Global Clean Label Ingredients Market - Key Trends and Drivers Summarized

Why Are Clean Label Ingredients Gaining Prominence in the Food Industry?

Clean label ingredients have rapidly gained prominence in the food and beverage industry, reflecting a broader shift toward transparency and health-conscious consumer behavior. Today's consumers are more engaged with the ingredients in their food than ever before, actively seeking products that are made from natural, simple, and minimally processed ingredients. Clean label products respond to this demand by focusing on ingredient lists that are short, recognizable, and free from artificial additives, preservatives, and synthetic chemicals. Shoppers are increasingly wary of artificial colors, flavors, sweeteners, and preservatives, with many opting for products that promote transparency and health benefits. This movement is particularly strong in categories like plant-based foods, beverages, and snacks, where clean label claims are a key marketing strategy used to appeal to health-conscious and environmentally aware consumers. Moreover, clean label products often emphasize the absence of genetically modified organisms (GMOs), allergens, and processed ingredients, further aligning with consumer preferences for natural and whole food options. As brands and retailers increasingly respond to this demand, clean label ingredients have become central to product reformulation, driving change across the entire food supply chain and shaping the future of food production and consumption.How Are Technological Innovations Enhancing the Use of Clean Label Ingredients?

The clean label movement has been significantly bolstered by technological innovations that allow manufacturers to maintain product quality while relying on natural ingredients. Historically, one of the main challenges of using clean label ingredients was ensuring that natural components could deliver the same shelf stability, texture, and flavor as their synthetic counterparts. However, advancements in food science have provided new solutions to these challenges. For instance, natural preservatives like rosemary extract, cultured dextrose, and vinegar are increasingly being used in place of synthetic preservatives to extend shelf life while maintaining a clean ingredient profile. Innovations in enzymatic processing and fermentation have allowed for the development of natural emulsifiers, stabilizers, and texturizers that offer consistency and functionality without relying on artificial chemicals. Furthermore, enhanced extraction technologies have improved the ability to produce concentrated natural flavors, colors, and sweeteners from fruits, vegetables, and botanicals, providing manufacturers with more options for clean label product formulations. These technological advancements have not only expanded the range of clean label products available to consumers but have also helped address some of the key limitations of early clean label formulations, such as variability in quality and shorter shelf life. As a result, manufacturers are now able to meet clean label demands without compromising on the taste, texture, or functionality of their products.Which Industries Are Leading the Shift Toward Clean Label Ingredients?

The shift toward clean label ingredients has been most pronounced in sectors such as plant-based foods, snacks, beverages, and bakery products, but the trend is now extending across nearly every corner of the food and beverage industry. Plant-based foods, in particular, have seen a surge in demand for clean label formulations, as consumers of these products tend to prioritize natural, non-GMO, and minimally processed ingredients. The clean label trend aligns perfectly with the growing popularity of plant-based and vegan diets, which emphasize natural ingredients and transparency. The snack and beverage industries have also embraced clean label trends, with brands reformulating their products to eliminate artificial ingredients while maintaining flavor and texture. Energy bars, smoothies, and non-dairy milk alternatives are increasingly marketed with clean label claims, targeting health-conscious consumers looking for functional benefits in their foods. Similarly, the bakery and dairy sectors are shifting toward clean label ingredients, where natural preservatives, flavorings, and colorants are replacing synthetic counterparts to meet consumer demand for healthier options. Beyond food, the clean label trend is also gaining traction in personal care and cosmetics, where consumers are beginning to demand transparency and natural ingredients in the products they use on their bodies, further expanding the market's reach. Across these industries, clean label products are becoming the standard as consumer expectations evolve, forcing manufacturers to adopt cleaner formulations to stay competitive.What Is Driving the Growth of the Clean Label Ingredients Market?

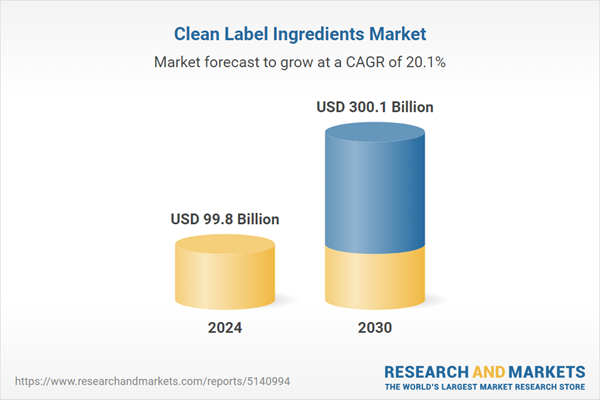

The growth in the clean label ingredients market is driven by several factors, primarily the rising demand for natural, healthy, and minimally processed foods. Health-conscious consumers are increasingly scrutinizing the ingredients in the products they purchase, leading to a growing preference for foods made from simple, recognizable components. This shift in consumer behavior has pushed manufacturers to reformulate their products with clean label ingredients, such as natural flavors, non-GMO components, and minimally processed extracts. The popularity of plant-based and organic foods has further accelerated the adoption of clean label ingredients, particularly as these categories align with the broader movement toward sustainable and transparent food production. Regulatory pressures on the use of artificial additives and chemicals in food products have also played a role in driving the clean label trend, especially in regions like Europe and North America, where stricter guidelines are being enforced around food safety and labeling. Furthermore, the growing consumer demand for eco-friendly and ethically sourced ingredients is contributing to the rise of clean label products, as shoppers increasingly look for options that reflect their values around sustainability and environmental impact. Advances in natural food processing technologies, such as improved extraction methods and fermentation techniques, have made it easier for manufacturers to maintain the quality and shelf life of clean label products, further propelling market growth. As consumers continue to seek healthier and more transparent food options, the clean label ingredients market is poised for sustained expansion across a broad range of food and beverage categories.Report Scope

The report analyzes the Clean Label Ingredients market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Form (Dry, Liquid); Application (Beverages, Ready-to-Eat Meal, Snacks & Cereals, Dairy & Frozen Desserts, Bakery, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Beverages Application segment, which is expected to reach US$128.3 Billion by 2030 with a CAGR of 24.8%. The Ready-to-Eat Meal Application segment is also set to grow at 17% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $22.8 Billion in 2024, and China, forecasted to grow at an impressive 29.6% CAGR to reach $128.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Clean Label Ingredients Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Clean Label Ingredients Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Clean Label Ingredients Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Archer Daniels Midland Company, Brisan, Cargill, Inc., Chr. Hansen Holdings A/S, Corbion NV and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Clean Label Ingredients market report include:

- Archer Daniels Midland Company

- Brisan

- Cargill, Inc.

- Chr. Hansen Holdings A/S

- Corbion NV

- Dow, Inc.

- DuPont de Nemours, Inc.

- Groupe Limagrain Holding SA

- Ingredion, Inc.

- Kerry Group PLC

- Koninklijke DSM NV

- Sensient Technologies Corporation

- Tate & Lyle PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Archer Daniels Midland Company

- Brisan

- Cargill, Inc.

- Chr. Hansen Holdings A/S

- Corbion NV

- Dow, Inc.

- DuPont de Nemours, Inc.

- Groupe Limagrain Holding SA

- Ingredion, Inc.

- Kerry Group PLC

- Koninklijke DSM NV

- Sensient Technologies Corporation

- Tate & Lyle PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 99.8 Billion |

| Forecasted Market Value ( USD | $ 300.1 Billion |

| Compound Annual Growth Rate | 20.1% |

| Regions Covered | Global |