Global Soft Skills Management Market - Key Trends & Drivers Summarized

What Is Soft Skills Management and Why Is It Critical for Modern Workplaces?

Soft skills management refers to the structured approach to developing, enhancing, and assessing non-technical interpersonal and communication skills, such as teamwork, leadership, problem-solving, adaptability, and emotional intelligence, which are crucial for personal and professional success. Unlike hard skills, which are technical and job-specific, soft skills are transferable and applicable across various roles and industries, making them indispensable for effective collaboration, conflict resolution, and leadership in the workplace. Soft skills management encompasses a wide range of activities, including training programs, workshops, coaching sessions, and digital learning platforms that aim to build and strengthen these skills in employees at all levels.The global adoption of soft skills management is transforming modern workplaces by promoting a culture of continuous learning and employee development. With the rapid pace of technological advancements and automation, traditional technical skills are becoming less relevant, and employers are increasingly valuing soft skills as critical differentiators for career advancement and organizational success. Research indicates that soft skills such as empathy, communication, and adaptability are essential for navigating complex work environments, fostering innovation, and building high-performing teams. As companies recognize the impact of soft skills on employee engagement, productivity, and retention, they are investing heavily in structured soft skills development programs to create a well-rounded workforce. The rising emphasis on holistic employee development and the growing recognition of soft skills as a strategic asset are driving the expansion of the soft skills management market across industries and regions.

How Are Technological Advancements Shaping the Capabilities and Reach of Soft Skills Management Solutions?

Technological advancements are significantly enhancing the capabilities and reach of soft skills management solutions, making it easier for organizations to deliver personalized, scalable, and effective soft skills training to employees. One of the most impactful innovations in this field is the integration of digital learning platforms and e-learning modules. Digital platforms enable companies to deliver soft skills training through interactive video tutorials, virtual simulations, and gamified content, providing a more engaging and flexible learning experience. These platforms often include assessments, quizzes, and feedback mechanisms that allow learners to track their progress and receive personalized recommendations. The use of cloud-based learning management systems (LMS) further enables organizations to offer on-demand, self-paced training that can be accessed from anywhere, making it easier to reach a geographically dispersed workforce.Another key technological advancement driving the soft skills management market is the use of artificial intelligence (AI) and machine learning (ML) to create adaptive learning paths and personalized content. AI algorithms can analyze data on learners' progress, performance, and preferences to identify skill gaps and recommend targeted learning modules that cater to individual needs. This personalized approach not only enhances the learning experience but also increases the effectiveness of training programs by focusing on areas where improvement is needed most. Additionally, AI-powered virtual coaches and chatbots are being used to simulate real-world interactions and provide instant feedback, allowing learners to practice soft skills such as negotiation, conflict resolution, and leadership in a safe and supportive environment. These AI-driven tools are making soft skills training more accessible and effective, enabling organizations to upskill their employees in a cost-efficient manner.

Furthermore, advancements in virtual reality (VR) and augmented reality (AR) are revolutionizing soft skills training by creating immersive learning experiences that replicate real-world scenarios. VR-based training programs enable learners to practice soft skills such as public speaking, teamwork, and customer service in simulated environments that mimic actual workplace situations. This experiential learning approach allows employees to develop their skills through hands-on practice, build confidence, and receive real-time feedback on their performance. AR technology is also being used to overlay digital information onto physical environments, providing contextual guidance and support during live interactions. For example, AR can be used to display conversation tips or emotional cues during a customer service interaction, helping employees navigate difficult conversations more effectively. These technological advancements are not only enhancing the capabilities of soft skills management solutions but are also expanding their reach by making training more engaging, interactive, and applicable to real-world contexts.

What Factors Are Driving the Adoption of Soft Skills Management Solutions Across Various Industries and Regions?

The adoption of soft skills management solutions is being driven by several key factors, including the growing need for workforce agility, the rising focus on employee engagement and retention, and the increasing integration of soft skills into organizational performance metrics. One of the primary drivers is the growing need for workforce agility in response to the rapid pace of change in the business environment. As industries undergo digital transformation and automation reshapes job roles, employees need to adapt quickly to new technologies, processes, and ways of working. Soft skills such as adaptability, creativity, and problem-solving are becoming essential for navigating these changes and maintaining productivity. Organizations are therefore investing in soft skills training to build a more agile and resilient workforce that can thrive in dynamic and uncertain environments. This trend is particularly strong in technology-driven industries such as IT, finance, and healthcare, where the ability to manage change and work collaboratively across disciplines is critical for success.Another significant factor driving the adoption of soft skills management solutions is the rising focus on employee engagement, satisfaction, and retention. Research has shown that employees with strong soft skills are more engaged, motivated, and likely to stay with their employers. Companies that prioritize soft skills development create a positive work culture that encourages open communication, collaboration, and mutual respect. This, in turn, enhances job satisfaction and reduces turnover rates. As competition for top talent intensifies, especially in sectors with high turnover rates such as retail and hospitality, organizations are leveraging soft skills training as part of their employee value proposition to attract, develop, and retain skilled employees. The implementation of comprehensive soft skills development programs is helping companies build a more engaged and loyal workforce, contributing to long-term organizational success.

Moreover, the increasing integration of soft skills into organizational performance metrics is influencing the adoption of soft skills management solutions. As organizations recognize the impact of soft skills on overall performance, they are incorporating these skills into competency frameworks, leadership models, and performance evaluations. Soft skills such as communication, teamwork, and emotional intelligence are being assessed alongside technical skills to provide a more holistic view of employee capabilities. This shift is driving the adoption of tools and platforms that can assess, track, and develop soft skills in a structured and measurable way. In regions such as North America and Europe, where corporate governance and leadership development are highly valued, there is strong demand for solutions that support the systematic development of soft skills at all levels of the organization. Similarly, in emerging markets such as Asia-Pacific, the growing emphasis on leadership development and global competitiveness is driving the adoption of soft skills management solutions that can help build a workforce equipped with the skills needed to excel in a global business environment.

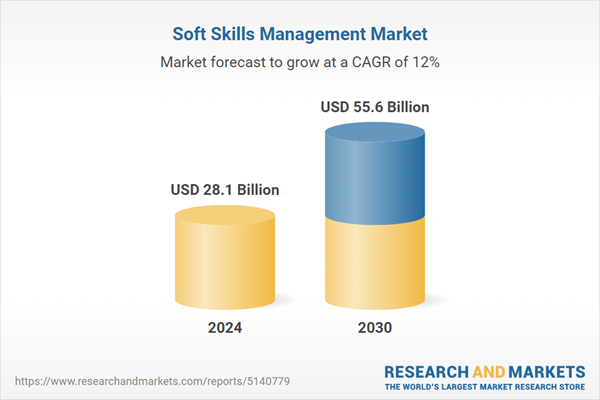

What Is Driving the Growth of the Global Soft Skills Management Market?

The growth in the global Soft Skills Management market is driven by several factors, including the increasing investment in employee development, the growing emphasis on leadership and talent development, and the rise of digital learning platforms. One of the primary growth drivers is the increasing investment in employee development by organizations across industries. Companies are recognizing that investing in the continuous development of their workforce is crucial for maintaining competitiveness and fostering innovation. This is especially true in knowledge-intensive industries such as technology, finance, and consulting, where soft skills like critical thinking, communication, and collaboration are essential for success. As a result, organizations are allocating larger portions of their learning and development (L&D) budgets to soft skills training, driving demand for comprehensive soft skills management solutions that can support employee development at scale.Another significant driver of market growth is the growing emphasis on leadership and talent development. Soft skills are critical for effective leadership, as they enable leaders to inspire, influence, and guide their teams through change and uncertainty. Companies are increasingly prioritizing the development of leadership capabilities at all levels, from first-time managers to senior executives. This focus on leadership development is creating strong demand for soft skills training programs that address areas such as emotional intelligence, conflict resolution, and strategic thinking. The rise of global leadership development programs, which aim to build a pipeline of future leaders with the skills needed to navigate complex business environments, is further supporting the growth of the soft skills management market. The trend is particularly prominent in multinational organizations and large enterprises, which are investing in soft skills management solutions to develop a globally competent leadership team.

Moreover, the rise of digital learning platforms is supporting the growth of the soft skills management market by making training more accessible, scalable, and cost-effective. Digital platforms enable organizations to deliver soft skills training through online courses, webinars, and virtual workshops, providing employees with the flexibility to learn at their own pace and convenience. The integration of AI, machine learning, and analytics into these platforms is enhancing the ability to personalize learning experiences, track progress, and measure the impact of training programs. This digital transformation of learning and development is particularly beneficial for organizations with a remote or globally distributed workforce, as it allows them to provide consistent and high-quality training to employees regardless of their location. The growing adoption of digital learning solutions is driving demand for soft skills management platforms that can support a hybrid or fully virtual learning environment, further contributing to market growth.

Furthermore, the increasing use of soft skills assessments and certifications is influencing the growth of the market. As companies place greater emphasis on the value of soft skills, there is a growing need for reliable methods to assess and certify these competencies. Soft skills assessments, which can include self-assessments, peer reviews, and simulations, provide valuable insights into an employee's strengths and areas for development. Certifications, in turn, validate these skills and provide a tangible measure of competence. The use of assessments and certifications is gaining traction in sectors such as education, healthcare, and professional services, where soft skills are critical for effective performance. As these factors continue to shape the global workforce development landscape, the Soft Skills Management market is expected to experience robust growth, driven by rising investment in employee development, technological advancements in digital learning, and the increasing emphasis on leadership and talent development.

Report Scope

The report analyzes the Soft Skills Management market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Delivery Mode (Regular/Offline, Online); End-Use Industry (Banking, Financial Services & Insurance (BFSI), Manufacturing, IT & Telecom, Hospitality, Media & Entertainment, Other End-Use Industries).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Regular/Offline Delivery segment, which is expected to reach US$34.3 Billion by 2030 with a CAGR of a 12.4%. The Online Delivery segment is also set to grow at 11.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.7 Billion in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $8.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Soft Skills Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Soft Skills Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Soft Skills Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Articulate Global, Inc., Cengage Learning, Inc., Computer Generated Solutions, Inc. (CGS), D2L Corporation, Edx, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 13 companies featured in this Soft Skills Management market report include:

- Articulate Global, Inc.

- Cengage Learning, Inc.

- Computer Generated Solutions, Inc. (CGS)

- D2L Corporation

- Edx, Inc.

- Interaction Associates

- New Horizons Worldwide, LLC

- Niit Limited

- Pearson PLC

- QA Limited

- SkillSoft Corporation

- The Insights Group Limited

- Vitalsmarts India

- Wilson Learning Worldwide Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Articulate Global, Inc.

- Cengage Learning, Inc.

- Computer Generated Solutions, Inc. (CGS)

- D2L Corporation

- Edx, Inc.

- Interaction Associates

- New Horizons Worldwide, LLC

- Niit Limited

- Pearson PLC

- QA Limited

- SkillSoft Corporation

- The Insights Group Limited

- Vitalsmarts India

- Wilson Learning Worldwide Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 259 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 28.1 Billion |

| Forecasted Market Value ( USD | $ 55.6 Billion |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | Global |