Global Geopolymers Market - Key Trends and Drivers Summarized

Why Are Geopolymers Revolutionizing Sustainable Construction and Industrial Applications?

Geopolymers are emerging as a game-changing material in sustainable construction and industrial applications, offering an eco-friendly alternative to traditional cement and concrete. But why are geopolymers so critical today? Geopolymers are inorganic polymers formed by the reaction of aluminosilicate materials (such as fly ash, slag, or kaolin) with an alkaline solution. Unlike conventional Portland cement, which is produced through energy-intensive processes that emit large amounts of CO2, geopolymers can be synthesized at much lower temperatures and have a significantly reduced carbon footprint. This makes them an attractive solution for reducing the environmental impact of construction projects while providing materials with comparable or superior strength, durability, and chemical resistance.In construction, geopolymers are used to create sustainable concrete, pavements, and building materials that not only reduce carbon emissions but also offer enhanced performance in terms of fire resistance, durability, and chemical stability. Geopolymers are particularly suited for use in aggressive environments, such as coastal areas or industrial zones, where they resist corrosion and degradation better than traditional cement. Additionally, geopolymers are finding applications in waste management, where they can encapsulate and immobilize hazardous industrial by-products, turning waste into valuable construction materials. Their versatility and sustainability make geopolymers a cornerstone of modern green building practices and industrial innovation.

How Are Technological Advancements Expanding the Applications and Performance of Geopolymers?

Technological advancements are driving significant improvements in the performance, efficiency, and range of applications for geopolymers, making them a viable solution for various sectors beyond construction. One of the key innovations in geopolymer technology is the use of industrial waste materials, such as fly ash from coal-fired power plants or blast furnace slag from steel production, as raw materials. This not only provides a sustainable alternative to virgin resources but also addresses the issue of industrial waste disposal. By incorporating waste by-products into geopolymer production, manufacturers can create high-performance materials while reducing environmental impact and lowering costs.Another important advancement is the development of enhanced geopolymer formulations that improve their mechanical properties and broaden their application range. For example, researchers have optimized the mix design of geopolymers to increase their compressive strength, making them suitable for use in high-load-bearing structures such as bridges, highways, and skyscrapers. Advances in curing techniques, such as the use of heat curing or steam curing, have further enhanced the strength and durability of geopolymers, enabling them to compete directly with traditional cement in large-scale construction projects. These advancements are expanding the use of geopolymers in critical infrastructure where strength, longevity, and sustainability are essential.

In addition to construction, geopolymers are finding applications in high-temperature environments due to their exceptional fire resistance and thermal stability. Geopolymers can withstand temperatures up to 1,200°C, making them ideal for use in refractory materials, fire-resistant coatings, and insulation systems. These characteristics have led to the use of geopolymers in industries such as aerospace, metallurgy, and energy, where they are employed to produce fireproof panels, thermal barriers, and high-temperature-resistant adhesives.

The integration of digital tools and material science research is also enhancing the performance of geopolymers. Through the use of computational modeling and simulations, researchers can predict the behavior of geopolymer materials under various conditions, allowing for optimized formulations tailored to specific applications. This not only improves material performance but also accelerates the adoption of geopolymers in industries that require high-performance, customized materials. With these technological innovations, geopolymers are becoming more adaptable, durable, and scalable, making them a transformative solution for a wide range of industrial and environmental challenges.

Why Are Geopolymers Critical for Sustainable Construction and Circular Economy Initiatives?

Geopolymers are critical for sustainable construction and circular economy initiatives because they provide a way to significantly reduce carbon emissions, utilize industrial waste, and create durable, eco-friendly building materials. One of the major advantages of geopolymers is their low carbon footprint compared to traditional Portland cement. The production of Portland cement is responsible for approximately 8% of global CO2 emissions, largely due to the high-temperature calcination process required to produce clinker. Geopolymers, on the other hand, are synthesized at much lower temperatures, resulting in a drastic reduction in energy consumption and greenhouse gas emissions. By replacing conventional cement with geopolymers in construction projects, developers can contribute to a more sustainable built environment.Moreover, geopolymers play a key role in promoting the circular economy by turning industrial waste into valuable construction materials. The use of fly ash, slag, and other by-products in geopolymer production reduces the demand for virgin raw materials and diverts waste from landfills. This not only minimizes the environmental impact of resource extraction but also addresses the growing issue of industrial waste management. For example, coal fly ash, which is often disposed of in landfills, can be converted into geopolymer concrete that exhibits high compressive strength, durability, and chemical resistance. By integrating waste materials into the production process, geopolymers support the principles of resource efficiency and waste minimization that are central to circular economy models.

Geopolymers are also critical for sustainable infrastructure development due to their superior durability and resistance to environmental degradation. Traditional concrete is prone to issues like corrosion, cracking, and chemical attack, especially in harsh environments. Geopolymers, however, offer enhanced durability, making them ideal for use in projects where long-term performance and minimal maintenance are required. For instance, in coastal infrastructure, where structures are exposed to saltwater and aggressive marine conditions, geopolymers resist chloride penetration and corrosion, extending the lifespan of the structures and reducing the need for costly repairs. This durability makes geopolymers a sustainable choice for building resilient infrastructure that can withstand climate change-related challenges, such as rising sea levels and more extreme weather events.

In addition to construction, geopolymers contribute to environmental protection through their application in waste encapsulation and remediation. Geopolymerization can immobilize hazardous materials, such as heavy metals and radioactive waste, by incorporating them into a stable, solid matrix. This process prevents the leaching of harmful substances into the environment and provides a safe, long-term solution for waste disposal. By offering sustainable alternatives for both construction and environmental management, geopolymers are helping to advance the circular economy and reduce the environmental impact of industrial and building activities.

What Factors Are Driving the Growth of the Geopolymer Market?

Several key factors are driving the rapid growth of the geopolymer market, including increasing demand for sustainable construction materials, rising environmental regulations, advancements in geopolymer technology, and the growing adoption of geopolymers in industrial applications. First, the rising demand for eco-friendly building materials is a major driver of the geopolymer market. As the construction industry seeks to reduce its carbon footprint and comply with stricter environmental regulations, geopolymers are gaining traction as a sustainable alternative to traditional cement. Green building standards, such as LEED (Leadership in Energy and Environmental Design), encourage the use of low-carbon materials like geopolymers, which contribute to the certification of sustainable projects.Second, government policies and international efforts to combat climate change are driving the adoption of geopolymers. Countries around the world are implementing stricter regulations on carbon emissions and industrial waste management, prompting industries to seek more sustainable and low-emission alternatives. In this context, geopolymers, which emit significantly less CO2 during production and incorporate industrial waste materials, are emerging as a preferred solution for companies aiming to reduce their environmental impact. The construction sector, in particular, is adopting geopolymers as part of broader efforts to decarbonize infrastructure and meet global climate goals.

Third, technological advancements in geopolymer research and production are fueling market growth. The development of new geopolymer formulations with enhanced mechanical properties, durability, and fire resistance is expanding the range of applications for geopolymers in both construction and industrial sectors. Innovations such as the use of nanomaterials to improve geopolymer performance, as well as the optimization of curing processes, are making geopolymers more competitive with traditional materials. Additionally, the introduction of 3D printing technologies for geopolymer materials is opening new possibilities for custom-designed, sustainable building components, further boosting market demand.

The expanding use of geopolymers in industrial applications is also contributing to the growth of the market. Beyond construction, geopolymers are increasingly being adopted in sectors such as aerospace, automotive, and energy for their high-temperature resistance and excellent mechanical properties. In aerospace, geopolymers are used in the production of lightweight, fire-resistant materials for aircraft components, while in the energy sector, they are employed as coatings and linings for equipment exposed to high temperatures and corrosive environments. The versatility of geopolymers in industrial applications is driving demand from industries looking for materials that offer both sustainability and high performance.

Lastly, the increasing focus on waste management and the circular economy is boosting the adoption of geopolymers. By utilizing industrial waste products such as fly ash and slag, geopolymers provide a solution for reducing waste and turning by-products into valuable construction materials. This aligns with the growing emphasis on resource efficiency and waste reduction in industries ranging from energy production to manufacturing. As companies seek to minimize their environmental impact and move toward more circular business models, geopolymers offer a practical and sustainable solution for both waste management and material production.

In conclusion, the growth of the geopolymer market is being driven by the increasing demand for sustainable construction materials, rising environmental regulations, technological advancements, and the expanding use of geopolymers in industrial applications. As industries and governments continue to prioritize sustainability, geopolymers will play a crucial role in reducing carbon emissions, promoting the circular economy, and advancing green building practices worldwide.

Report Scope

The report analyzes the Geopolymers market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Cement, Concrete & Precast Panels, Grouts & Binders, Other Applications); End-Use (Buildings, Transportation Infrastructure, Coating Applications, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cement, Concrete & Precast Panels Application segment, which is expected to reach US$21.7 Billion by 2030 with a CAGR of 14.5%. The Grouts & Binders Application segment is also set to grow at 16.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3 Billion in 2024, and China, forecasted to grow at an impressive 19.7% CAGR to reach $6.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Geopolymers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Geopolymers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Geopolymers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Corning, Inc., Dow, Inc., DuPont de Nemours, Inc., Geobeton LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Geopolymers market report include:

- BASF SE

- Corning, Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Geobeton LLC

- Milliken Infrastructures Solutions, LLC

- Pci Augsburg GmbH

- Wagners

- Zeobond Pty Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- Corning, Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Geobeton LLC

- Milliken Infrastructures Solutions, LLC

- Pci Augsburg GmbH

- Wagners

- Zeobond Pty Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

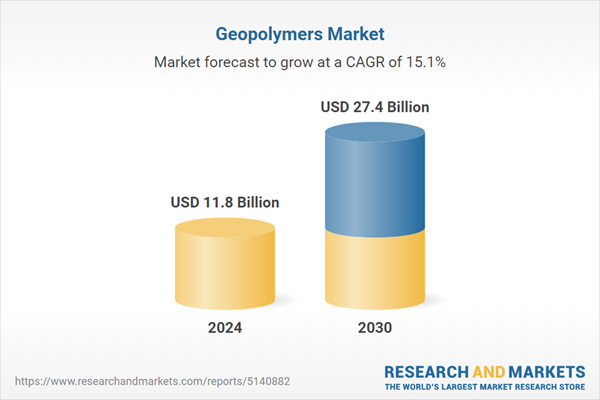

| Estimated Market Value ( USD | $ 11.8 Billion |

| Forecasted Market Value ( USD | $ 27.4 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |