Global Organic Pea Proteins Market - Key Trends & Drivers Summarized

What Is Organic Pea Protein, and Why Is It Gaining Popularity?

Organic pea protein is a plant-based protein derived from organically grown peas (Pisum sativum), and it is free from synthetic pesticides, herbicides, and genetically modified organisms (GMOs). It has emerged as a popular protein source, particularly among health-conscious consumers and those with dietary restrictions such as vegans, vegetarians, and individuals with dairy or soy allergies. Organic pea protein is rich in essential amino acids, easily digestible, and hypoallergenic, making it a versatile ingredient in a wide array of food products, from protein supplements to meat alternatives and dairy-free products. Its clean-label appeal and compatibility with organic food trends have significantly boosted its demand in the health and wellness sectors. The shift toward plant-based diets, driven by concerns over animal welfare, environmental sustainability, and health benefits, has placed organic pea protein at the forefront of the global plant-based protein market.How Are Technological Advancements Influencing the Organic Pea Protein Market?

Technological innovations in pea protein extraction and processing have enhanced the quality, functionality, and nutritional profile of organic pea protein. Advances in protein isolation techniques, such as wet fractionation and dry milling, have enabled producers to achieve higher purity and concentration levels, making the protein more suitable for various applications such as beverages, bakery products, and meat substitutes. The development of organic pea protein isolates and textured pea proteins has expanded their use in the production of plant-based meat alternatives, where texture and mouthfeel are critical. Additionally, new advancements in flavor-masking technologies have addressed one of the main challenges with pea protein - its natural, earthy taste - making it more palatable for consumers in flavored beverages and food formulations. The rising interest in organic food production has also led to improvements in organic farming practices, ensuring a sustainable supply of high-quality peas for protein extraction.Where Is Organic Pea Protein Being Used Most?

Organic pea protein is widely used across several industries, with its most prominent applications in food and beverages, dietary supplements, and plant-based meat alternatives. In the food and beverage sector, it is increasingly used in protein shakes, meal replacements, energy bars, dairy-free yogurt, and non-dairy milk alternatives due to its high protein content and clean-label attributes. The growing popularity of vegan and vegetarian diets has also fueled its demand in plant-based meat products, where it serves as a key ingredient for replicating the texture and protein content of animal-based products. Additionally, organic pea protein is commonly used in dietary supplements and sports nutrition products, where it is prized for being a complete protein source that provides all nine essential amino acids. In pet food and animal nutrition, organic pea protein is also gaining traction as a sustainable, hypoallergenic alternative to traditional animal-based proteins.What Is Driving the Growth of the Organic Pea Protein Market?

The growth in the organic pea protein market is driven by several factors, particularly the rising consumer demand for plant-based and organic foods. The growing trend of plant-based diets, spurred by health concerns, ethical considerations, and environmental sustainability, is one of the key drivers behind the increasing adoption of organic pea protein in food and beverage products. The surge in demand for clean-label and non-GMO ingredients is also boosting the market, as organic pea protein offers a natural, allergen-free alternative to traditional animal proteins such as whey and casein. Another driver is the rising awareness of the environmental impact of livestock farming, with organic pea protein positioned as a more sustainable, eco-friendly source of protein. The expansion of the plant-based meat industry has further fueled the demand for organic pea protein, as manufacturers seek to create high-protein, allergen-free alternatives to meat. Additionally, the increasing availability of organic food products in mainstream retail channels, including supermarkets and e-commerce platforms, has made organic pea protein more accessible to a broader range of consumers, driving further market growth.Report Scope

The report analyzes the Organic Pea Proteins market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Isolates, Concentrates, Textured); Form (Dry, Liquid); Application (Dietary Supplements, Bakery Products, Meat Extenders & Analogs, Beverages, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Isolates segment, which is expected to reach US$20.2 Billion by 2030 with a CAGR of 9.6%. The Concentrates segment is also set to grow at 12.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $6.3 Billion in 2024, and China, forecasted to grow at an impressive 14.5% CAGR to reach $9.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Organic Pea Proteins Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Organic Pea Proteins Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Organic Pea Proteins Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AIDP, Inc., Axiom Foods, Inc., Bioway (Xi'an) Organic Ingredients Co., Ltd., Phyto-Therapy Pty Ltd., PURIS and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Organic Pea Proteins market report include:

- AIDP, Inc.

- Axiom Foods, Inc.

- Bioway (Xi'an) Organic Ingredients Co., Ltd.

- Phyto-Therapy Pty Ltd.

- PURIS

- Shaanxi Fuheng (Fh) Biotechnology Co., Ltd.

- The Green Labs LLC.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AIDP, Inc.

- Axiom Foods, Inc.

- Bioway (Xi'an) Organic Ingredients Co., Ltd.

- Phyto-Therapy Pty Ltd.

- PURIS

- Shaanxi Fuheng (Fh) Biotechnology Co., Ltd.

- The Green Labs LLC.

Table Information

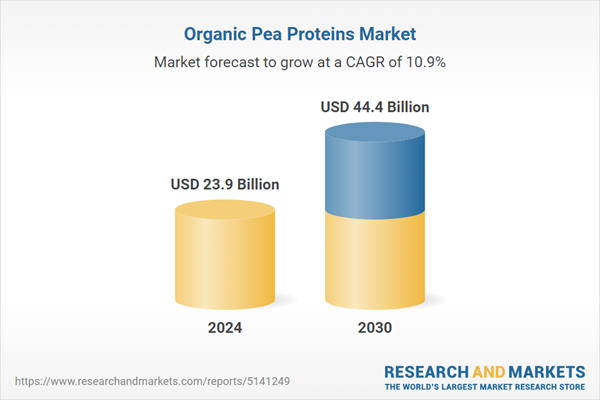

| Report Attribute | Details |

|---|---|

| No. of Pages | 326 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 23.9 Billion |

| Forecasted Market Value ( USD | $ 44.4 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |