Global Rugged Electronics Market - Key Trends & Drivers Summarized

What Are Rugged Electronics and Why Are They Crucial for High-Stress Environments?

Rugged electronics refer to specialized devices and components designed to operate reliably under extreme environmental conditions such as severe temperatures, high humidity, shock, vibration, and exposure to dust or water. These electronics are engineered with reinforced exteriors, robust internal structures, and durable materials that enable them to withstand the rigors of harsh environments where standard consumer-grade electronics would fail. Rugged electronics include a variety of products, such as rugged laptops, smartphones, tablets, cameras, and industrial control systems. They are widely used across sectors like defense, aerospace, construction, mining, and oil & gas, where durability and reliability are paramount. In the defense and aerospace sectors, rugged electronics are employed in critical communication, navigation, and surveillance systems, ensuring uninterrupted performance in challenging conditions. Similarly, in industrial and outdoor applications, these devices are used for monitoring, data collection, and control, offering a high degree of resilience to mechanical impacts and environmental stressors.The growing demand for rugged electronics is driven by their ability to perform consistently and maintain functionality in adverse conditions, minimizing downtime and reducing the total cost of ownership. These devices are built to meet industry-specific standards and certifications, such as MIL-STD-810G for military applications or IP (Ingress Protection) ratings for water and dust resistance, which ensure that they are capable of operating in extreme environments without failure. The reliability and robustness of rugged electronics make them an essential choice for industries where operational continuity is critical and where device failure could result in safety risks, operational delays, or substantial financial losses. Moreover, advancements in materials science and manufacturing processes have enabled the development of rugged electronics that are not only durable but also lightweight and portable, further enhancing their usability and appeal. As industries continue to demand higher levels of performance and durability from their equipment, rugged electronics are set to play an increasingly important role in supporting mission-critical operations across various sectors.

How Are Technological Advancements Shaping the Development of Rugged Electronics?

Technological advancements are significantly enhancing the capabilities and expanding the application scope of rugged electronics, making them more versatile, efficient, and user-friendly. One of the most impactful innovations is the integration of advanced materials and protective coatings. Modern rugged devices are constructed using high-strength alloys, specialized polymers, and reinforced composites that provide superior protection against mechanical impacts, corrosion, and chemical exposure. These materials not only enhance the structural integrity of the devices but also reduce weight, making them easier to handle in field operations. Additionally, protective coatings such as anti-glare, anti-scratch, and anti-fingerprint treatments are being applied to display screens, ensuring optimal visibility and durability in outdoor or high-use environments. These advancements are allowing rugged electronics to maintain high performance and functionality even in the most demanding conditions, such as underwater exploration, desert operations, or high-altitude missions.Another key technological development is the incorporation of enhanced connectivity and communication features. Rugged electronics are now being equipped with advanced wireless communication capabilities, including 5G, satellite connectivity, and Internet of Things (IoT) integration. These features enable seamless real-time data transmission and remote monitoring, making rugged devices indispensable tools in applications such as field data collection, asset tracking, and remote diagnostics. The ability to connect with other devices and systems in real-time is particularly valuable in sectors like oil & gas, construction, and emergency response, where timely and accurate information is crucial for decision-making and operational efficiency. Additionally, innovations in power management technologies, such as energy-efficient processors and long-lasting batteries, are extending the operational life of rugged devices, ensuring that they remain functional for longer periods without frequent recharging. This is especially important in remote or inaccessible locations where power availability is limited. Furthermore, the integration of advanced sensors and AI-powered analytics into rugged electronics is enabling predictive maintenance, fault detection, and enhanced situational awareness, further expanding their capabilities and value proposition across various industries.

What Factors Are Driving the Adoption of Rugged Electronics Across Different Sectors?

The adoption of rugged electronics is being driven by several key factors, including the need for reliable performance in harsh environments, increased focus on worker safety and efficiency, and the growing demand for digital transformation in industrial sectors. One of the primary drivers is the rising need for reliable and durable devices that can function effectively in extreme conditions. In industries such as construction, mining, and oil & gas, workers often operate in environments characterized by heavy machinery, dust, moisture, and extreme temperatures. Rugged electronics, designed to withstand these conditions, provide critical support for communication, data collection, and control operations, ensuring that workflows are not disrupted by equipment failures. Their ability to maintain performance and functionality under adverse conditions makes rugged devices a preferred choice for field operations, where reliability and durability are paramount for safety and productivity.Another significant factor driving the adoption of rugged electronics is the increasing emphasis on worker safety and operational efficiency. In hazardous work environments, the use of rugged devices equipped with features such as thermal imaging, gas detection, and emergency communication capabilities can help enhance worker safety by providing real-time data and alerts about potential dangers. For example, in mining and construction sites, rugged tablets and handhelds with integrated sensors can monitor environmental conditions and detect hazardous gases, ensuring timely intervention and reducing the risk of accidents. Moreover, the ergonomic designs and user-friendly interfaces of modern rugged devices improve worker efficiency by allowing for easy operation even while wearing gloves or protective gear. Additionally, the push for digital transformation and automation in industrial sectors is supporting the adoption of rugged electronics. As industries seek to implement IoT, AI, and machine learning technologies for better process optimization and asset management, rugged devices are being used as the interface for collecting and analyzing data in real-time, facilitating more informed decision-making and enhancing overall productivity. These factors, combined with the increasing use of rugged devices in logistics, transportation, and public safety applications, are driving the widespread adoption of rugged electronics across various sectors.

What Is Driving the Growth of the Global Rugged Electronics Market?

The growth in the global Rugged Electronics market is driven by several key factors, including the expansion of industrial and defense sectors, rising investments in infrastructure and automation, and the increasing need for durable and reliable devices in emerging markets. One of the primary growth drivers is the expansion of the industrial and defense sectors, particularly in regions such as North America, Europe, and Asia-Pacific. As these industries continue to grow, there is a corresponding increase in demand for rugged electronics that can support complex operations in challenging environments. In the defense sector, for instance, rugged electronics are used in communication systems, navigation equipment, and surveillance devices, where their ability to withstand extreme temperatures, shock, and vibration is essential for mission success. Similarly, in the oil & gas and mining industries, rugged devices are used to monitor and control operations in remote and hazardous locations, ensuring the safety and efficiency of the workforce. The increasing deployment of rugged electronics in these high-growth sectors is contributing significantly to market expansion.Another critical driver of market growth is the rising investment in infrastructure development and industrial automation. Governments and private organizations worldwide are investing in modernizing infrastructure, building smart cities, and implementing automation technologies to enhance productivity and reduce operational costs. Rugged electronics are playing a crucial role in these initiatives by providing the necessary tools and equipment to support real-time monitoring, data acquisition, and remote control of infrastructure and industrial assets. Moreover, the growing adoption of automation and robotics in manufacturing and logistics is boosting demand for rugged devices that can operate seamlessly in factory environments or logistics centers with high levels of mechanical stress and temperature variations. The increasing availability of affordable rugged devices, coupled with advancements in connectivity and software integration, is also making them more accessible to small and medium-sized enterprises (SMEs), further driving market growth. Additionally, the expansion of rugged electronics into emerging markets, where the need for robust and reliable devices is critical due to challenging environmental conditions, is providing new growth opportunities. As these factors converge, the global Rugged Electronics market is poised for sustained growth, driven by rising industrialization, technological advancements, and the growing demand for durable and reliable solutions in high-stress environments.

Report Scope

The report analyzes the Rugged Electronics market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Industrial Computing & Handheld Devices, Hardware Components, Tracking Devices, Other Product Types); End-Use (Defense, Aerospace, Chemicals, Metal & Mining, Power, Transportation, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Industrial Computing & Handheld Devices segment, which is expected to reach US$25.5 Billion by 2030 with a CAGR of a 6.9%. The Hardware Components segment is also set to grow at 6.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.6 Billion in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $7.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Rugged Electronics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Rugged Electronics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Rugged Electronics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Crystal Group Inc., DRS Technologies, Inc., DT Research, Inc., MobileDemand, L.C., Mountain Secure Systems and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 54 companies featured in this Rugged Electronics market report include:

- Crystal Group Inc.

- DRS Technologies, Inc.

- DT Research, Inc.

- MobileDemand, L.C.

- Mountain Secure Systems

- Panasonic Corporation

- Schneider Electric SA

- Siemens AG

- Xplore Technologies Corporation of America

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Crystal Group Inc.

- DRS Technologies, Inc.

- DT Research, Inc.

- MobileDemand, L.C.

- Mountain Secure Systems

- Panasonic Corporation

- Schneider Electric SA

- Siemens AG

- Xplore Technologies Corporation of America

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 229 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

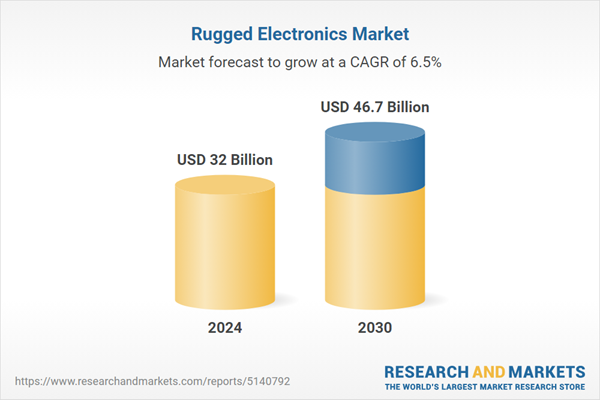

| Estimated Market Value ( USD | $ 32 Billion |

| Forecasted Market Value ( USD | $ 46.7 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |