Global Glycerol Market - Key Trends and Drivers Summarized

Why Is Glycerol Emerging as a Versatile Ingredient Across Multiple Industries?

Glycerol, also known as glycerin, is becoming increasingly significant across various industries due to its wide range of applications and beneficial properties. But why is glycerol so essential today? Glycerol is a naturally occurring, non-toxic, and biodegradable substance that is derived primarily as a byproduct of biodiesel production, but it can also be produced synthetically. It is a colorless, odorless, and viscous liquid with hygroscopic properties, meaning it attracts water from its surroundings, making it incredibly versatile. Glycerol's non-toxicity and moisturizing properties make it a common ingredient in food, pharmaceuticals, cosmetics, and personal care products.In the food industry, glycerol is used as a sweetener, humectant, and preservative, helping to retain moisture and improve texture in products like baked goods, candies, and processed foods. In pharmaceuticals, it serves as a solvent, carrier, and excipient, playing a critical role in drug formulations. Its moisturizing properties make it essential in cosmetics and skincare products, helping to keep skin hydrated. Additionally, glycerol has industrial applications in products like antifreeze, lubricants, and even as a feedstock for biofuel production. With its wide range of applications, glycerol has become a valuable and sustainable ingredient across multiple sectors, enhancing product performance and contributing to more eco-friendly processes.

How Are Technological Advancements Expanding the Applications of Glycerol?

Technological advancements are greatly expanding the applications and production efficiency of glycerol, making it a more valuable and versatile ingredient across diverse industries. One of the key innovations is the development of efficient biotechnological methods for converting glycerol into higher-value products. For instance, microbial fermentation processes are being used to transform glycerol into chemicals such as 1,3-propanediol, which is used in the production of biodegradable plastics and polyesters. This process creates added value from glycerol, particularly from the surplus generated as a byproduct of biodiesel production, making it a sustainable and economically viable raw material.Another advancement is the use of glycerol in biofuel production, particularly in the generation of bioethanol and biogas. Glycerol can be fermented by certain microorganisms to produce ethanol, offering a renewable and low-cost alternative to traditional fossil fuels. Similarly, in anaerobic digestion processes, glycerol serves as an excellent feedstock for biogas production due to its high energy content. These developments have positioned glycerol as an important component in the growing bioenergy market, providing a sustainable solution for energy generation while reducing waste from other industrial processes, like biodiesel manufacturing.

In the pharmaceutical industry, advances in drug delivery systems are leveraging glycerol's ability to act as a solvent and carrier for active ingredients. Glycerol's solubility in both water and alcohol makes it ideal for formulating liquid medications, syrups, and topical ointments. It also improves the bioavailability of certain drugs, ensuring that active compounds are absorbed more efficiently by the body. In drug delivery research, glycerol is being explored as a base for sustained-release formulations, where its hydrophilic nature helps control the release of medication over time, improving patient outcomes.

The cosmetics industry has also benefited from technological advancements related to glycerol. Formulation science has allowed for better integration of glycerol into skincare and haircare products, enhancing its moisturizing effects. Modern techniques are improving the stability of glycerol-based emulsions, ensuring longer shelf life and better performance in products like creams, lotions, and serums. Additionally, glycerol is increasingly used in eco-friendly formulations, replacing harsher chemicals in personal care products. This aligns with the growing demand for natural, sustainable ingredients that are gentle on both the skin and the environment.

These advancements are not limited to just bioenergy and pharmaceuticals. Glycerol is also being used in innovative ways in materials science, particularly in the development of biodegradable plastics and other environmentally friendly materials. By converting glycerol into high-value polymers and additives, industries can reduce their reliance on petroleum-based products, contributing to a more circular economy. The increasing focus on sustainability is driving research into new uses for glycerol, ensuring its continued importance across multiple sectors.

Why Is Glycerol Critical for Sustainability, Moisturization, and Bio-Based Product Development?

Glycerol is critical for sustainability, moisturization, and bio-based product development due to its inherent properties and ability to serve as a renewable, eco-friendly ingredient. In terms of sustainability, glycerol plays a key role in reducing waste and promoting resource efficiency. As a major byproduct of biodiesel production, glycerol is available in large quantities, and its use in various industries helps prevent it from being discarded as waste. By finding applications in biofuels, chemicals, and even biodegradable plastics, glycerol contributes to a more sustainable economy by creating value from what would otherwise be considered waste. Its biodegradability further enhances its appeal as an environmentally friendly ingredient, ensuring that it does not accumulate in ecosystems or contribute to pollution.Moisturization is another area where glycerol is indispensable. Glycerol's ability to attract and retain moisture makes it an essential ingredient in a wide range of personal care and cosmetic products. It acts as a humectant, drawing water into the skin and keeping it hydrated. This makes glycerol particularly valuable in skincare products like lotions, creams, and serums, where hydration is crucial for maintaining healthy skin. Glycerol also helps improve the texture and spreadability of these products, enhancing the user experience. In hair care, glycerol is used to combat dryness and frizz, locking in moisture to keep hair smooth and manageable.

In food production, glycerol is equally important for its moisture-retaining properties. It helps maintain the softness and texture of baked goods, prevents hardening in candies, and acts as a preservative in processed foods by preventing them from drying out. As more food manufacturers seek to reduce the use of synthetic additives, glycerol offers a natural and effective alternative for enhancing the quality and shelf life of food products.

Bio-based product development is another area where glycerol is having a significant impact. As industries transition from petroleum-based products to renewable, plant-based alternatives, glycerol is emerging as a key feedstock for the production of bio-based chemicals, plastics, and fuels. The ability to convert glycerol into valuable chemicals like 1,3-propanediol and epichlorohydrin (a precursor for epoxy resins) makes it a valuable input for producing biopolymers and other sustainable materials. These materials have a lower carbon footprint compared to traditional petroleum-based products and are biodegradable, contributing to efforts to reduce plastic waste and environmental pollution.

Additionally, glycerol's role in the bioenergy sector is critical for advancing renewable energy solutions. Its use as a feedstock for bioethanol and biogas production offers a cleaner, renewable alternative to fossil fuels, helping to reduce greenhouse gas emissions. As the world shifts toward more sustainable energy sources, glycerol will continue to play an important role in biofuel production, making it a vital ingredient in the global transition to a greener economy.

What Factors Are Driving the Growth of the Glycerol Market?

Several key factors are driving the rapid growth of the glycerol market, including the expansion of the biodiesel industry, increasing demand for natural and sustainable ingredients in personal care and cosmetics, the rise of bio-based product development, and advancements in pharmaceutical applications. First, the rapid growth of the biodiesel industry has significantly increased the supply of glycerol, as it is produced in large quantities as a byproduct of biodiesel production. This has created a steady, cost-effective supply of glycerol for use in various industries, driving market growth. As countries continue to push for cleaner energy and reduce their reliance on fossil fuels, the biodiesel market is expected to expand further, resulting in increased glycerol availability.Second, the growing consumer demand for natural and sustainable ingredients in personal care and cosmetic products is boosting the glycerol market. As consumers become more conscious of the ingredients in their skincare and haircare products, there is a shift toward natural, non-toxic, and environmentally friendly options. Glycerol, derived from plant-based sources, fits perfectly into this trend, making it a preferred ingredient in formulations for moisturizers, lotions, shampoos, and other personal care products. Its ability to hydrate the skin without causing irritation makes it ideal for use in products marketed as “clean” or “green,” aligning with the broader shift toward eco-conscious beauty and personal care.

Third, the rise of bio-based product development is contributing to the growth of the glycerol market. As industries transition away from petroleum-based products and embrace more sustainable materials, glycerol's role as a feedstock for producing bio-based chemicals and biodegradable plastics is becoming increasingly important. Glycerol's versatility in being converted into a variety of high-value compounds, such as biopolymers and bio-based fuels, positions it as a key ingredient in the growing bioeconomy. Companies and manufacturers are investing in technologies that leverage glycerol for producing sustainable alternatives to petrochemicals, plastics, and fuels, driving demand for this renewable resource.

Advancements in pharmaceutical applications are also contributing to the increased demand for glycerol. Its use in drug formulations, particularly in liquid medications, syrups, and topical products, has become more widespread due to glycerol's safety, solubility, and stability. As the pharmaceutical industry continues to innovate with new drug delivery systems, glycerol's role as a carrier and stabilizer is expanding. Additionally, glycerol's non-toxic and hydrating properties make it an essential ingredient in a wide range of over-the-counter and prescription medications.

Finally, the growing focus on sustainability and environmental responsibility across industries is driving demand for renewable, biodegradable ingredients like glycerol. As manufacturers in sectors ranging from food and beverage to pharmaceuticals and biofuels seek to reduce their carbon footprints, glycerol offers a renewable, plant-based alternative to synthetic ingredients and chemicals. Its versatility, coupled with its sustainability, positions glycerol as a key ingredient in the shift toward greener, more responsible production processes.

In conclusion, the growth of the glycerol market is driven by the expansion of the biodiesel industry, increasing demand for natural and sustainable ingredients, the rise of bio-based product development, and advancements in pharmaceutical applications. As industries continue to prioritize sustainability, efficiency, and innovation, glycerol will play a central role in shaping the future of diverse markets, from personal care and food production to bioenergy and pharmaceuticals.

Report Scope

The report analyzes the Glycerol market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Personal Care & Cosmetics, Food & Beverage, Pharmaceuticals, Industrial, Nutraceutical, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

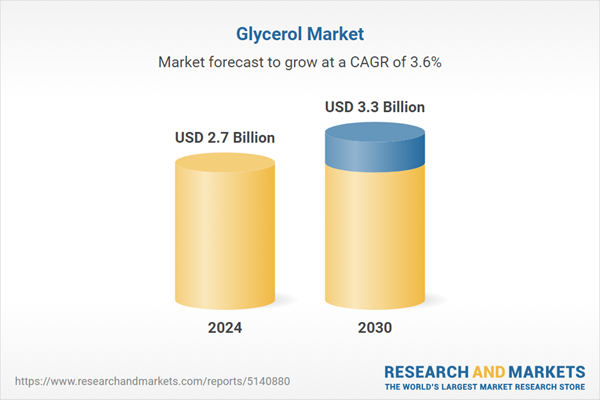

- Market Growth: Understand the significant growth trajectory of the Personal Care & Cosmetics End-Use segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of 4%. The Food & Beverage End-Use segment is also set to grow at 3.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $723.8 Million in 2024, and China, forecasted to grow at an impressive 6.3% CAGR to reach $696.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Glycerol Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Glycerol Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Glycerol Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as CREMER OLEO GmbH & Co. KG, Emery Oleochemicals Group, IOI Corporation Berhad, Kao Corporation, KLK OLEO and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Glycerol market report include:

- CREMER OLEO GmbH & Co. KG

- Emery Oleochemicals Group

- IOI Corporation Berhad

- Kao Corporation

- KLK OLEO

- Oleon NV

- P&G Chemicals

- Wilmar International Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- CREMER OLEO GmbH & Co. KG

- Emery Oleochemicals Group

- IOI Corporation Berhad

- Kao Corporation

- KLK OLEO

- Oleon NV

- P&G Chemicals

- Wilmar International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.3 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |