Global Ethoxylates Market - Unraveling Key Trends & Growth Catalysts

Why Are Ethoxylates Integral to Modern Industrial and Consumer Applications?

Ethoxylates have become a fundamental component in a wide range of industrial and consumer applications due to their excellent emulsifying, dispersing, and wetting properties. These non-ionic surfactants are produced through the ethoxylation process, where ethylene oxide reacts with fatty alcohols, fatty acids, or phenols to create highly effective chemical agents. Ethoxylates are widely used in detergents, personal care products, pharmaceuticals, agrochemicals, and oil & gas applications, making them a crucial ingredient in everyday products. Their versatility, biodegradability, and ability to improve solubility have made them indispensable in modern manufacturing processes.The increasing demand for high-performance cleaning agents has driven the widespread use of ethoxylates in household and industrial detergents. Their ability to break down grease, oils, and stains while maintaining a mild formulation has made them a preferred choice in dishwashing liquids, laundry detergents, and surface cleaners. In personal care, ethoxylates are commonly found in shampoos, lotions, and cosmetics, where they enhance texture, foam stability, and solubility. Additionally, their application in agriculture as emulsifiers in pesticide formulations has expanded, as farmers seek more efficient ways to deliver active ingredients to crops. With their broad-spectrum utility, ethoxylates continue to play a critical role in key industrial and consumer sectors.

How Are Innovations and Sustainability Trends Shaping the Ethoxylates Market?

Technological advancements and sustainability trends are transforming the ethoxylates market, leading to the development of more eco-friendly formulations. One of the biggest shifts in the industry is the move toward biodegradable and low-toxicity ethoxylates, driven by stricter environmental regulations and consumer demand for greener products. Traditional nonylphenol ethoxylates (NPEs), once widely used in industrial cleaners and detergents, have faced regulatory bans due to concerns about their persistence in the environment and potential endocrine-disrupting effects. As a result, manufacturers are increasingly developing alcohol ethoxylates and plant-based ethoxylates derived from renewable sources such as palm oil, coconut oil, and soy.Another significant innovation is the advancement of bio-based ethoxylation processes that reduce the reliance on petroleum-derived feedstocks. Companies are investing in green chemistry techniques to develop ethoxylates with improved biodegradability while maintaining high performance in cleaning and emulsification applications. Additionally, advancements in formulation technology have led to the creation of multifunctional ethoxylates that offer enhanced stability, foam control, and lower toxicity, particularly in pharmaceutical and agrochemical applications. As industries seek sustainable alternatives, the market for eco-friendly ethoxylates is expanding, positioning these surfactants as a critical component in the future of green chemistry.

Which Industries Are Driving the Growth of Ethoxylates?

The ethoxylates market is experiencing strong demand across multiple industries, with the household and industrial cleaning sector being the largest consumer. The increasing focus on hygiene and sanitation, especially following the COVID-19 pandemic, has fueled demand for high-performance surfactants in cleaning and disinfecting products. Major detergent brands are continuously formulating new and improved products that rely on ethoxylates to enhance foaming, emulsification, and dirt-removing capabilities, making these compounds essential in the formulation of both liquid and powder-based detergents.The pharmaceutical and personal care industries are also significant growth drivers, as ethoxylates are widely used in drug formulations, emulsions, and skincare products. In pharmaceuticals, they function as solubilizers and stabilizers, ensuring the effective delivery of active ingredients. In personal care, ethoxylates improve the texture and application properties of shampoos, conditioners, and moisturizers, contributing to their widespread adoption. Additionally, the agrochemical sector is increasingly incorporating ethoxylates in pesticide and herbicide formulations, where they act as effective dispersing agents that enhance the efficiency of active ingredients. The oil & gas industry also relies on ethoxylates in drilling fluids and enhanced oil recovery (EOR) techniques, where their ability to reduce surface tension improves extraction efficiency. As industries continue to seek high-performance, biodegradable surfactants, the demand for ethoxylates is expected to grow steadily.

What's Driving the Rapid Expansion of the Ethoxylates Market?

The growth in the global ethoxylates market is driven by several factors, including the rising demand for high-performance surfactants in cleaning, personal care, and industrial applications. The increasing awareness of hygiene and sanitation has significantly boosted the consumption of ethoxylates in detergents and disinfectants, as consumers prioritize effective cleaning solutions. Additionally, the shift toward sustainable and biodegradable formulations has accelerated the development of eco-friendly ethoxylates, creating new market opportunities for bio-based and plant-derived alternatives. Stricter environmental regulations, particularly in North America and Europe, have also pushed manufacturers to phase out nonylphenol ethoxylates (NPEs) in favor of safer, more sustainable alternatives.The expansion of the pharmaceutical and agrochemical industries has further fueled ethoxylate demand, as these compounds play a crucial role in drug delivery systems and pesticide formulations. Additionally, the growing adoption of ethoxylates in oilfield chemicals, lubricants, and emulsifiers has strengthened their market presence in the energy sector. The rising investments in research and development (R&D) for greener ethoxylation processes and specialty surfactants are also contributing to market growth, as companies seek to enhance the performance and sustainability of their products. With increasing industrialization, technological advancements, and the push for environmental sustainability, the ethoxylates market is set for continued expansion, positioning itself as a key player in the future of specialty chemicals and surfactants.

Report Scope

The report analyzes the Ethoxylates market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Alcohol Ethoxylates, Fatty Amine Ethoxylates, Fatty Acid Ethoxylates, Glyceride, Other Types); End-Use (Household & Personal Care, Pharmaceuticals, Agrochemicals, Oilfields, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Alcohol Ethoxylates segment, which is expected to reach US$11.5 Billion by 2030 with a CAGR of 5.4%. The Fatty Amine Ethoxylates segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.5 Billion in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $4.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ethoxylates Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ethoxylates Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ethoxylates Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

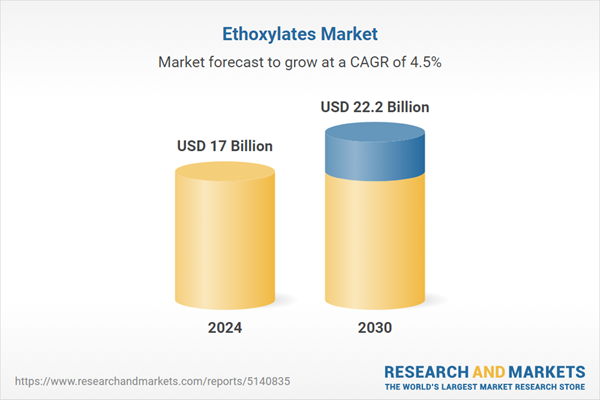

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Berryman Chemical Inc, Bio Gen Active, India Glycols Ltd., KAVYA PHARMA, Matangi Industries LLP and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Ethoxylates market report include:

- Berryman Chemical Inc

- Bio Gen Active

- India Glycols Ltd.

- KAVYA PHARMA

- Matangi Industries LLP

- Saudi Arabia Basic Industries Corporation

- Saudi Kayan Petrochemical Company

- Sinarmas Cepsa Pte. Ltd.

- SPAK Orgochem (India) Pvt Ltd

- Stepan Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Berryman Chemical Inc

- Bio Gen Active

- India Glycols Ltd.

- KAVYA PHARMA

- Matangi Industries LLP

- Saudi Arabia Basic Industries Corporation

- Saudi Kayan Petrochemical Company

- Sinarmas Cepsa Pte. Ltd.

- SPAK Orgochem (India) Pvt Ltd

- Stepan Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17 Billion |

| Forecasted Market Value ( USD | $ 22.2 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |