Global Relays Market - Key Trends & Drivers Summarized

What Are Relays and Why Are They Integral to Modern Electrical Systems?

Relays are electrically operated switches used to control circuits by opening and closing contacts in response to an electrical signal. These devices serve as critical components in a wide range of applications, including industrial automation, automotive systems, telecommunications, and household appliances. Typically, relays consist of an electromagnet, an armature, a spring, and a set of electrical contacts. When a small current flows through the coil, it generates a magnetic field that moves the armature, thereby opening or closing the contacts and controlling a larger electrical circuit. Relays are known for their ability to isolate and protect low-voltage circuits from high-voltage ones, making them essential for safety and functionality in many electrical systems. The versatility of relays, coupled with their capability to perform in environments with varying voltage and current requirements, has solidified their role in modern electrical and electronic devices.The global relays market is gaining momentum due to the increasing demand for automation and smart devices across various sectors. In industrial settings, relays are used to control machinery and processes, enhancing productivity and safety. In the automotive sector, relays are integral to systems such as lighting, wipers, and engine control, where reliable operation under challenging conditions is crucial. Additionally, with the rise of smart homes and IoT-enabled devices, relays are being utilized to manage energy consumption, automate lighting systems, and integrate with home security systems. As technology continues to evolve, the need for more advanced relays - such as solid-state relays that offer faster switching speeds and higher durability - has grown, expanding the market's scope and creating new opportunities for manufacturers. The integration of relays with emerging technologies such as cloud-based monitoring and digital diagnostics is further enhancing their functionality, making them indispensable components in a wide array of applications.

How Are Technological Advancements Shaping the Evolution of Relays in the Market?

Technological advancements are significantly transforming the capabilities and performance of relays, paving the way for new applications and increased efficiency. One of the most impactful innovations is the development of solid-state relays (SSRs). Unlike traditional electromechanical relays, SSRs use semiconductor devices such as thyristors, triacs, and transistors to switch circuits. This eliminates the need for moving parts, resulting in faster response times, quieter operation, and longer lifespans. SSRs are also known for their ability to handle high switching frequencies and operate in environments with extreme temperature variations, making them ideal for use in automation and industrial control systems. Additionally, the miniaturization of relay components has enabled the design of more compact and lightweight relays, which are being increasingly incorporated into modern electronic devices and automotive systems where space constraints are a concern. This trend is particularly evident in the automotive industry, where relays are being integrated into electronic control units (ECUs) to support advanced features such as automatic braking, adaptive cruise control, and electric vehicle battery management systems.Another significant technological advancement is the introduction of programmable relays and digital relays. These devices offer enhanced functionality, such as the ability to store programmable logic, execute time-delay functions, and provide real-time monitoring and diagnostics. Programmable relays are finding applications in smart grids, where they are used to control and protect distribution networks, detect faults, and enable automated switching. Digital relays, equipped with communication interfaces like Modbus or Ethernet, can be integrated into industrial control systems to provide remote monitoring and control capabilities. This digital transformation is enabling the seamless integration of relays into smart factories, IoT ecosystems, and cloud-based platforms, allowing for improved system management and maintenance. As a result, manufacturers are increasingly focusing on developing relays that offer higher efficiency, greater precision, and advanced connectivity features, catering to the growing demand for intelligent control solutions in industrial automation, smart infrastructure, and transportation systems.

What Factors Are Driving the Adoption of Relays Across Different Industry Verticals?

The adoption of relays is being driven by several industry-specific factors, including the rising demand for automation, the growth of the electric vehicle (EV) market, and the increasing focus on energy efficiency and sustainability. In the industrial sector, relays are essential components of automation systems, where they are used to control machinery, execute safety functions, and ensure the seamless operation of production processes. The ongoing shift towards Industry 4.0, which emphasizes the use of smart manufacturing technologies and connected devices, has further boosted the demand for advanced relays that offer real-time data monitoring, remote control capabilities, and predictive maintenance features. This trend is driving the adoption of digital and programmable relays, which enable manufacturers to optimize production, reduce downtime, and enhance overall operational efficiency. The ability of modern relays to perform complex logic operations and integrate with supervisory control and data acquisition (SCADA) systems has made them indispensable in the automation of factories, power plants, and utility networks.In the automotive industry, the transition to electric vehicles (EVs) and the adoption of advanced driver-assistance systems (ADAS) are fueling the demand for relays. EVs require relays for battery management, power distribution, and control of auxiliary systems, where precise and reliable operation is critical. As EV production ramps up globally, manufacturers are looking for relays that can withstand high voltages and currents while ensuring safety and efficiency. Moreover, the proliferation of ADAS and autonomous driving technologies is creating new requirements for relays that can support complex control functions and ensure the reliable operation of critical systems. Another significant driver of relay adoption is the emphasis on energy efficiency and sustainable practices. Relays are widely used in energy management systems to control lighting, heating, ventilation, and air conditioning (HVAC) systems, helping to optimize energy consumption and reduce costs. The use of relays in smart grids and renewable energy applications, such as wind and solar power, is also on the rise, as they enable the integration of distributed energy resources and support grid stability.

What Is Driving the Growth of the Global Relays Market?

The growth in the global Relays market is driven by several factors, including the rising demand for energy-efficient solutions, increasing investments in infrastructure and industrial automation, and the growth of renewable energy projects. One of the primary growth drivers is the increasing focus on energy efficiency across industries. As businesses and governments worldwide seek to reduce energy consumption and carbon emissions, the adoption of energy-efficient relays that support smart power management is gaining momentum. These relays are being used to control lighting systems, HVAC units, and industrial equipment, enabling organizations to optimize energy usage and lower operational costs. The demand for relays is also being fueled by the growth of renewable energy projects, such as wind farms and solar power installations, where relays play a critical role in controlling and protecting power distribution systems, ensuring safe and efficient energy flow.Another significant driver is the rising investment in industrial automation and smart infrastructure. As industries embrace automation to enhance productivity, safety, and flexibility, the demand for advanced relays that can perform multiple functions and integrate with digital control systems is increasing. Programmable relays, digital relays, and solid-state relays are becoming essential components in automated production lines, power management systems, and building automation. The growing adoption of smart grid technologies is further boosting the demand for intelligent relays that can monitor and control grid operations in real-time. Additionally, the expansion of the automotive industry, particularly the shift towards electric vehicles and autonomous driving, is creating new opportunities for relay manufacturers. Relays are being used in EV charging stations, battery management systems, and various control units, driving market growth in this sector. As these trends continue to evolve, the global Relays market is poised for sustained growth, driven by the need for reliable, efficient, and intelligent switching solutions across a diverse range of applications.

Report Scope

The report analyzes the Relays market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Electromechanical Relay, Automotive Relay, Solid State Relay, Latching Relay, Overload Protection Relay, Other Product Types); Application (Industrial Automation, Electronics, Military, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Relays Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Relays Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Relays Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

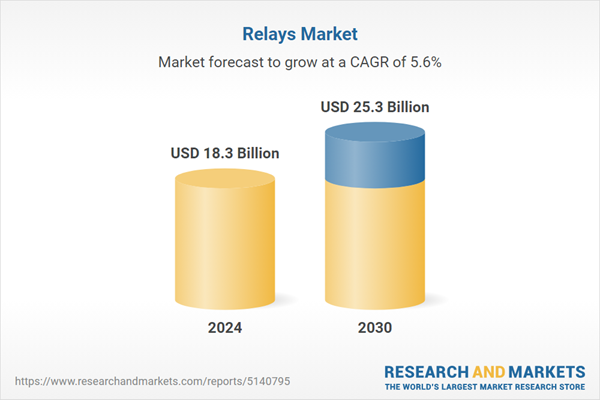

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alstom SA, Comus International, Coto Technology USA, Crydom, Inc., Fujitsu Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 72 companies featured in this Relays market report include:

- Alstom SA

- Comus International

- Coto Technology USA

- Crydom, Inc.

- Fujitsu Ltd.

- Omron Corporation

- Schneider Electric SA

- Siemens AG

- Standex Electronics, Inc.

- Teledyne Relays

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alstom SA

- Comus International

- Coto Technology USA

- Crydom, Inc.

- Fujitsu Ltd.

- Omron Corporation

- Schneider Electric SA

- Siemens AG

- Standex Electronics, Inc.

- Teledyne Relays

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 238 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.3 Billion |

| Forecasted Market Value ( USD | $ 25.3 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |