Global Cancer Diagnostics Market - Key Trends and Drivers Summarized

Why Is Cancer Diagnostics at the Forefront of Medical Innovation?

Cancer diagnostics is a critical field within healthcare, providing essential tools for the early detection, diagnosis, and monitoring of cancer, significantly improving patient outcomes. The ability to diagnose cancer accurately and at an early stage can make a tremendous difference in treatment success rates and survival. Over the years, cancer diagnostics has evolved from basic imaging techniques to highly sophisticated molecular and genetic testing, enabling the identification of specific cancer types, their progression, and genetic mutations that may influence treatment decisions. The integration of various diagnostic technologies, such as biopsy, blood tests, imaging modalities (like MRI and CT scans), and genomic profiling, provides clinicians with a comprehensive view of a patient's cancer. Moreover, advancements in liquid biopsy and next-generation sequencing (NGS) have transformed how early-stage cancer is detected and monitored. As the field advances, cancer diagnostics is becoming more precise and personalized, playing a crucial role in shaping treatment strategies and improving patient survival rates.How Are Technological Innovations Driving Cancer Diagnostics?

The rapid pace of technological innovation is profoundly reshaping the cancer diagnostics landscape, bringing forth new tools and methodologies that allow for more accurate and earlier detection. One of the most significant developments has been the rise of genomic and molecular diagnostics, which provide insights into the genetic mutations driving cancer growth. Next-generation sequencing (NGS) enables the comprehensive analysis of a patient's genetic profile, helping clinicians tailor treatments to the individual's unique cancer characteristics, making personalized medicine a reality. Liquid biopsy, another cutting-edge advancement, allows for the detection of cancer through a simple blood test, offering a less invasive and faster alternative to traditional tissue biopsies. This technology is not only useful for early detection but also for monitoring cancer progression and treatment efficacy. Artificial intelligence (AI) and machine learning are also making their mark by enhancing imaging technologies, improving the accuracy of cancer screening, and allowing for the interpretation of complex datasets at an unprecedented speed. These innovations are streamlining diagnostic processes, enabling earlier detection, and facilitating better patient outcomes through more precise, individualized treatment approaches.What Are the Emerging Trends and Challenges in Cancer Diagnostics?

Several key trends are currently shaping the cancer diagnostics market, each influencing how cancer is detected and managed. A major trend is the increasing demand for non-invasive diagnostics, such as liquid biopsy and advanced imaging techniques, which minimize patient discomfort and reduce the time needed to obtain results. This shift towards minimally invasive methods is gaining traction as patients and healthcare providers alike look for safer and more convenient options. Another trend is the growing emphasis on early detection, driven by rising awareness of cancer screening's life-saving potential. Screening programs for cancers such as breast, colorectal, and lung have expanded, leading to increased demand for diagnostic tools that can catch cancer at its earliest stages. However, the field faces several challenges as well. The complexity and cost of advanced diagnostic technologies can pose barriers to widespread adoption, particularly in low- and middle-income regions. Moreover, the sheer volume of data generated by genomic testing and imaging requires sophisticated data management and analysis systems, posing a challenge for healthcare providers in terms of integration and interpretation. Despite these challenges, the trend towards personalized medicine and early detection continues to propel innovation in cancer diagnostics.What Factors Are Fueling the Expansion of the Cancer Diagnostics Market?

The growth in the cancer diagnostics market is driven by several factors, primarily advances in technology, rising cancer prevalence, and the increasing emphasis on early detection and personalized treatment. One of the key growth drivers is the surge in demand for molecular diagnostics, particularly next-generation sequencing (NGS) and liquid biopsy technologies, which provide more accurate and less invasive options for detecting cancer. The growing adoption of personalized medicine, where treatment plans are tailored to the individual's genetic profile, has also spurred demand for diagnostic tools that can identify specific biomarkers and mutations. Additionally, the rising global incidence of cancer, driven by factors such as aging populations and lifestyle-related risk factors, is increasing the need for diagnostic solutions that can detect cancer early and improve patient outcomes. Government initiatives and healthcare policies promoting regular cancer screenings have also fueled the demand for diagnostic tests, particularly in developed markets. Another significant factor driving market growth is the integration of artificial intelligence and machine learning into diagnostic imaging and data analysis, which enhances the accuracy and speed of cancer detection. These factors, combined with the continued expansion of diagnostic capabilities into emerging markets, are expected to sustain the rapid growth of the cancer diagnostics industry in the years to come.Report Scope

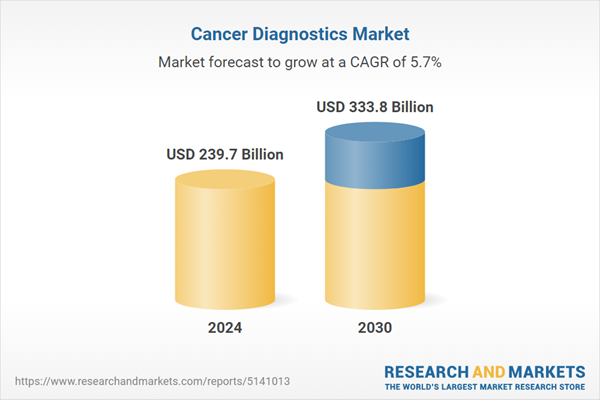

The report analyzes the Cancer Diagnostics market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Imaging, Laboratory Tests, Genetic Tests, Endoscopy, Biopsy, Other Types); Application (Breast, Lung, Blood, Colorectal, Skin, Prostate, Ovarian, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Breast Application segment, which is expected to reach US$56.4 Billion by 2030 with a CAGR of 5.9%. The Lung Application segment is also set to grow at 6.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $62.7 Billion in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $75.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cancer Diagnostics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cancer Diagnostics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cancer Diagnostics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Diagnostics, Abbott Laboratories, Agilent Technologies, Inc., Ambry Genetics Corporation, Applied Imaging and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Cancer Diagnostics market report include:

- Abbott Diagnostics

- Abbott Laboratories

- Agilent Technologies, Inc.

- Ambry Genetics Corporation

- Applied Imaging

- AstraZeneca PLC

- AutoGenomics, Inc.

- BARD, A Becton, Dickinson Company

- Bayer AG

- Becton, Dickinson and Company

- BioCurex, Inc.

- bioMeriux SA

- Celara Diagnostics

- Diagnostic Products Corporation

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- GE Healthcare

- Genoptix, Inc.

- GlaxoSmithKline PLC

- Hologic, Inc.

- Illumina, Inc.

- Pfizer, Inc.

- Philips Healthcare

- QIAGEN GmbH

- Siemens Healthineers

- Thermo Fisher Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Diagnostics

- Abbott Laboratories

- Agilent Technologies, Inc.

- Ambry Genetics Corporation

- Applied Imaging

- AstraZeneca PLC

- AutoGenomics, Inc.

- BARD, A Becton, Dickinson Company

- Bayer AG

- Becton, Dickinson and Company

- BioCurex, Inc.

- bioMeriux SA

- Celara Diagnostics

- Diagnostic Products Corporation

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- GE Healthcare

- Genoptix, Inc.

- GlaxoSmithKline PLC

- Hologic, Inc.

- Illumina, Inc.

- Pfizer, Inc.

- Philips Healthcare

- QIAGEN GmbH

- Siemens Healthineers

- Thermo Fisher Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 239.7 Billion |

| Forecasted Market Value ( USD | $ 333.8 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |