Global Smart Mining Market - Key Trends & Drivers Summarized

What Is Smart Mining and Why Is It Revolutionizing the Mining Industry?

Smart mining is an advanced approach to mining operations that integrates various digital technologies, such as the Internet of Things (IoT), artificial intelligence (AI), robotics, and data analytics, to optimize the extraction, transportation, and processing of minerals. Unlike traditional mining, which relies on manual processes and siloed systems, smart mining leverages automation, connectivity, and real-time data to create highly efficient, safe, and environmentally friendly operations. This technological transformation is enabling mining companies to enhance operational efficiency, reduce costs, improve worker safety, and minimize environmental impact. Smart mining solutions include autonomous haulage systems, real-time monitoring and control systems, remote-operated machinery, predictive maintenance, and digital twin technology, all of which contribute to smarter decision-making and more sustainable resource management.The global adoption of smart mining is being driven by the growing need to address challenges such as declining ore grades, deeper mines, and increasing operational costs. Mining companies are under pressure to maintain profitability while adhering to stricter environmental regulations and ensuring the safety of their workforce. Smart mining technologies help overcome these challenges by automating repetitive tasks, providing real-time insights into mine conditions, and enabling predictive maintenance that reduces downtime and extends equipment life. Additionally, smart mining solutions are playing a key role in improving resource efficiency by enabling precise control over production processes and reducing waste. As the mining industry continues to embrace digital transformation, smart mining is poised to become the new standard for sustainable and profitable mining operations worldwide, offering a competitive edge in a rapidly changing industry landscape.

How Are Technological Advancements Shaping the Development and Capabilities of Smart Mining?

Technological advancements are at the core of smart mining, enabling greater automation, connectivity, and intelligence throughout the mining value chain. One of the most significant innovations in this field is the use of autonomous and remote-operated vehicles. Autonomous haul trucks, drilling rigs, and loaders are equipped with advanced sensors, GPS navigation, and AI algorithms that allow them to operate independently, transporting materials and performing mining activities without direct human intervention. These vehicles can work continuously without breaks, increasing productivity and reducing labor costs. Additionally, autonomous vehicles improve safety by eliminating the need for workers to be present in hazardous environments, such as deep underground mines or open-pit operations with challenging terrain. The integration of real-time monitoring and control systems further enhances the capabilities of these vehicles, enabling operators to oversee and manage their performance remotely, from central command centers.Another key technological advancement driving smart mining is the implementation of IoT and real-time monitoring systems. IoT devices, such as sensors and connected equipment, are used to collect and transmit data on various parameters, including equipment health, environmental conditions, and ore quality. This data is then analyzed using AI and machine learning algorithms to provide actionable insights that help optimize mining processes, improve resource utilization, and prevent equipment failures. Predictive maintenance is a prime example of how IoT and AI are transforming mining operations. By analyzing data from machinery and equipment in real-time, predictive maintenance systems can identify potential issues before they lead to breakdowns, reducing unplanned downtime and maintenance costs. Additionally, real-time monitoring of environmental conditions, such as air quality and seismic activity, enables mining companies to proactively manage safety risks and ensure compliance with environmental regulations.

Furthermore, the adoption of digital twins and simulation technology is revolutionizing how mining operations are planned, monitored, and optimized. Digital twins are virtual replicas of physical mining assets or processes, used to simulate different scenarios and predict outcomes based on real-time data. By creating digital twins of mining equipment, processes, or entire mining sites, operators can test various operational strategies, assess the impact of changes, and identify potential improvements without disrupting actual operations. This technology is particularly valuable in complex mining operations, where multiple variables interact and small changes can have a significant impact on performance. Additionally, the integration of robotics and automated systems is enabling more precise and efficient drilling, blasting, and material handling processes. Robotic systems can perform tasks with high accuracy and consistency, reducing waste and improving overall productivity. These technological advancements are not only enhancing the capabilities of smart mining but are also driving innovation and sustainability in the industry, making it possible to extract and process minerals more efficiently and responsibly.

What Factors Are Driving the Adoption of Smart Mining Across Various Regions and Mining Companies?

The adoption of smart mining is being driven by several key factors, including the need for operational efficiency, the growing emphasis on worker safety, and the increasing focus on sustainability and environmental responsibility. One of the primary drivers is the growing need for operational efficiency in the face of declining ore grades and rising operational costs. As mineral deposits become harder to access and extract, mining companies are turning to smart mining technologies to optimize their operations and maintain profitability. Automated systems, real-time monitoring, and data analytics enable companies to identify inefficiencies, reduce waste, and optimize resource utilization, leading to higher productivity and lower costs. The ability to perform predictive maintenance and optimize equipment performance is also reducing downtime and extending the lifespan of critical assets, further enhancing operational efficiency.Another significant factor driving the adoption of smart mining is the increasing focus on worker safety and risk management. Mining is inherently hazardous, with workers exposed to risks such as rock falls, explosions, toxic gases, and machinery accidents. Smart mining technologies, such as autonomous vehicles, remote monitoring, and robotic systems, are enabling companies to reduce the need for human presence in dangerous areas, thereby minimizing the risk of accidents and improving overall safety. Additionally, wearable devices and smart helmets equipped with sensors can monitor the health and safety of workers in real-time, providing early warnings in case of dangerous conditions and enabling quick response to emergencies. The use of smart mining technologies is not only enhancing safety but is also helping companies comply with stringent safety regulations and improve their overall safety records.

Moreover, the increasing focus on sustainability and environmental responsibility is influencing the adoption of smart mining technologies. As the global push for sustainability intensifies, mining companies are under pressure to reduce their environmental impact, minimize waste, and lower their carbon footprint. Smart mining solutions, such as energy management systems, water management technologies, and waste reduction strategies, enable companies to optimize resource use and reduce emissions. The ability to monitor and control environmental parameters in real-time allows companies to operate more sustainably and comply with environmental regulations. Additionally, smart mining technologies are supporting the transition to more sustainable mining practices, such as in-situ mining and precision mining, which reduce surface disturbance and minimize environmental damage. As these factors continue to shape the mining industry, the adoption of smart mining technologies is expected to grow, supported by advancements in technology, increasing regulatory pressure, and the rising emphasis on sustainability and safety.

What Is Driving the Growth of the Global Smart Mining Market?

The growth in the global Smart Mining market is driven by several factors, including rising investments in digital transformation, increasing demand for minerals and metals, and government initiatives to promote sustainable mining practices. One of the primary growth drivers is the rising investment in digital transformation across the mining sector. Mining companies are investing heavily in advanced technologies to modernize their operations and remain competitive in a rapidly evolving industry. These investments are creating a strong demand for smart mining solutions, including autonomous vehicles, digital twins, and advanced analytics. The trend is particularly prominent in large mining companies, which are deploying smart mining technologies to optimize production, reduce costs, and improve resource efficiency. Additionally, the COVID-19 pandemic has accelerated the adoption of digital technologies, as companies seek to minimize human presence on-site and ensure business continuity in the face of operational disruptions.Another significant driver of market growth is the increasing global demand for minerals and metals. As the world shifts towards renewable energy and electric vehicles, the demand for minerals such as copper, lithium, cobalt, and rare earth elements is surging. These minerals are essential for the production of batteries, wind turbines, solar panels, and other components of the green energy infrastructure. Smart mining technologies are enabling companies to extract these valuable resources more efficiently and sustainably, ensuring a reliable supply to meet growing market demand. The ability to optimize extraction processes and reduce waste is particularly valuable in the mining of critical minerals, where resource efficiency is key to meeting production targets and minimizing environmental impact.

Moreover, government initiatives and policies aimed at promoting sustainable mining practices and digitalization are supporting the growth of the smart mining market. Governments in regions such as North America, Europe, and Asia-Pacific are implementing regulations and incentives to encourage the adoption of advanced mining technologies and reduce the environmental footprint of mining operations. These initiatives include funding for research and development, tax incentives for green technologies, and support for pilot projects in smart mining. The focus on improving safety and reducing emissions is also driving the adoption of smart mining technologies that enable remote monitoring, real-time data analysis, and automation. Additionally, the increasing availability of high-speed connectivity, such as 5G networks, is facilitating the implementation of smart mining solutions by enabling real-time data transfer and remote control of mining equipment. As these factors continue to shape the mining industry, the Smart Mining market is expected to experience robust growth, driven by technological advancements, rising demand for minerals, and the growing emphasis on safety and sustainability in mining operations worldwide.

Report Scope

The report analyzes the Smart Mining market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Service Type (System Integration, Consulting, Engineering & Maintenance); Solution (Smart Control Systems, Smart Asset Management, Safety and Security Systems, Data Management and Analytics Software, Monitoring Systems, Other Solutions).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Smart Control Systems segment, which is expected to reach US$3.8 Billion by 2030 with a CAGR of a 17%. The Smart Asset Management segment is also set to grow at 20.7% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Smart Mining Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Smart Mining Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Smart Mining Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Alcatel-Lucent, Atlas Joy Global Inc., Caterpillar Inc., Cisco Systems, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Smart Mining market report include:

- ABB Ltd.

- Alcatel-Lucent

- Atlas Joy Global Inc.

- Caterpillar Inc.

- Cisco Systems, Inc.

- Copco

- Hexagon AB

- Hitachi Ltd.

- Komatsu Ltd.

- OutotecOyj

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Sandvik AG

- Trimble, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Alcatel-Lucent

- Atlas Joy Global Inc.

- Caterpillar Inc.

- Cisco Systems, Inc.

- Copco

- Hexagon AB

- Hitachi Ltd.

- Komatsu Ltd.

- OutotecOyj

- Robert Bosch GmbH

- Rockwell Automation Inc.

- Sandvik AG

- Trimble, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

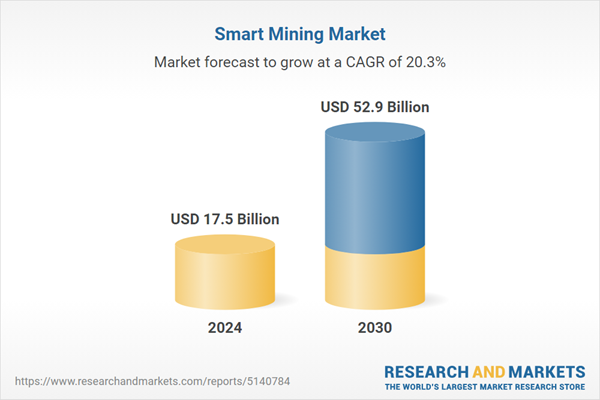

| Estimated Market Value ( USD | $ 17.5 Billion |

| Forecasted Market Value ( USD | $ 52.9 Billion |

| Compound Annual Growth Rate | 20.3% |

| Regions Covered | Global |