Global Rubber Coated Fabrics Market - Key Trends & Drivers Summarized

What Are Rubber Coated Fabrics and Why Are They Gaining Popularity Across Multiple Industries?

Rubber coated fabrics are textile materials that have been treated or laminated with a layer of rubber to enhance their durability, flexibility, and resistance to environmental elements such as water, chemicals, heat, and abrasion. These fabrics are manufactured using various natural and synthetic rubber compounds, such as neoprene, nitrile, and silicone, depending on the specific application requirements. Rubber coated fabrics are widely used across diverse industries, including automotive, aerospace, marine, construction, and healthcare, due to their ability to provide robust protection and extend the life of products exposed to harsh operating conditions. In the automotive industry, for example, these fabrics are used in the manufacturing of airbags, seat covers, and convertible tops, offering superior resistance to wear and tear, temperature extremes, and UV radiation. In the construction and roofing sectors, rubber coated fabrics are utilized for waterproofing membranes, tarpaulins, and awnings, where their impermeability and durability make them ideal for outdoor applications.The growing popularity of rubber coated fabrics can be attributed to their versatile properties and the expanding range of applications they cater to. These fabrics combine the inherent strength and elasticity of textiles with the protective characteristics of rubber, making them suitable for use in products that require both flexibility and resistance to environmental stressors. Furthermore, the development of advanced coating techniques, such as knife coating, calendaring, and hot melt extrusion, has enabled manufacturers to produce rubber coated fabrics with enhanced performance characteristics tailored to specific end-use applications. As industries continue to prioritize safety, durability, and environmental sustainability, the demand for high-performance coated fabrics is increasing, positioning rubber coated fabrics as a key material in modern industrial and consumer applications. The growing emphasis on using materials that offer longevity and protection in extreme environments is driving further innovation and adoption of rubber coated fabrics across various industries.

How Are Technological Innovations Shaping the Development and Performance of Rubber Coated Fabrics?

Technological advancements are significantly enhancing the development and performance of rubber coated fabrics, enabling manufacturers to create products with improved properties and expanding their use in new and demanding applications. One of the most impactful innovations is the use of advanced coating and lamination techniques. Modern processes such as knife-over-roll coating, dip coating, and extrusion coating allow for precise control over the thickness and uniformity of the rubber layer applied to the fabric substrate. This precision results in fabrics with consistent quality, enhanced durability, and superior resistance to punctures, abrasion, and chemical exposure. Additionally, advancements in polymer chemistry have led to the development of high-performance rubber compounds that offer specific functional properties, such as flame retardancy, anti-static behavior, or high resistance to oils and fuels. These specialized compounds enable manufacturers to produce rubber coated fabrics that meet stringent industry standards, making them suitable for critical applications in sectors such as aerospace, where materials must withstand extreme temperatures and rigorous mechanical stress.Another significant technological development in the rubber coated fabrics market is the focus on sustainable and environmentally friendly solutions. With increasing environmental regulations and growing consumer demand for eco-friendly products, manufacturers are investing in the development of sustainable rubber compounds and coatings that minimize environmental impact. For example, the use of water-based coatings instead of solvent-based ones reduces the emission of volatile organic compounds (VOCs), making the production process more environmentally friendly. Additionally, some manufacturers are exploring bio-based rubber alternatives, such as natural latex or plant-derived elastomers, to create rubber coated fabrics that are both sustainable and high-performing. Innovations in textile substrates, such as the use of recycled polyester or organic cotton, are also contributing to the development of eco-conscious rubber coated fabrics. Moreover, advancements in nanotechnology are enabling the production of fabrics with enhanced functional properties, such as self-cleaning surfaces or improved thermal insulation. These technological innovations are not only improving the performance and sustainability of rubber coated fabrics but are also opening up new possibilities for their use in a broader range of applications.

What Factors Are Driving the Adoption of Rubber Coated Fabrics Across Various Industries?

The adoption of rubber coated fabrics is being driven by a combination of factors, including the rising demand for durable and high-performance materials, the need for enhanced safety and protection, and the growing focus on sustainable solutions. One of the primary drivers is the increasing need for robust materials that can withstand challenging environments. In the automotive and transportation sectors, for instance, rubber coated fabrics are used extensively in the production of airbags, seat belts, and upholstery due to their superior strength, flexibility, and resistance to wear and tear. These properties are crucial for ensuring the safety and longevity of automotive components, especially in high-stress situations such as airbag deployment. Similarly, in the marine and oil & gas industries, rubber coated fabrics are used for flexible hoses, inflatable boats, and oil containment booms, where they must resist exposure to harsh chemicals, saltwater, and extreme temperatures. The ability of rubber coated fabrics to provide a reliable barrier against environmental elements and mechanical stress makes them ideal for such demanding applications.Another key factor driving the adoption of rubber coated fabrics is the growing emphasis on workplace safety and regulatory compliance. Industries such as construction, mining, and manufacturing require materials that can provide protection against hazardous conditions, such as fire, chemical spills, or electrical hazards. Rubber coated fabrics, with their flame-retardant, chemical-resistant, and anti-static properties, are being increasingly used to manufacture protective clothing, safety covers, and equipment enclosures. Additionally, the rising focus on sustainability and eco-friendly materials is encouraging industries to seek out products that offer reduced environmental impact without compromising on performance. The development of recyclable and biodegradable rubber coated fabrics is gaining traction, as companies look to meet environmental standards and reduce waste. Moreover, the expanding use of rubber coated fabrics in the healthcare sector, for products like medical mattresses, surgical drapes, and protective gear, is further driving demand. The growing awareness of hygiene and infection control, particularly in light of the COVID-19 pandemic, has highlighted the need for materials that are easy to clean, disinfect, and maintain. These factors, coupled with the versatility and durability of rubber coated fabrics, are contributing to their widespread adoption across various industries.

What Is Driving the Growth of the Global Rubber Coated Fabrics Market?

The growth in the global Rubber Coated Fabrics market is driven by several key factors, including rising industrialization, increased demand for high-performance materials, and the expanding applications of coated fabrics in emerging markets. One of the primary growth drivers is the increasing demand for durable and versatile materials in industries such as automotive, aerospace, and construction. As these industries continue to expand, there is a growing need for materials that can offer superior protection and longevity under a wide range of conditions. Rubber coated fabrics, with their unique combination of flexibility, durability, and resistance to environmental factors, are becoming essential materials in the production of automotive components, aircraft interiors, and industrial safety equipment. Additionally, the increasing focus on infrastructure development and construction activities worldwide is boosting the demand for rubber coated fabrics used in roofing, waterproofing, and outdoor applications. These fabrics are valued for their ability to withstand extreme weather conditions, UV radiation, and mechanical stress, making them ideal for use in building and construction projects.Another significant factor driving market growth is the rising demand for eco-friendly and sustainable products. The global shift towards sustainability is encouraging manufacturers to develop rubber coated fabrics that are made from environmentally friendly materials, have lower emissions during production, and are recyclable or biodegradable. The introduction of sustainable alternatives, such as natural rubber compounds and bio-based coatings, is meeting the growing consumer and regulatory demand for greener products. This trend is particularly pronounced in regions like Europe and North America, where stringent environmental regulations are shaping market dynamics. Furthermore, the growing adoption of advanced manufacturing technologies, such as automated coating and lamination processes, is enhancing the production efficiency and quality of rubber coated fabrics. These technologies are enabling manufacturers to produce high-performance fabrics that meet the specific requirements of industries such as healthcare, defense, and marine, further driving market growth. As these factors continue to shape the global Rubber Coated Fabrics market, it is expected to witness robust growth, supported by ongoing innovations in material science, expanding industrial applications, and the increasing focus on sustainability and performance.

Report Scope

The report analyzes the Rubber Coated Fabrics market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Synthetic Rubber, Natural Rubber); End-Use (Automotive, Building & Construction, Military & Defense, Industrial, Aerospace, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Synthetic Rubber segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 3.5%. The Natural Rubber segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $537.8 Million in 2024, and China, forecasted to grow at an impressive 6% CAGR to reach $507.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Rubber Coated Fabrics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Rubber Coated Fabrics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Rubber Coated Fabrics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as COLMANT COATED FABRICS, ContiTech AG, Cross Rubber Products Ltd, Fabri Cote, Joyson Safety Systems and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 58 companies featured in this Rubber Coated Fabrics market report include:

- COLMANT COATED FABRICS

- ContiTech AG

- Cross Rubber Products Ltd

- Fabri Cote

- Joyson Safety Systems

- Longwood Elastomers

- RAVASCO

- Takata

- Trelleborg AB

- Zenith Industrial Rubber Products Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- COLMANT COATED FABRICS

- ContiTech AG

- Cross Rubber Products Ltd

- Fabri Cote

- Joyson Safety Systems

- Longwood Elastomers

- RAVASCO

- Takata

- Trelleborg AB

- Zenith Industrial Rubber Products Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

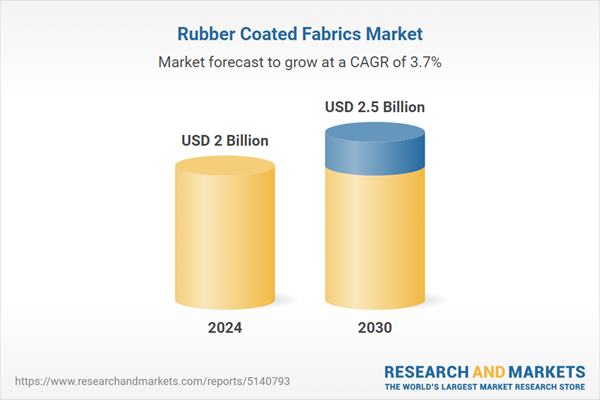

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.5 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |