Global Coating Additives Market - Key Trends and Drivers Summarized

Why Are Coating Additives Gaining Momentum Across Industries?

Coating additives have emerged as critical components in the formulation of modern coatings. Coating additives are specialized chemicals added to coatings to enhance their performance, durability, and aesthetic qualities. These additives play a crucial role in improving properties such as viscosity, surface smoothness, drying time, UV protection, and resistance to corrosion, abrasion, and chemical exposure. Industries ranging from automotive and construction to consumer goods and electronics rely on coatings that meet stringent performance requirements, and additives are what make these coatings more effective and versatile. For example, in the automotive sector, coating additives are vital for achieving high gloss, durability, and protection against environmental damage. In construction, additives improve weather resistance and extend the life of coatings applied to buildings and infrastructure. By modifying the behavior of coatings in different environments and applications, additives have become indispensable in creating high-performance solutions across multiple industries.How Are Technological Advancements Shaping the Coating Additives Market?

What role does innovation play in the development of coating additives? Technological advancements are pushing the boundaries of what coating additives can achieve, transforming them into highly specialized solutions for modern-day challenges. One major area of innovation is the development of environmentally friendly additives, driven by growing regulatory pressures and consumer demand for sustainable products. Low-VOC (volatile organic compounds) and water-based coatings are now gaining popularity, and these eco-friendly alternatives require new types of additives to maintain or even enhance performance. Manufacturers are focusing on bio-based and non-toxic additives to meet environmental standards while ensuring that coatings remain durable, resilient, and cost-effective. Another breakthrough in coating additives is the rise of nanotechnology, which enables the production of additives at the molecular level. Nanoparticles, when incorporated into coatings, significantly enhance properties such as scratch resistance, thermal stability, and even self-cleaning capabilities. These advancements not only boost the functional aspects of coatings but also open up new applications in high-tech industries like aerospace, electronics, and healthcare, where precision and performance are paramount.What Market Trends Are Driving the Demand for Coating Additives?

The demand for coating additives is evolving in line with broader industry trends, but what are the key factors influencing this growth? One of the major trends driving the demand for coating additives is the increasing need for high-performance and multi-functional coatings. Industries such as automotive, marine, and construction are looking for coatings that offer not just protection but also additional benefits like anti-fouling, anti-graffiti, or self-healing properties. This has led to the development of advanced additives that provide coatings with superior functionality, making them more efficient and long-lasting. Another significant trend is the rise of smart coatings, which can adapt to their environment or provide real-time data on wear and tear. Additives that enable coatings to respond to stimuli such as temperature changes or UV exposure are becoming more popular, particularly in sectors like defense, aerospace, and energy. In the consumer goods market, the demand for aesthetic appeal combined with durability is pushing the use of additives that enhance color retention, gloss, and finish quality. As consumers seek more sustainable products, the market is also seeing an increased preference for additives that allow for greener formulations without compromising on performance.What Are the Key Growth Drivers in the Coating Additives Market?

The growth in the coating additives market is driven by several factors, many of which are tied directly to technological advancements, industrial demands, and environmental regulations. One of the primary drivers is the growing use of water-based coatings across various industries, including automotive, construction, and packaging. As these industries shift away from solvent-based coatings to meet environmental standards, the need for specialized additives that enhance the performance of water-based systems is rising. Another key factor is the increasing focus on sustainability and the demand for eco-friendly coatings. This trend has accelerated the development of additives that reduce VOC emissions and enable the formulation of coatings that are biodegradable or based on renewable resources. The construction industry's demand for coatings that offer long-term protection against harsh weather, corrosion, and UV exposure is also fueling the need for additives that enhance durability and performance. Moreover, the expanding use of coatings in electronics, aerospace, and healthcare, where precision and functionality are critical, is driving innovation in additives that provide advanced characteristics such as conductivity, heat resistance, and antimicrobial properties. In addition, the rise of Industry 4.0 and the trend toward automation in manufacturing processes are generating demand for additives that improve the ease of application, drying times, and overall efficiency in coating operations. These combined factors are shaping the growth trajectory of the coating additives market, making it a dynamic and evolving sector driven by both industrial needs and technological progress.Report Scope

The report analyzes the Coating Additives market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Formulation (Water-Borne, Powder-Based, Solvent-Borne); Function (Rheology Modification, Anti-Foaming, Wetting & Dispersion, Biocides Impact Modification, Other Functions); Type (Acrylics, Urethanes, Metallic Additives, Fluoropolymers, Other Types); Application (Architectural, Industrial, Wood & Furniture, Automotive, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Water-borne Formulation segment, which is expected to reach US$8.5 Billion by 2030 with a CAGR of 6.4%. The Powder-based Formulation segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3 Billion in 2024, and China, forecasted to grow at an impressive 9% CAGR to reach $3.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Coating Additives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Coating Additives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Coating Additives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akzo Nobel NV, ANGUS Chemical Company, Arkema Group, Ashland, Inc., BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Coating Additives market report include:

- Akzo Nobel NV

- ANGUS Chemical Company

- Arkema Group

- Ashland, Inc.

- BASF SE

- Buckman Laboratories International, Inc.

- BYK-Chemie GmbH

- Cabot Corporation

- Chattem Chemicals, Inc.

- Cytec Industries, Inc.

- Daikin Industries Ltd.

- Double Bond Chemical Ind., Co., Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Dynea AS

- Eastman Chemical Company

- Elementis PLC

- Evonik Industries AG

- Fuji Silysia Chemical Ltd.

- ICL\ Advanced Additives, a division of ICL Specialty Products Inc.

- KaMin LLC.

- Kenrich Petrochemicals, Inc.

- King Industries, Inc.

- K-Tech Limited

- Lonza Inc.

- Lorama Group Inc.

- Michelman, Inc.

- Momentive Performance Materials, Inc.

- SK Formulations India Pvt. Ltd.

- The Lubrizol Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akzo Nobel NV

- ANGUS Chemical Company

- Arkema Group

- Ashland, Inc.

- BASF SE

- Buckman Laboratories International, Inc.

- BYK-Chemie GmbH

- Cabot Corporation

- Chattem Chemicals, Inc.

- Cytec Industries, Inc.

- Daikin Industries Ltd.

- Double Bond Chemical Ind., Co., Ltd.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Dynea AS

- Eastman Chemical Company

- Elementis PLC

- Evonik Industries AG

- Fuji Silysia Chemical Ltd.

- ICL\ Advanced Additives, a division of ICL Specialty Products Inc.

- KaMin LLC.

- Kenrich Petrochemicals, Inc.

- King Industries, Inc.

- K-Tech Limited

- Lonza Inc.

- Lorama Group Inc.

- Michelman, Inc.

- Momentive Performance Materials, Inc.

- SK Formulations India Pvt. Ltd.

- The Lubrizol Corporation

Table Information

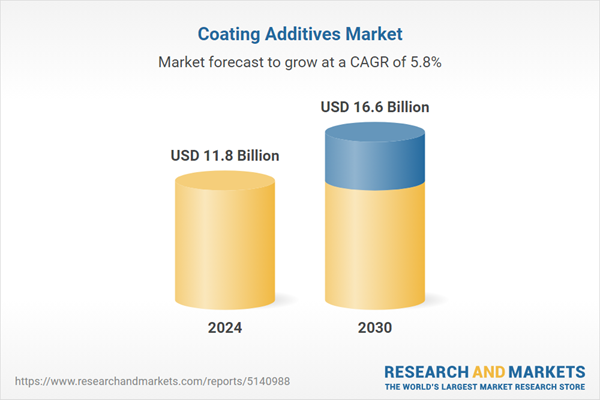

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.8 Billion |

| Forecasted Market Value ( USD | $ 16.6 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |