Global Colorants Market - Key Trends and Drivers Summarized

Why Are Colorants Essential to Modern Manufacturing?

Colorants, including dyes and pigments, are indispensable substances used to impart color to a wide variety of materials and products. From plastics and textiles to cosmetics, food, and packaging, colorants add aesthetic appeal and brand distinction across numerous industries. Pigments, which are insoluble, provide opacity and durability, making them ideal for paints, coatings, and plastics. Dyes, on the other hand, are soluble and preferred in industries like textiles and printing, where deep penetration of color is critical. The use of colorants is fundamental not only for enhancing product appearance but also for ensuring uniformity and meeting branding requirements. As consumer expectations rise for visually appealing, customized products, the demand for effective and innovative colorants continues to grow in markets worldwide.How Do Colorants Influence Consumer Behavior and Product Success Across Industries?

The use of colorants is reshaping various industries by driving product appeal and influencing consumer decisions. In the food and beverage industry, colorants are vital in ensuring products appear fresh, appetizing, and consistent. Vibrant natural or synthetic colors play a critical role in how consumers perceive the quality of products like candies, beverages, and processed foods. Similarly, in cosmetics, colorants are at the heart of the creation of makeup products, where manufacturers must offer an extensive palette of shades to meet diverse customer preferences for lipsticks, eyeshadows, and foundations. The importance of precise color matching in cosmetics drives innovation in the use of colorants to achieve consistent results. In packaging, color is a powerful tool that brands use to stand out on store shelves. Carefully chosen colorants can evoke emotions, build brand recognition, and sway purchase decisions. This is especially true in industries such as consumer goods and luxury products, where color is closely tied to brand identity. In textiles, colorants allow manufacturers to offer a wide range of fashionable and customized clothing options. With the rise of fast fashion and the increasing demand for unique designs, colorants help textile manufacturers meet the fast-paced consumer demand for new and visually appealing products.What Innovations Are Shaping the Future of Colorants?

The colorants industry is undergoing significant transformations due to innovations in sustainability, performance, and customization. As consumers and regulators alike demand greener alternatives, natural and eco-friendly colorants are increasingly replacing synthetic options. Plant-based and biodegradable colorants are gaining traction in the food, cosmetics, and textiles sectors, as brands strive to meet the demand for clean-label and environmentally responsible products. Advancements in extraction and stabilization techniques are allowing manufacturers to develop vibrant natural colorants that maintain the performance standards of synthetic counterparts without the environmental drawbacks. Technological advances are also pushing the limits of what colorants can achieve. In industries like coatings and plastics, new formulations are being developed that offer enhanced UV resistance, heat stability, and fade resistance, ensuring longer-lasting colors. Functional colorants, such as those with antimicrobial properties or those that change color in response to temperature or light (thermochromic or photochromic), are also seeing wider applications, especially in packaging, healthcare, and smart textiles. Furthermore, innovations in digital color-matching technology are allowing manufacturers to create bespoke colors with greater precision, offering endless possibilities for customization and branding.What Factors Are Fueling the Growth of the Colorants Market?

The growth in the colorants market is driven by several factors, including increasing demand for customized and visually appealing products, advancements in sustainable solutions, and technological improvements in colorant formulations. As consumer preferences shift toward vibrant, distinct products, industries like food, cosmetics, and textiles are driving demand for high-quality, customizable colorants. The rise of fast fashion, the beauty industry's focus on personalization, and the growing importance of packaging design are all fueling this demand for innovative color solutions that can differentiate brands in competitive markets. Sustainability is another major growth driver. With rising environmental concerns, companies are increasingly opting for natural, biodegradable, and eco-friendly colorants to meet both regulatory standards and consumer demand for green products. This trend is particularly strong in the food and cosmetics industries, where clean-label products are becoming increasingly important. Technological advancements are also contributing to market growth. Innovations in nanotechnology and functional colorants are enhancing the durability and versatility of colorants, opening up new applications in sectors like healthcare, electronics, and smart packaging. Furthermore, the emphasis on packaging aesthetics and product differentiation is encouraging manufacturers to invest in high-quality colorants that help products stand out on store shelves and reinforce brand identity. As companies continue to leverage color as a strategic tool in marketing and design, the demand for innovative, sustainable, and customizable colorants will continue to grow, driving the colorants market forward across various industries.Report Scope

The report analyzes the Colorants market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Pigments, Dyes, Masterbatches, Color Concentrates); End-Use (Packaging, Building & Construction, Automotive, Textiles, Paper & Printing, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pigments segment, which is expected to reach US$40.9 Billion by 2030 with a CAGR of 5.7%. The Dyes segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $17.9 Billion in 2024, and China, forecasted to grow at an impressive 8.1% CAGR to reach $21.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Colorants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Colorants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Colorants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A. Schulman, Inc., Ampacet Corporation, Archroma Management LLC, Atul Ltd., BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 62 companies featured in this Colorants market report include:

- A. Schulman, Inc.

- Ampacet Corporation

- Archroma Management LLC

- Atul Ltd.

- BASF SE

- Cabot Corporation

- Chromatech Incorporated

- Clariant AG

- DIC Corporation

- Dow, Inc.

- DuPont de Nemours, Inc.

- DyStar Singapore Pte Ltd

- Ferro Corporation

- Flint Group

- Greenville Colorants

- Heubach Colour Pvt., Ltd.

- Holland Colours N.V.

- Huntsman Corporation

- Kronos Worldwide, Inc.

- LANXESS AG

- PolyOne Corporation

- Solvay S.A

- Sudarshan Chemical Industries Ltd.

- Sun Chemical Corporation

- The Chemours Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A. Schulman, Inc.

- Ampacet Corporation

- Archroma Management LLC

- Atul Ltd.

- BASF SE

- Cabot Corporation

- Chromatech Incorporated

- Clariant AG

- DIC Corporation

- Dow, Inc.

- DuPont de Nemours, Inc.

- DyStar Singapore Pte Ltd

- Ferro Corporation

- Flint Group

- Greenville Colorants

- Heubach Colour Pvt., Ltd.

- Holland Colours N.V.

- Huntsman Corporation

- Kronos Worldwide, Inc.

- LANXESS AG

- PolyOne Corporation

- Solvay S.A

- Sudarshan Chemical Industries Ltd.

- Sun Chemical Corporation

- The Chemours Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 204 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

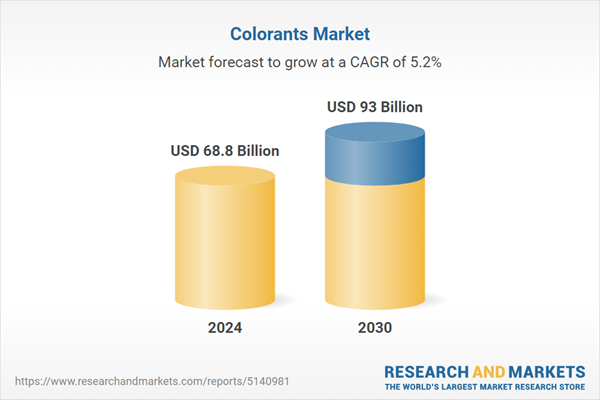

| Estimated Market Value ( USD | $ 68.8 Billion |

| Forecasted Market Value ( USD | $ 93 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |