Global Coil Coatings Market - Key Trends and Drivers Summarized

What Are Coil Coatings and Why Are They Crucial to Modern Manufacturing?

Coil coatings refer to a specialized type of coating applied to metal coils before the metal is formed into end products like building panels, appliances, or automotive components. This process, known as pre-painting, provides metal substrates with an extra layer of protection against corrosion, weathering, and wear. The use of coil coatings allows manufacturers to create more durable and aesthetically appealing products while improving production efficiency. These coatings are designed to enhance the performance characteristics of metals such as steel and aluminum, making them more resistant to the elements, chemicals, and mechanical stresses. In industries like construction, transportation, and consumer goods, where both durability and appearance are key, coil coatings play a critical role in extending product life and reducing maintenance costs. The ability to pre-treat and coat metal in large volumes before fabrication also ensures consistency in quality, which is essential for large-scale manufacturing operations.How Are Coil Coatings Transforming Key Industries and Product Performance?

Coil coatings have become indispensable in industries such as construction, automotive, and appliances due to their ability to improve both the functionality and appearance of metal products. In the construction sector, for instance, coil-coated steel and aluminum are widely used for roofing, cladding, and insulation panels. These coatings not only protect buildings from harsh environmental conditions but also offer design flexibility with a wide range of colors and finishes. In the automotive industry, coil coatings contribute to the production of lightweight yet highly durable car components, helping manufacturers meet the growing demand for fuel efficiency and sustainability. Similarly, the appliance industry benefits from coil-coated metals that provide a sleek, resilient finish for household products like refrigerators, washing machines, and ovens. Beyond their protective properties, coil coatings also contribute to the aesthetic value of products, offering gloss, texture, and color options that enhance consumer appeal. As industries push for more innovative designs and longer-lasting materials, coil coatings are at the forefront of delivering the required performance while meeting environmental and regulatory standards.What Technologies and Innovations Are Driving Advancements in Coil Coatings?

The coil coatings industry is seeing significant advancements, largely driven by innovations in materials science, application technologies, and environmental sustainability. One of the key innovations in the field is the development of high-performance coatings that offer enhanced corrosion resistance, UV stability, and scratch resistance. These advancements are particularly important for industries like construction, where coated metal products are exposed to extreme weather conditions. The rise of nanotechnology has also enabled the creation of more durable and functional coatings, with properties like self-cleaning surfaces or enhanced thermal insulation. Moreover, application technologies are becoming more efficient, with coil coating lines now able to apply multiple layers of primer, topcoat, and protective finishes in a single, continuous process. Sustainability is another major driving force behind the advancements in coil coatings. Increasingly, manufacturers are developing eco-friendly formulations, such as water-based and solvent-free coatings, that reduce volatile organic compound (VOC) emissions during the production process. This shift is not only driven by regulatory pressures but also by the growing consumer demand for more sustainable and environmentally friendly products. Energy-efficient curing processes, which use UV or infrared light instead of conventional heat ovens, are further contributing to the sustainability of the coil coating process.What Factors Are Fueling Expansion in the Coil Coatings Market?

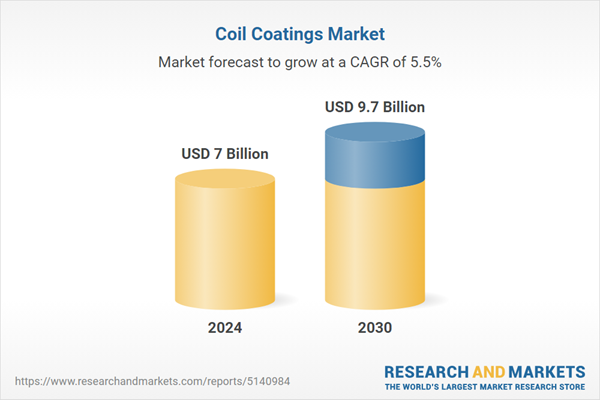

The growth in the coil coatings market is driven by several factors, including increasing construction activity, rising demand for durable and aesthetic metal products, and the push for environmentally sustainable solutions. One of the primary drivers is the construction sector, where the demand for pre-coated metals in roofing, cladding, and insulation applications continues to rise. As urbanization and infrastructure development accelerate globally, particularly in emerging markets, the use of coil-coated metals in residential and commercial buildings is expanding. In addition to construction, the automotive industry's shift towards lightweight materials to improve fuel efficiency is spurring the adoption of aluminum and steel coils with advanced coatings. Coil coatings enable automakers to produce vehicles that are not only lightweight but also more resistant to corrosion, contributing to the longevity of automotive components. The rising demand for household appliances with sleek, durable finishes is prompting appliance manufacturers to adopt coil-coated materials that offer both functionality and aesthetic appeal. Furthermore, the increasing focus on sustainability is propelling the adoption of eco-friendly coil coatings that reduce VOC emissions and energy consumption during production. Regulatory pressures, especially in developed regions like North America and Europe, are also encouraging manufacturers to shift toward more sustainable coating solutions, further driving innovation in water-based and low-VOC formulations. As industries across the board look for ways to improve the durability, appearance, and environmental footprint of their products, coil coatings are becoming an integral part of modern manufacturing processes. These factors, combined with technological advancements in application and material science, are fueling the continued expansion of the global coil coatings market.Report Scope

The report analyzes the Coil Coatings market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Fluoropolymer, Siliconized Polyester, Polyester, Plastisol, Other Types); End-Use (Building & Construction, Automotive, Appliances, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fluoropolymer segment, which is expected to reach US$3.4 Billion by 2030 with a CAGR of 6.4%. The Siliconized Polyester segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $2.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Coil Coatings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Coil Coatings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Coil Coatings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzo Nobel NV, BASF SE, Dow, Inc., DuPont de Nemours, Inc., Henkel AG & Co., KgaA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Coil Coatings market report include:

- Akzo Nobel NV

- BASF SE

- Dow, Inc.

- DuPont de Nemours, Inc.

- Henkel AG & Co., KgaA

- Kansai Paint Co., Ltd.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- The Valspar Corporation

- Wacker Chemie AG

- Wilh. Becker Holding GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel NV

- BASF SE

- Dow, Inc.

- DuPont de Nemours, Inc.

- Henkel AG & Co., KgaA

- Kansai Paint Co., Ltd.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- The Valspar Corporation

- Wacker Chemie AG

- Wilh. Becker Holding GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7 Billion |

| Forecasted Market Value ( USD | $ 9.7 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |