Global Construction Management Software Market - Key Trends and Drivers Summarized

How Is Construction Management Software Transforming the Industry?

Construction management software is revolutionizing the construction industry by streamlining project planning, execution, and collaboration. These software platforms integrate various aspects of construction management, such as scheduling, cost control, document management, and resource allocation, into a unified system that enables project managers and stakeholders to work more efficiently and transparently. By providing real-time access to project data, construction management software helps teams stay on top of deadlines, budgets, and materials, ensuring that projects are completed on time and within scope. It also fosters better communication between different teams - such as architects, contractors, and engineers - by offering a centralized platform for sharing updates, plans, and progress reports. This reduces the risk of miscommunication and ensures that all parties have access to the same, up-to-date information. As construction projects become more complex and involve multiple stakeholders, the adoption of construction management software is becoming essential for delivering projects efficiently and effectively in today's fast-paced construction environment.How Do Technological Advancements Enhance Construction Management Software?

Technological advancements are dramatically enhancing the capabilities of construction management software, making it more powerful and versatile. Cloud-based platforms, for instance, have made construction management software more accessible, enabling teams to access and update project information from any location in real time. This is particularly beneficial for construction sites that are often remote or spread across multiple locations. Mobile compatibility is another significant advancement, allowing workers on-site to input data, update progress, and share information using smartphones or tablets, which reduces delays and improves communication between field and office teams. Additionally, the integration of artificial intelligence (AI) and machine learning into construction management software is transforming project planning and risk management by automating scheduling, predicting potential delays, and analyzing resource needs. These tools help project managers make more informed decisions and adjust plans proactively. Building Information Modeling (BIM) is another game-changer, allowing construction management software to integrate with 3D modeling systems, providing a more comprehensive view of project designs and workflows. These technological innovations are driving greater efficiency, accuracy, and adaptability within construction management software, making it an indispensable tool for modern construction projects.How Does Construction Management Software Improve Collaboration and Accountability?

Collaboration and accountability are critical components of any successful construction project, and construction management software significantly improves both by centralizing communication and project oversight. The software acts as a single source of truth, where all stakeholders can access the same data, ensuring transparency throughout the project's lifecycle. With tools for document management, construction teams can easily share blueprints, contracts, permits, and other essential documents, reducing the chance of errors caused by outdated or incomplete information. Furthermore, real-time updates on progress and resource use help all team members stay aligned, minimizing miscommunication between field and office teams. Construction management software also enables better accountability by providing audit trails and activity logs, which track who made changes to schedules, budgets, or plans, and when those changes occurred. This level of transparency holds everyone involved accountable for their tasks, ensuring that deadlines are met and that the project stays on track. Additionally, robust reporting features allow project managers to generate detailed reports on financials, timelines, and performance metrics, providing clear insights into project health and allowing for timely interventions if issues arise. By fostering a more collaborative and transparent working environment, construction management software significantly reduces the risk of delays and cost overruns.What Factors Are Driving Rapid Expansion of the Construction Management Software Market?

The growth in the construction management software market is driven by several key factors, including the increasing complexity of construction projects, the need for improved efficiency, and the rise of digital transformation within the industry. One of the primary drivers is the growing demand for more efficient project management tools as construction projects become larger and more intricate, involving multiple contractors, stakeholders, and locations. Construction management software provides a comprehensive platform to handle the complexity of these projects, enabling better coordination, resource management, and real-time communication. Additionally, the shift toward sustainability and cost efficiency is pushing construction companies to adopt tools that help reduce waste, optimize resource allocation, and streamline workflows, all of which construction management software excels at. Another significant factor fueling market growth is the rising adoption of cloud-based solutions. Cloud-based construction management platforms offer scalability, remote accessibility, and lower upfront costs compared to traditional software. This makes them especially appealing to small- and medium-sized enterprises (SMEs) that want to modernize their operations without significant investment. The adoption of mobile applications that allow on-site data entry and real-time updates has also contributed to the software's growing popularity, as it bridges the gap between on-site crews and office-based managers. Furthermore, regulatory requirements and client demands for greater transparency and accountability are driving the adoption of construction management software. Clients and investors increasingly expect detailed reporting on project timelines, budgets, and sustainability metrics, all of which can be effectively managed through these platforms. Lastly, as construction companies prioritize digital transformation, the integration of AI, BIM, and other advanced technologies into construction management software is positioning it as an essential tool for forward-thinking firms. These factors are driving the rapid expansion of the construction management software market, making it an indispensable resource in modern construction.Report Scope

The report analyzes the Construction Management Software market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Deployment (Cloud, On-Premise); End-Use (Builders & Contractors, Construction Managers, Engineers & Architects).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cloud Deployment segment, which is expected to reach US$2.5 Billion by 2030 with a CAGR of 9.1%. The On-Premise Deployment segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $574.3 Million in 2024, and China, forecasted to grow at an impressive 11.8% CAGR to reach $889.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Construction Management Software Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Construction Management Software Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Construction Management Software Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Autodesk, Inc., Bentley Systems, Inc., Oracle Corporation, PlanGrid, Inc., The Sage Group Plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 16 companies featured in this Construction Management Software market report include:

- Autodesk, Inc.

- Bentley Systems, Inc.

- Oracle Corporation

- PlanGrid, Inc.

- The Sage Group Plc

- Trimble Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Autodesk, Inc.

- Bentley Systems, Inc.

- Oracle Corporation

- PlanGrid, Inc.

- The Sage Group Plc

- Trimble Inc.

Table Information

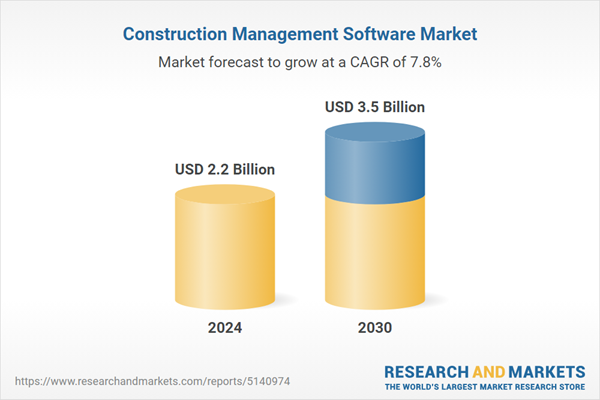

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 3.5 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |