Global Silage Additives Market - Key Trends and Drivers Summarized

Why Are Silage Additives Crucial for Modern Livestock Farming?

Silage additives have become indispensable tools in modern livestock farming, primarily used to enhance the preservation and nutritional quality of forage crops like grass, corn, and legumes that are stored as silage. Silage, which serves as a key component of the diet for dairy cows, beef cattle, and other ruminants, must be properly fermented to maintain its nutritional value over time. Silage additives are introduced during the ensiling process to control fermentation, inhibit spoilage, and improve the feed's digestibility. Without these additives, silage can spoil due to undesirable microorganisms such as molds, yeasts, and harmful bacteria, leading to significant feed losses and decreased nutritional value. The use of silage additives helps ensure that the forage retains its energy, protein, and fiber content, which are critical for the health and productivity of livestock. In addition to improving feed quality, these additives can also reduce the emission of harmful byproducts like methane, contributing to more sustainable livestock farming practices. As a result, silage additives have become a vital component of feed management strategies in dairy and meat production worldwide.How Have Silage Additives Evolved to Meet the Needs of the Livestock Industry?

Over the years, silage additives have evolved significantly, with advancements in biotechnology and microbiology leading to the development of more effective and specialized formulations. Early silage additives were relatively simple, primarily consisting of organic acids like propionic and lactic acid to lower the pH and control microbial activity. Today, the range of additives available is much broader and includes bacterial inoculants, enzymes, and chemical preservatives, each designed to address specific challenges in the silage-making process. Bacterial inoculants, for example, are among the most popular additives used today. They consist of beneficial lactic acid bacteria that speed up the fermentation process, reducing the time it takes for silage to stabilize and improving the preservation of essential nutrients. Enzyme-based additives work by breaking down complex plant fibers, making the forage more digestible for livestock. These advancements have allowed farmers to fine-tune the fermentation process based on the type of forage and the specific nutritional needs of their livestock. As the livestock industry becomes more focused on efficiency and sustainability, the role of advanced silage additives in improving feed quality, reducing waste, and supporting animal health continues to grow.What Challenges Are Associated with the Use of Silage Additives and How Are They Being Addressed?

While silage additives offer significant benefits, their use is not without challenges. One of the primary concerns for farmers is the cost associated with applying these additives, particularly for large-scale operations that process vast quantities of silage. For some, the upfront investment may seem prohibitive, even though the long-term benefits in terms of improved feed quality and reduced spoilage often justify the expense. Another challenge is selecting the right additive for specific conditions, as different types of forage and environmental factors, such as moisture content and temperature, can affect the fermentation process. Incorrect use or dosage of additives can lead to inconsistent results or even spoilage, making it critical for farmers to have a deep understanding of the ensiling process and the specific needs of their crops. Additionally, as the focus on reducing environmental impact grows, there is increasing pressure on the industry to develop more sustainable and eco-friendly additives. To address these challenges, many companies are now providing tailored solutions, offering custom blends of bacterial inoculants, enzymes, and preservatives that are optimized for different types of forage and climatic conditions. Research and development efforts are also focused on creating more cost-effective and environmentally friendly additives, ensuring that farmers can achieve both economic and ecological benefits.What Factors Are Driving the Growth in the Silage Additives Market?

The growth in the silage additives market is driven by several factors tied to technological advancements, shifts in livestock farming practices, and rising demand for high-quality animal feed. One of the primary drivers is the increasing focus on improving the productivity and efficiency of dairy and meat production, which requires better quality forage to ensure healthy livestock and high milk or meat yields. As farm sizes expand and the pressure to optimize feed management grows, the demand for silage additives that enhance forage preservation and nutrient retention is rising. Another significant driver is the ongoing adoption of bacterial inoculants, which have become a preferred choice for farmers looking to achieve consistent fermentation results and improve feed digestibility. Additionally, the growing awareness of the environmental impact of livestock farming has accelerated the demand for additives that reduce greenhouse gas emissions, particularly methane, from ruminant digestion. Moreover, the increasing need for year-round feed availability, especially in regions with fluctuating climates, has led to higher adoption of silage additives that ensure the long-term preservation of forage. The trend toward sustainable farming practices and the push for organic livestock production also contribute to market growth, as organic and eco-friendly silage additives gain traction. Collectively, these factors are propelling the expansion of the silage additives market, with advancements in microbial inoculants, enzyme technologies, and sustainability-focused solutions playing key roles in driving demand.Report Scope

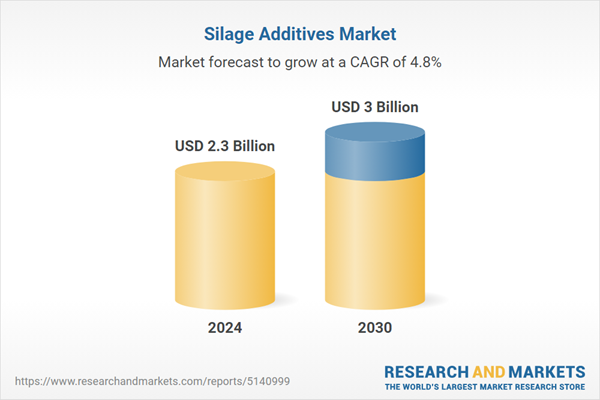

The report analyzes the Silage Additives market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Enzymes, Acids & Organic Acid Salts, Adsorbents, Chemical Inhibitors, Other Types); Application (Legumes, Cereal Crops, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Legumes Application segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of 4.7%. The Cereal Crops Application segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $597.1 Million in 2024, and China, forecasted to grow at an impressive 7.3% CAGR to reach $663.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Silage Additives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Silage Additives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Silage Additives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADDCON GmbH, American Farm Products, Archer Daniels Midland Company, BASF SE, Brett Brothers Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Silage Additives market report include:

- ADDCON GmbH

- American Farm Products

- Archer Daniels Midland Company

- BASF SE

- Brett Brothers Ltd.

- Cargill, Inc.

- Carrs Billington Agriculture (Sales) Ltd.

- Envirosystems Inc.

- Nutreco NV

- Specialist Nutrition

- Vita Plus Corporation

- Volac International Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADDCON GmbH

- American Farm Products

- Archer Daniels Midland Company

- BASF SE

- Brett Brothers Ltd.

- Cargill, Inc.

- Carrs Billington Agriculture (Sales) Ltd.

- Envirosystems Inc.

- Nutreco NV

- Specialist Nutrition

- Vita Plus Corporation

- Volac International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.3 Billion |

| Forecasted Market Value ( USD | $ 3 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |