers, and other stakeholders can reduce administrative overhead, accelerate claims processing, and improve overall operational efficiency.The global adoption of core administration technologies in healthcare is being driven by the need to address inefficiencies in administrative processes and reduce costs associated with manual, paper-based systems. The healthcare industry is known for its complex administrative workflows, which can lead to errors, delays, and increased costs. Technology spending on core administration helps address these challenges by automating routine tasks, enabling seamless data exchange between different departments and entities, and providing real-time insights into administrative operations. Additionally, these technologies support better patient experiences by enabling more efficient scheduling, quicker registration, and faster billing processes. As healthcare systems worldwide undergo digital transformation and shift towards value-based care models, investment in core administration technologies is becoming a strategic priority, driving the growth of the global market for technology spending on core administration in healthcare.

How Are Technological Advancements Shaping the Development and Adoption of Core Administration Technologies in Healthcare?

Technological advancements are significantly enhancing the development, functionality, and adoption of core administration technologies in healthcare, making them more integrated, intelligent, and user-friendly. One of the most impactful innovations in this field is the integration of artificial intelligence (AI) and machine learning (ML) into administrative software solutions. AI and ML are being used to automate a wide range of administrative tasks, such as claims adjudication, coding, and billing, reducing the need for manual intervention and improving process accuracy. For example, AI-driven claims management systems can automatically identify errors, detect fraud, and prioritize claims for faster processing, significantly reducing turnaround times and administrative costs. Machine learning algorithms are also being used to predict patient demand, optimize scheduling, and allocate resources more efficiently, improving the utilization of healthcare facilities and staff. These AI-powered capabilities are transforming core administration processes, enabling healthcare organizations to achieve higher levels of efficiency, accuracy, and cost savings.Another key technological advancement driving the adoption of core administration technologies is the development of cloud-based solutions and platforms. Cloud computing is enabling healthcare organizations to access core administration technologies as software-as-a-service (SaaS) offerings, which provide several advantages over traditional on-premises systems. Cloud-based solutions offer greater scalability, lower upfront costs, and easier integration with other healthcare applications, making them accessible to organizations of all sizes, including small practices and independent clinics. These solutions also facilitate seamless data sharing and collaboration between different departments, healthcare providers, and payers, enhancing the coordination of administrative processes. The use of cloud-based core administration technologies is particularly beneficial in multi-site healthcare organizations, where centralized access to patient records, billing information, and compliance data can streamline operations and reduce administrative complexity. The growing adoption of cloud-based platforms is making core administration technologies more flexible, affordable, and easier to implement, supporting their adoption across the healthcare industry.

Furthermore, advancements in interoperability standards and healthcare data integration are improving the functionality and effectiveness of core administration technologies. Interoperability allows different healthcare systems and applications to communicate and share data seamlessly, which is critical for ensuring that administrative processes are based on accurate, up-to-date information. The use of health information exchange (HIE) standards such as HL7, FHIR (Fast Healthcare Interoperability Resources), and X12 is enabling core administration technologies to integrate with electronic health records (EHR), clinical systems, and patient management platforms, creating a unified view of patient and administrative data. This integration supports more efficient claims processing, eligibility verification, and patient scheduling, reducing the risk of errors and administrative bottlenecks. The development of application programming interfaces (APIs) and middleware solutions is further enhancing the ability of core administration technologies to connect with existing healthcare IT infrastructure, improving data accuracy and process efficiency. These advancements in interoperability and data integration are making core administration technologies more effective in supporting healthcare operations and are driving their adoption in various healthcare settings.

What Factors Are Driving the Adoption of Core Administration Technologies Across the Healthcare Sector?

The adoption of core administration technologies is being driven by several key factors, including the increasing complexity of healthcare administrative processes, the growing need for cost containment, and the rising focus on improving patient experiences. One of the primary drivers is the increasing complexity of healthcare administrative processes, particularly in the context of regulatory compliance and value-based care models. Healthcare organizations must navigate a complex web of regulations, billing codes, and reimbursement rules, which can vary by payer, geography, and care setting. Compliance with these regulations requires accurate documentation, timely reporting, and strict adherence to coding standards. Core administration technologies help healthcare organizations manage these complexities by automating compliance checks, standardizing documentation, and providing real-time insights into compliance performance. This capability is particularly valuable for large healthcare systems, multi-specialty practices, and payer organizations that must manage multiple regulatory requirements and reimbursement models. The adoption of core administration technologies is supporting healthcare organizations in achieving regulatory compliance and reducing the administrative burden associated with complex healthcare processes.Another significant factor driving the adoption of core administration technologies is the growing need for cost containment in the healthcare sector. Administrative costs account for a significant portion of overall healthcare spending, and inefficiencies in administrative processes can lead to increased costs and reduced profitability for healthcare organizations. Core administration technologies are being adopted as a means of reducing administrative costs through automation, process standardization, and the elimination of manual errors. Automated claims processing, for example, can significantly reduce the time and labor required to process claims, resulting in faster reimbursements and lower administrative overhead. Similarly, automated patient scheduling and resource management tools can optimize the use of clinical and administrative resources, reducing waste and improving financial performance. The use of core administration technologies is helping healthcare organizations streamline their operations, reduce costs, and achieve financial sustainability, making these technologies an essential component of cost containment strategies in the healthcare sector.

Moreover, the rising focus on improving patient experiences is influencing the adoption of core administration technologies across various healthcare settings. Patients today expect a seamless, convenient, and transparent experience when interacting with healthcare providers, from appointment scheduling and check-in to billing and payment. Core administration technologies are being used to enhance patient engagement and satisfaction by providing user-friendly digital tools for scheduling, communication, and payment processing. For example, online appointment scheduling systems allow patients to book, reschedule, or cancel appointments at their convenience, reducing waiting times and improving access to care. Automated patient reminders and follow-up notifications help reduce no-show rates and ensure that patients receive timely care. Additionally, digital billing and payment solutions provide patients with a transparent view of their charges, insurance coverage, and payment options, improving transparency and satisfaction. The adoption of core administration technologies is supporting healthcare organizations in delivering patient-centered care and enhancing the overall patient experience, driving demand for these technologies across the healthcare industry.

What Is Driving the Growth of the Global Technology Spending on Core Administration in Healthcare Market?

The growth in the global Technology Spending on Core Administration in Healthcare market is driven by several factors, including rising investments in healthcare IT infrastructure, the increasing adoption of digital health technologies, and the growing demand for data-driven decision-making. One of the primary growth drivers is the rising investment in healthcare IT infrastructure by healthcare providers, payers, and government organizations. As healthcare systems worldwide undergo digital transformation, there is a growing focus on modernizing administrative processes and building digital capabilities that support efficient, cost-effective, and patient-centered operations. Investments in healthcare IT infrastructure are enabling healthcare organizations to implement core administration technologies that automate workflows, enhance data management, and improve collaboration across the care continuum. Government initiatives to promote the adoption of health IT, such as the HITECH Act in the United States and digital health strategies in Europe and Asia-Pacific, are also supporting investments in core administration technologies. These investments are driving the growth of the market by creating demand for advanced software solutions, IT services, and cloud-based platforms that support core administrative functions.Another significant driver of market growth is the increasing adoption of digital health technologies, such as telehealth, remote patient monitoring, and digital therapeutics, which are transforming the way healthcare is delivered and managed. The adoption of these technologies is creating new administrative challenges related to scheduling, billing, and claims management, as well as new opportunities for improving operational efficiency and patient engagement. Core administration technologies are being used to integrate digital health solutions into existing administrative workflows, ensuring that virtual visits, remote monitoring data, and digital health interactions are accurately documented, billed, and reimbursed. The integration of core administration technologies with digital health solutions is enabling healthcare organizations to provide a seamless patient experience, optimize resource utilization, and enhance financial performance. This trend is driving demand for core administration technologies that support the adoption of digital health and telemedicine, contributing to the growth of the market.

Moreover, the growing demand for data-driven decision-making is supporting the growth of the core administration technology market. Healthcare organizations are increasingly leveraging data analytics and business intelligence tools to gain insights into administrative performance, financial health, and patient outcomes. Core administration technologies that incorporate analytics capabilities are enabling healthcare organizations to analyze claims data, track key performance indicators (KPIs), and identify areas for improvement in administrative processes. For example, revenue cycle management (RCM) platforms with built-in analytics can help organizations identify trends in claim denials, optimize reimbursement strategies, and improve cash flow. Similarly, patient management systems that provide data on appointment utilization and no-show rates can help optimize scheduling and resource allocation. The ability to make data-driven decisions is enhancing the effectiveness of core administration technologies in supporting strategic planning and operational excellence, driving demand for these technologies in the healthcare sector.

Furthermore, the increasing focus on product innovation and the development of value-added core administration solutions is influencing the growth of the market. Manufacturers and technology providers are investing in research and development (R&D) to create next-generation core administration solutions that offer advanced features, such as AI-driven automation, blockchain-based data security, and enhanced interoperability. The introduction of AI-powered coding and billing solutions, for example, is reducing the time and complexity associated with medical coding and ensuring greater accuracy in claims submission. The use of blockchain technology in core administration solutions is enhancing data security and privacy, making these solutions more compliant with healthcare regulations such as HIPAA and GDPR. These innovations are making core administration technologies more effective in addressing the evolving needs of healthcare organizations and are supporting the growth of the market by providing solutions that offer enhanced performance, security, and user experience. As these factors continue to shape the global healthcare landscape, the Technology Spending on Core Administration in Healthcare market is expected to experience robust growth, driven by rising investments in healthcare IT infrastructure, the increasing adoption of digital health technologies, and the growing demand for data-driven decision-making.

Report Scope

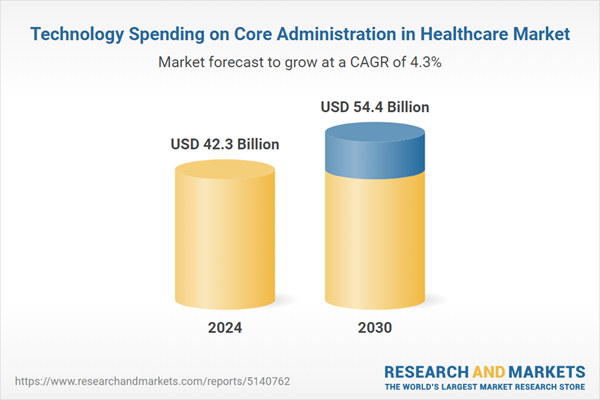

The report analyzes the Technology Spending on Core Administration in Healthcare market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Payers, Providers); Solution (In-house, Outsource).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the In-house Solution segment, which is expected to reach US$24.3 Billion by 2030 with a CAGR of a 4.2%. The Outsource Solution segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.5 Billion in 2024, and China, forecasted to grow at an impressive 4% CAGR to reach $8.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Technology Spending on Core Administration in Healthcare Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Technology Spending on Core Administration in Healthcare Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Technology Spending on Core Administration in Healthcare Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as DST Systems, Inc., Health Solutions Plus, HealthAxis Group, LLC, HealthEdge Software, Inc., PLEXIS Healthcare Systems, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Technology Spending on Core Administration in Healthcare market report include:

- DST Systems, Inc.

- Health Solutions Plus

- HealthAxis Group, LLC

- HealthEdge Software, Inc.

- PLEXIS Healthcare Systems, Inc.

- Trizetto Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- DST Systems, Inc.

- Health Solutions Plus

- HealthAxis Group, LLC

- HealthEdge Software, Inc.

- PLEXIS Healthcare Systems, Inc.

- Trizetto Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 246 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 42.3 Billion |

| Forecasted Market Value ( USD | $ 54.4 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |