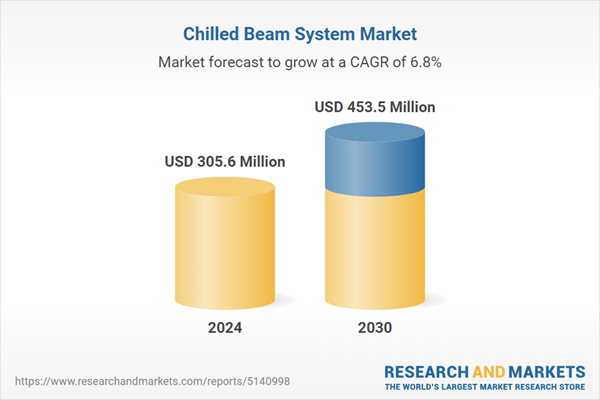

Global Chilled Beam System Market - Key Trends and Drivers Summarized

Why Are Chilled Beam Systems Becoming Popular in Modern Building Designs?

Chilled beam systems are gaining traction in modern building designs, particularly in energy-efficient and sustainable construction projects. A chilled beam system is a type of heating, ventilation, and air conditioning (HVAC) system that uses water as the primary medium for cooling and heating spaces, unlike traditional systems that rely heavily on air-based solutions. This approach significantly reduces energy consumption, as water has a higher capacity to transfer heat than air, making it a more efficient solution for temperature control. In an era where green building certifications such as LEED and BREEAM are increasingly important, chilled beam systems offer a low-energy, low-maintenance alternative to conventional HVAC systems. Additionally, chilled beam systems operate quietly, improving occupant comfort in spaces such as offices, hospitals, and schools, where noise reduction is essential. As architects and engineers continue to prioritize sustainability and energy efficiency in building designs, chilled beam systems are becoming a central component of modern construction projects, aligning with the global push toward reducing carbon footprints and enhancing indoor environmental quality.How Do Chilled Beam Systems Improve Energy Efficiency and Indoor Air Quality?

Chilled beam systems are designed not only to provide energy-efficient temperature control but also to improve indoor air quality, a key factor in occupant comfort and health. The energy efficiency of chilled beam systems comes from their reliance on water as the heat transfer medium, which is much more efficient than air. Since water can carry and transfer heat at a higher capacity, it requires less energy to cool or heat a space compared to traditional all-air HVAC systems. This results in reduced energy consumption for both cooling and heating, making chilled beams particularly effective in buildings looking to minimize their operational costs and environmental impact. In terms of air quality, chilled beam systems contribute to healthier indoor environments by decoupling ventilation from the cooling and heating functions. Fresh air is introduced through a dedicated air handling system, while the chilled beams focus solely on maintaining the desired temperature. This separation allows for more precise control over the quality and quantity of outdoor air being introduced into the space, ensuring adequate ventilation without overcooling or overheating. This setup reduces the need for high air volumes, thereby decreasing the energy required for air movement and improving the overall air exchange rates. By enhancing ventilation efficiency and using less energy to maintain comfortable indoor temperatures, chilled beam systems help create healthier, comfortable spaces while aligning with sustainability goals.What Innovations Are Shaping the Future of Chilled Beam Systems?

The evolution of chilled beam technology is being driven by innovations in energy efficiency, system design, and integration with smart building technologies. One significant development is the integration of active chilled beams with advanced sensors and smart building systems. These systems can now be linked with occupancy sensors, temperature sensors, and CO2 monitors to dynamically adjust cooling, heating, and air quality in real-time. This kind of automation reduces energy waste by delivering climate control only when and where it is needed, optimizing overall building performance. Moreover, smart building systems can monitor the operational efficiency of chilled beams and schedule maintenance only when necessary, further reducing costs and improving system longevity. Another innovation in the chilled beam market is the hybridization of these systems with other HVAC technologies. For instance, hybrid systems that combine chilled beams with displacement ventilation or radiant heating and cooling are emerging as a popular solution in areas requiring specific humidity control. These hybrid setups provide more versatility, making chilled beam systems suitable for a wider range of climates and building types, including high-humidity environments where traditional chilled beams may face limitations. Additionally, advancements in materials used for chilled beam manufacturing, such as corrosion-resistant materials and enhanced thermal conductivity alloys, are improving system durability and performance. These innovations make chilled beam systems more adaptable, energy-efficient, and capable of meeting the demands of modern, high-performance buildings.What Are the Factors Propelling Growth in the Chilled Beam Systems Market?

The growth in the chilled beam systems market is driven by several factors, including the increasing emphasis on energy efficiency, the rise in green building certifications, and advancements in HVAC technology. As global energy regulations become more stringent, building developers and owners are under pressure to reduce their energy consumption, particularly in commercial spaces. Chilled beam systems, which consume significantly less energy compared to traditional HVAC solutions, are increasingly seen as a viable option for achieving these energy reduction goals. The ability of chilled beams to cut operational costs by reducing energy usage for both heating and cooling is a major factor driving their adoption, particularly in sectors like healthcare, education, and commercial office buildings, where long-term operational savings are a priority. Another key growth driver is the rise in demand for green building certifications such as LEED, BREEAM, and WELL. These certifications require buildings to meet specific energy efficiency and environmental performance benchmarks, and chilled beam systems offer a highly efficient solution that can contribute to these certifications. Additionally, the growing focus on occupant comfort and indoor environmental quality is spurring the adoption of chilled beam systems, particularly in high-performance buildings where both energy efficiency and air quality are critical. Technological advancements, such as the integration of chilled beams with smart building systems and the development of hybrid HVAC solutions, are expanding the applicability of these systems, making them more attractive to a broader range of building types and climates. Furthermore, increasing awareness about the environmental impact of traditional HVAC systems, combined with rising energy costs, is pushing developers to seek out more sustainable solutions, positioning chilled beam systems for continued market growth in the coming years.Report Scope

The report analyzes the Chilled Beam System market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Design (Multi-Service Chilled Beam, Passive Chilled Beam, Active Chilled Beam); Product (Concealed, Exposed, Recessed); Application (Commercial Offices, Educational Institutions, Healthcare, Hotels, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Multi-Service Chilled Beam System segment, which is expected to reach US$254.2 Million by 2030 with a CAGR of 7.9%. The Passive Chilled Beam System segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $79.1 Million in 2024, and China, forecasted to grow at an impressive 10.3% CAGR to reach $110 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Chilled Beam System Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Chilled Beam System Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Chilled Beam System Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Caverion Corporation, FlaktGroup, Frenger Systems Ltd., Ftf Group Climate, Lindab AB and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 11 companies featured in this Chilled Beam System market report include:

- Caverion Corporation

- FlaktGroup

- Frenger Systems Ltd.

- Ftf Group Climate

- Lindab AB

- Mestek, Inc.

- Oy Halton Group Ltd.

- Price Industries

- Swegon

- Systemair AB

- Titus Hvac

- TROX GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Caverion Corporation

- FlaktGroup

- Frenger Systems Ltd.

- Ftf Group Climate

- Lindab AB

- Mestek, Inc.

- Oy Halton Group Ltd.

- Price Industries

- Swegon

- Systemair AB

- Titus Hvac

- TROX GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 305.6 Million |

| Forecasted Market Value ( USD | $ 453.5 Million |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |