Global Electrostatic Discharge (ESD) Packaging Market - Key Trends & Drivers Summarized

Why Is Electrostatic Discharge Packaging Crucial for Modern Electronics?

Electrostatic discharge (ESD) packaging plays a critical role in protecting sensitive electronic components from the harmful effects of static electricity during shipping, handling, and storage. Electronics, especially microchips, circuit boards, and semiconductors, are highly vulnerable to even the smallest electric discharges, which can cause severe damage, compromising product functionality and reliability. ESD packaging prevents this by using specialized materials that either dissipate or neutralize static charges, ensuring that electronic goods arrive at their destinations in optimal condition. As the global electronics industry continues to expand rapidly, particularly with the rise of consumer electronics, telecommunications, and automotive electronics, the need for effective ESD protection is more critical than ever.Industries like aerospace, defense, and healthcare, where the integrity of electronic equipment is paramount, rely heavily on ESD packaging to prevent costly failures. The packaging solutions range from ESD-safe bags, boxes, and foams to intricate protective enclosures, each designed to meet specific industry requirements. Given the growing complexity of electronic products and the increasing miniaturization of components, ESD packaging has evolved to offer better protection while complying with regulatory standards. The stringent quality controls in industries such as medical devices or aerospace ensure that every component's lifespan and reliability are preserved through effective packaging. But what technological advances are shaping the future of ESD packaging?

How Are Technological Advancements Changing The Electrostatic Discharge Packaging Market?

Recent technological innovations are significantly reshaping the electrostatic discharge packaging landscape, as manufacturers seek more efficient, durable, and environmentally friendly solutions. One major trend is the use of conductive and dissipative polymers in ESD packaging materials. These materials are lightweight yet highly effective in neutralizing static charges, offering a better alternative to traditional methods that relied on heavy or bulky packaging. The development of nanotechnology has also introduced more advanced forms of ESD protection, where nanoscale conductive layers are embedded into packaging materials to provide superior static dissipation. This is particularly beneficial for industries dealing with ultra-sensitive components, such as semiconductors and advanced electronics.Moreover, there is a growing shift toward sustainable ESD packaging solutions. With increasing pressure on companies to reduce their environmental footprint, manufacturers are exploring recyclable and biodegradable materials that still offer the same level of static protection. This shift is especially important in consumer electronics, where companies are being held accountable for their environmental impact across the supply chain. Additionally, automation and Industry 4.0 trends are influencing the design of ESD packaging. Automated packaging systems that can handle static-sensitive components with minimal human intervention are becoming more prevalent, reducing the risk of manual errors and improving overall operational efficiency. These innovations are driving the market forward, but which industries are leading the demand for ESD packaging?

Which Industries Are Driving The Demand For ESD Packaging?

Several key industries are accelerating the demand for electrostatic discharge packaging, with electronics manufacturing leading the way. The global electronics sector, encompassing everything from consumer electronics to industrial and automotive electronics, relies heavily on ESD packaging to protect critical components. With the growing trend of miniaturization and the increasing complexity of electronic devices, the need for effective ESD protection is higher than ever. Consumer electronics, such as smartphones, laptops, and wearable devices, represent a significant portion of the demand for ESD packaging, given their sensitivity to static discharge.The automotive industry is another major adopter of ESD packaging, particularly as modern vehicles incorporate advanced electronic systems like sensors, navigation devices, and autonomous driving components. These electronics are highly vulnerable to static, and the failure of even one component could lead to serious operational issues. Additionally, industries like telecommunications, aerospace, and healthcare are important end-users of ESD packaging. In telecommunications, ESD packaging is essential for the safe transport and storage of components like fiber optics, antennas, and signal processors. In the healthcare sector, the increasing use of electronics in medical devices - such as imaging equipment, diagnostic tools, and life-saving instruments - makes ESD protection critical to ensuring patient safety and product reliability. What factors are driving the market for ESD packaging forward?

The Growth In The Electrostatic Discharge Packaging Market Is Driven By Several Factors

The growth in the electrostatic discharge packaging market is driven by several factors linked to technological developments, consumer electronics trends, and industry-specific requirements. First and foremost, the global rise in consumer electronics, particularly with the advent of 5G technology, smart devices, and the Internet of Things (IoT), has led to a surge in demand for ESD protection. As more devices are connected and integrated, the complexity of their components grows, making ESD packaging a necessity for maintaining product integrity. The increasing adoption of electric vehicles (EVs) and autonomous driving technologies in the automotive sector is also driving demand for ESD packaging, as these vehicles depend heavily on sensitive electronic components.Another key factor propelling market growth is the growing awareness of the long-term damage caused by static electricity, which has led to more stringent regulatory standards across industries such as aerospace, healthcare, and defense. Companies operating in these sectors must comply with strict guidelines to prevent product failures, which has further boosted the need for ESD packaging solutions. Additionally, the push for sustainable packaging is becoming a significant driver, as manufacturers seek eco-friendly options that still provide robust protection. Recyclable, reusable, and biodegradable ESD packaging solutions are increasingly sought after, particularly by companies aiming to reduce waste and meet environmental standards. Moreover, advancements in packaging automation have streamlined the handling of static-sensitive products, reducing the risk of human error and improving operational efficiency. These factors are converging to ensure sustained growth in the electrostatic discharge packaging market in the years to come.

Report Scope

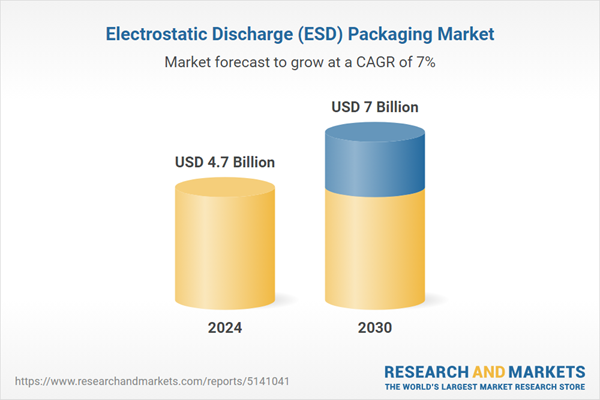

The report analyzes the Electrostatic Discharge (ESD) Packaging market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Bags, Boxes & Containers, Trays, ESD Films, ESD Foams, Other Products); End-Use (Consumer Electronics & Computer Peripherals, Network & Telecommunications, Automotive, Healthcare, Aerospace, Military & Defense, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bags segment, which is expected to reach US$2.4 Billion by 2030 with a CAGR of a 7.5%. The Boxes & Containers segment is also set to grow at 6.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electrostatic Discharge (ESD) Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electrostatic Discharge (ESD) Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electrostatic Discharge (ESD) Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMETEK CTS GmbH, AUER Packaging GmbH, Botron Company, Inc., Delphon Industries LLC, Desco Industries, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Electrostatic Discharge (ESD) Packaging market report include:

- AMETEK CTS GmbH

- AUER Packaging GmbH

- Botron Company, Inc.

- Delphon Industries LLC

- Desco Industries, Inc.

- Dou Yee Enterprises (S) Pte Ltd.

- DS Smith PLC

- Elcom Ltd.

- GWP Group

- Hans Kolb Wellpappe GmbH & Co. KG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMETEK CTS GmbH

- AUER Packaging GmbH

- Botron Company, Inc.

- Delphon Industries LLC

- Desco Industries, Inc.

- Dou Yee Enterprises (S) Pte Ltd.

- DS Smith PLC

- Elcom Ltd.

- GWP Group

- Hans Kolb Wellpappe GmbH & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 7 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |