Global Instrumentation Services Market - Key Trends & Drivers Summarized

What Are Instrumentation Services and Why Are They Essential?

Instrumentation services encompass a broad range of activities related to the calibration, maintenance, and optimization of instruments used in industrial and manufacturing processes. These services are vital for ensuring that the instrumentation systems - ranging from simple pressure gauges to complex automation systems - are functioning correctly and efficiently. Regular calibration and maintenance are crucial in industries such as oil and gas, pharmaceuticals, power generation, and chemical processing, where even minor deviations in instrument readings can lead to significant operational disruptions or safety hazards. Instrumentation services also include installation, commissioning, and troubleshooting of instruments, making them an integral part of the lifecycle management of these critical assets. As industries strive to achieve higher levels of precision and reliability, the demand for expert instrumentation services continues to grow.How Are Innovations Impacting the Instrumentation Services Market?

The instrumentation services market is being reshaped by technological innovations, particularly in the fields of automation and digitalization. The advent of smart instruments that can communicate wirelessly and provide real-time data has led to the development of more sophisticated service offerings. For instance, remote monitoring and diagnostics are becoming increasingly common, allowing service providers to predict and prevent instrument failures before they occur. Additionally, the use of advanced analytics and machine learning algorithms is enabling more precise calibration and optimization of instruments, further enhancing their performance and lifespan. The increasing complexity of instrumentation systems, especially in industries that are rapidly adopting Industry 4.0 practices, is also driving the demand for specialized services that can address the unique challenges posed by these advanced technologies.Why Is the Demand for Instrumentation Services Rising Across Industries?

The demand for instrumentation services is on the rise across various industries due to the growing need for operational efficiency and regulatory compliance. In the energy sector, for example, the shift towards more complex and integrated systems, such as smart grids and renewable energy installations, requires regular calibration and maintenance of instrumentation to ensure reliable operation. In the pharmaceutical and biotechnology industries, strict regulatory requirements mandate frequent validation and calibration of instruments to maintain product quality and safety. The chemical industry also relies heavily on precise instrumentation to monitor and control processes, especially in hazardous environments where safety is paramount. Furthermore, as industries become more automated, the need for regular maintenance and optimization of instrumentation systems to avoid costly downtimes and ensure continuous operation is becoming increasingly critical.What Factors Are Driving the Growth in the Instrumentation Services Market?

The growth in the instrumentation services market is driven by several factors that are closely tied to the evolving needs of modern industries. One of the primary drivers is the increasing adoption of automation and digitalization across various sectors, which necessitates regular calibration and maintenance of complex instrumentation systems. Another key factor is the stringent regulatory landscape, particularly in industries such as pharmaceuticals, biotechnology, and food and beverage, where compliance with quality standards is essential, driving the demand for frequent validation and calibration services. Additionally, the expansion of the renewable energy sector, with its focus on integrating advanced instrumentation for monitoring and control, is boosting the need for specialized services. The growing emphasis on operational efficiency and cost reduction is also leading industries to invest in regular maintenance and optimization of their instrumentation systems to minimize downtimes and extend the lifespan of their assets. As industries continue to modernize and scale their operations, the demand for expert instrumentation services is expected to grow, driven by these technological and regulatory imperatives.Report Scope

The report analyzes the Instrumentation Services market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Service (Calibration, Commissioning & Testing, Maintenance & Repair); End-Use (Process Industry, Discrete Industry).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Calibration Services segment, which is expected to reach US$4.6 Billion by 2030 with a CAGR of 5.2%. The Commissioning & Testing Services segment is also set to grow at 4.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $1.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Instrumentation Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Instrumentation Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Instrumentation Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Group, Honeywell International, Inc., KROHNE Messtechnik GmbH, Rockwell Automation, Inc., Schneider Electric SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Instrumentation Services market report include:

- ABB Group

- Honeywell International, Inc.

- KROHNE Messtechnik GmbH

- Rockwell Automation, Inc.

- Schneider Electric SA

- Siemens AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Group

- Honeywell International, Inc.

- KROHNE Messtechnik GmbH

- Rockwell Automation, Inc.

- Schneider Electric SA

- Siemens AG

Table Information

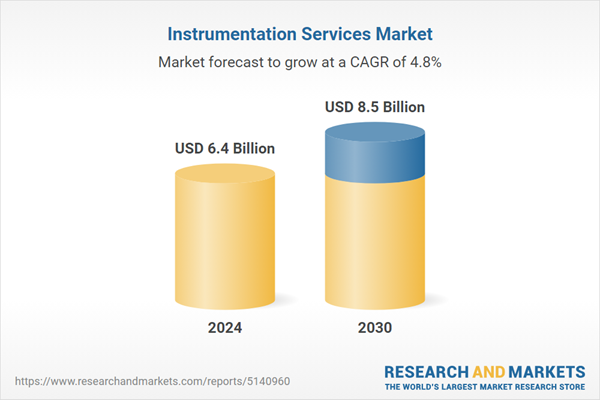

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.4 Billion |

| Forecasted Market Value ( USD | $ 8.5 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |