Global Capacitive Pressure Sensors Market - Key Trends and Drivers Summarized

How Are Capacitive Pressure Sensors Redefining Precision in Modern Industries?

Capacitive pressure sensors have become critical components in a wide range of industries, particularly in applications where precision, sensitivity, and reliability are paramount. These sensors work by detecting changes in capacitance caused by the movement of a diaphragm when exposed to pressure. This technology allows for highly accurate pressure measurement across a broad range of environments, from low-pressure medical devices to high-pressure industrial machinery. Capacitive pressure sensors are valued for their durability and ability to provide accurate readings in harsh conditions, such as extreme temperatures, high humidity, or exposure to corrosive materials. These characteristics make them ideal for industries like automotive, aerospace, medical, and environmental monitoring, where precise pressure measurements are crucial for safety, efficiency, and performance. Their growing use in consumer electronics, wearables, and smart devices further highlights their versatility, as they allow for touch-sensitive controls and environmental sensing in compact designs. As industries continue to adopt smart, automated systems, capacitive pressure sensors are becoming indispensable for ensuring accuracy and reliability in increasingly complex processes.How Are Breakthroughs in Technology Enhancing Capacitive Pressure Sensors?

Technological advancements have significantly enhanced the performance, accuracy, and applications of capacitive pressure sensors, making them more versatile and efficient. One of the key improvements has been in miniaturization, allowing for the integration of capacitive pressure sensors in smaller devices such as smartphones, wearable health monitors, and industrial IoT devices. Microelectromechanical systems (MEMS) technology has played a critical role in reducing the size and power consumption of these sensors while increasing their sensitivity and durability. Additionally, advancements in materials science have improved the durability and responsiveness of the sensor's diaphragm, allowing it to withstand greater pressure ranges and harsher environmental conditions. The integration of digital processing technologies has also enabled more sophisticated data analysis, improving the accuracy and reliability of sensor readings in real time. These innovations have made capacitive pressure sensors more adaptable to a wide variety of applications, from medical devices that require highly precise pressure monitoring to automotive systems where robustness and long-term reliability are critical. As the demand for smarter, more efficient devices grows, so too does the need for advanced capacitive pressure sensors that can meet the stringent requirements of modern industries.What Emerging Trends and Challenges Are Defining the Capacitive Pressure Sensor Landscape?

Several key trends are shaping the capacitive pressure sensor market, driven by the increasing demand for precision sensing technologies and the growing adoption of smart devices and automated systems. A major trend is the rise in the use of capacitive pressure sensors in automotive systems, particularly in advanced driver assistance systems (ADAS) and autonomous vehicles. These sensors are critical for monitoring tire pressure, engine performance, and various safety systems, making them essential for the growing demand for smarter, safer cars. Another important trend is the integration of capacitive pressure sensors in consumer electronics and wearable devices, where their compact size and high accuracy make them ideal for health monitoring, touch-sensitive controls, and environmental sensing. However, the market also faces challenges, including competition from alternative sensing technologies like piezoresistive and optical sensors. Each technology has its own strengths, and manufacturers must continually innovate to ensure capacitive pressure sensors remain competitive in terms of cost, size, and performance. Additionally, the need for enhanced durability in extreme environments, such as those found in industrial and aerospace applications, continues to push the development of more robust sensor designs. Despite these challenges, the growing adoption of capacitive pressure sensors across multiple industries ensures that they remain at the forefront of precision sensing technology.What Are the Factors Fueling Expansion of the Capacitive Pressure Sensor Market?

The growth in the capacitive pressure sensor market is driven by several factors, including advancements in sensor technology, the rising demand for precision sensing in various industries, and the increasing adoption of smart and connected devices. One of the primary drivers of growth is the expanding use of capacitive pressure sensors in the automotive industry, particularly in advanced driver assistance systems (ADAS), where accurate pressure monitoring is critical for vehicle safety and performance. As the automotive industry moves towards electric and autonomous vehicles, the need for reliable pressure sensing in areas like tire pressure monitoring and brake systems has significantly increased. Another key factor driving growth is the rising adoption of capacitive pressure sensors in healthcare devices, such as ventilators, blood pressure monitors, and wearable health trackers, where their sensitivity and accuracy are crucial for patient care. Additionally, the development of the Internet of Things (IoT) has created new opportunities for capacitive pressure sensors in smart home devices, industrial automation, and environmental monitoring systems. The miniaturization of sensors and improvements in energy efficiency has made them more suitable for these applications, allowing for wider deployment in connected environments. As industries continue to embrace automation and smart technologies, the capacitive pressure sensor market is expected to experience sustained growth, driven by the need for accurate, reliable, and versatile pressure measurement solutions across a broad range of applications.Report Scope

The report analyzes the Capacitive Pressure Sensors market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Silicon, Ceramic, Other Materials); End-Use (Automotive, Processing, Manufacturing, Healthcare, Marine, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

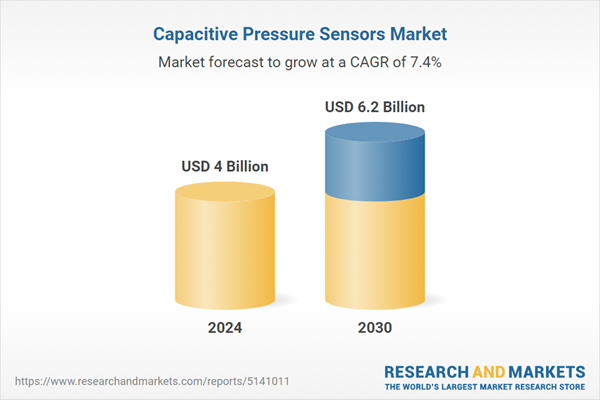

- Market Growth: Understand the significant growth trajectory of the Silicon Material segment, which is expected to reach US$3.2 Billion by 2030 with a CAGR of 7.4%. The Ceramic Material segment is also set to grow at 7.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1 Billion in 2024, and China, forecasted to grow at an impressive 10.8% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Capacitive Pressure Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Capacitive Pressure Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Capacitive Pressure Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACS-CONTROL-SYSTEM GmbH, BD Sensors GmbH, Impress Sensors & Systems Ltd., Infineon Technologies AG, Kavlico, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Capacitive Pressure Sensors market report include:

- ACS-CONTROL-SYSTEM GmbH

- BD Sensors GmbH

- Impress Sensors & Systems Ltd.

- Infineon Technologies AG

- Kavlico, Inc.

- Metallux SA

- Murata Manufacturing Co., Ltd.

- Pewatron AG

- Sensata Technologies, Inc.

- VEGA Controls Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACS-CONTROL-SYSTEM GmbH

- BD Sensors GmbH

- Impress Sensors & Systems Ltd.

- Infineon Technologies AG

- Kavlico, Inc.

- Metallux SA

- Murata Manufacturing Co., Ltd.

- Pewatron AG

- Sensata Technologies, Inc.

- VEGA Controls Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 6.2 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |