Global Securities Brokerages and Stock Exchanges Market - Key Trends & Drivers Summarized

How Is Technology Transforming Securities Brokerages And Stock Exchanges?

The securities brokerages and stock exchanges market is witnessing a technological revolution that is reshaping how trading is conducted. Automation, artificial intelligence (AI), and algorithmic trading have become integral to modern brokerage operations, enabling traders to execute transactions at unprecedented speeds with minimal human intervention. The rise of online trading platforms has democratized access to stock markets, allowing retail investors to participate alongside institutional players. Moreover, blockchain technology is beginning to have an impact on the market, particularly in areas like clearing, settlement, and trading, as it offers transparency, security, and reduced transaction costs. These advancements have made trading more efficient, but they have also introduced challenges around market volatility and the regulatory oversight of high-frequency trading.What Impact Has Retail Investing Had On The Brokerage Industry?

The surge in retail investing has dramatically impacted securities brokerages, particularly with the rise of commission-free trading platforms like Robinhood and E*TRADE. The COVID-19 pandemic sparked an increase in individual investor participation, with millions of new accounts being opened during periods of market volatility. This has led to a shift in how brokerages operate, with a greater focus on user-friendly interfaces, education, and access to financial products beyond traditional stocks, such as ETFs and cryptocurrency. The 'meme stock' phenomenon, driven by retail investors using social media platforms like Reddit to coordinate trading strategies, has demonstrated the growing influence of individual investors on market dynamics, pushing brokerages to adapt to a more volatile trading environment.How Are Regulations Evolving To Keep Pace With Market Changes?

Regulatory changes are playing a critical role in shaping the future of securities brokerages and stock exchanges. In response to the increasing complexity of trading, regulators worldwide are introducing new measures to ensure market transparency, fairness, and stability. Stricter oversight of high-frequency trading, algorithmic trading, and cryptocurrency transactions is becoming a priority to mitigate risks associated with rapid market shifts. In addition, efforts to protect retail investors from predatory practices and ensure that trading platforms provide adequate financial education are gaining momentum. Markets are also grappling with how to regulate decentralized finance (DeFi) platforms, which aim to bypass traditional financial intermediaries like brokerages altogether.What Factors Are Driving Growth In The Securities Brokerages And Stock Exchanges Market?

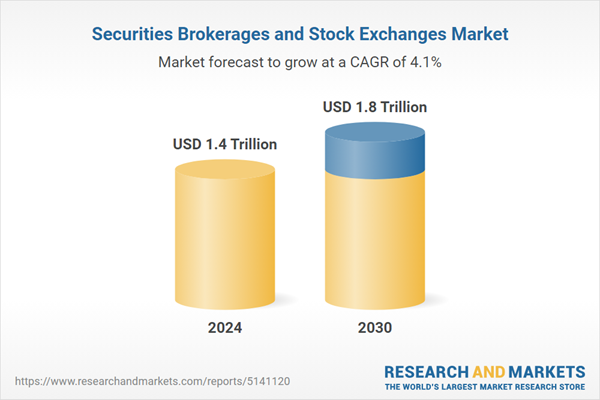

The growth in the securities brokerages and stock exchanges market is driven by several factors, including the rise of retail investing, advancements in trading technology, and evolving regulatory frameworks. Retail investors' increasing involvement, facilitated by commission-free trading and easy-to-use mobile platforms, has significantly expanded the market. Technological innovations, such as AI, algorithmic trading, and blockchain, have enhanced market efficiency and reduced barriers to entry for both individual and institutional investors. Furthermore, regulatory reforms aimed at increasing market transparency and protecting investors are fostering trust in the financial system, further driving growth.Report Scope

The report analyzes the Securities Brokerages and Stock Exchanges market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Equities Brokerage, Stock Exchanges, Bonds Brokerage, Derivatives & Commodities Brokerage, Other Stock Brokerages).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Equities Brokerage segment, which is expected to reach US$462.9 Billion by 2030 with a CAGR of a 4.1%. The Stock Exchanges segment is also set to grow at 4.4% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Securities Brokerages and Stock Exchanges Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Securities Brokerages and Stock Exchanges Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Securities Brokerages and Stock Exchanges Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as İnfo Yatırım, ACLEDA Bank, American Capital Partners, LLC., Ameriprise Financial, Inc., Banco de Crédito e Inversiones SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 87 companies featured in this Securities Brokerages and Stock Exchanges market report include:

- İnfo Yatırım

- ACLEDA Bank

- American Capital Partners, LLC.

- Ameriprise Financial, Inc.

- Banco de Crédito e Inversiones SA

- Bank of America

- BIBO Limited

- Canadian PMX Corp.

- Charles Schwab & Co., Inc.

- China Tonghai International Financial Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- İnfo Yatırım

- ACLEDA Bank

- American Capital Partners, LLC.

- Ameriprise Financial, Inc.

- Banco de Crédito e Inversiones SA

- Bank of America

- BIBO Limited

- Canadian PMX Corp.

- Charles Schwab & Co., Inc.

- China Tonghai International Financial Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.4 Trillion |

| Forecasted Market Value ( USD | $ 1.8 Trillion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |