Global Natural Sweeteners Market - Key Trends & Drivers Summarized

What Are Natural Sweeteners, and Why Are They So Crucial in Modern Food and Beverage Formulations?

Natural sweeteners are plant-derived substances used as alternatives to conventional sugar in food and beverage products. They offer sweetness without the high calorie content and glycemic impact associated with refined sugar, making them popular choices for health-conscious consumers. Examples of natural sweeteners include stevia, monk fruit extract, agave syrup, honey, maple syrup, coconut sugar, and sugar alcohols like erythritol and xylitol. These sweeteners come in various forms, including liquids, powders, and granules, catering to different applications across the food and beverage industry.The importance of natural sweeteners lies in their ability to provide healthier options for sweetening products while aligning with consumer preferences for natural, less-processed ingredients. With the growing focus on reducing sugar intake due to concerns about obesity, diabetes, and other health issues, natural sweeteners have emerged as key ingredients in sugar reduction strategies. They are widely used in a range of applications, including soft drinks, bakery products, dairy products, confectionery, and health supplements. As consumer demand for clean-label and functional foods continues to rise, natural sweeteners have become essential components in the development of low-sugar, low-calorie, and keto-friendly products.

How Are Technological Advancements Shaping the Natural Sweeteners Market?

Technological advancements have significantly enhanced the taste, formulation, and versatility of natural sweeteners, driving innovation across the food and beverage sector. One of the major developments is the refinement of stevia-based sweeteners, where advancements in extraction and processing techniques have led to better-tasting formulations with reduced bitterness. The introduction of new steviol glycosides, such as Reb M and Reb D, offers a more sugar-like sweetness, making stevia more palatable and suitable for a wider range of products, from beverages to dairy and confectionery.The rise of fermentation-based production methods has also transformed the natural sweeteners market. Companies are using fermentation to produce sweet molecules identical to those found in nature but in a more sustainable and scalable manner. This approach not only ensures a consistent supply of natural sweeteners but also reduces the environmental impact associated with traditional cultivation and extraction. Fermentation has been particularly impactful in the production of monk fruit sweeteners, where it enables larger-scale production without reliance on the seasonal growth of monk fruit.

Advancements in blending and formulation have improved the overall sensory experience of natural sweeteners in food and beverage products. By combining different sweeteners, manufacturers can create tailored sweetness profiles that closely mimic the taste and mouthfeel of sugar. For instance, blends of stevia, erythritol, and monk fruit are commonly used to achieve a balanced sweetness with minimal aftertaste. Encapsulation techniques have also enhanced the stability of natural sweeteners, protecting them from degradation during processing and ensuring consistent sweetness throughout the product's shelf life. These innovations not only enhance the functionality of natural sweeteners but also align with broader trends toward sugar reduction, clean-label products, and sustainable sourcing in the food and beverage industry.

What Are the Emerging Applications of Natural Sweeteners Across Different Sectors?

Natural sweeteners are finding expanding applications across a variety of sectors, driven by increasing demand for healthier, low-sugar products. In the food and beverage industry, they are widely used in formulating low-calorie drinks, including soft drinks, flavored water, energy drinks, and juices. Beverage manufacturers are incorporating natural sweeteners like stevia and monk fruit to reduce sugar content while maintaining the sweetness that consumers expect. Natural sweeteners are also used in ready-to-drink teas, plant-based milk alternatives, and alcoholic beverages, where they help maintain sweetness without adding extra calories or affecting blood sugar levels.In the bakery and confectionery sector, natural sweeteners are used to produce sugar-free or reduced-sugar versions of cakes, cookies, chocolates, and candies. These sweeteners help maintain the sweetness, texture, and overall appeal of baked goods while supporting the development of keto-friendly and diabetic-friendly products. For instance, erythritol and stevia are often combined to create sugar-free chocolate bars that retain a rich, sweet taste while significantly lowering the glycemic index. Similarly, in gum and mints, sugar alcohols like xylitol provide sweetness while offering dental health benefits, making them popular ingredients in oral care confectionery.

In the dairy sector, natural sweeteners are employed in products like flavored yogurt, ice cream, and milkshakes. They help reduce the sugar content of these products while maintaining a creamy texture and pleasant sweetness. Natural sweeteners are also being used in plant-based dairy alternatives, such as almond milk, oat milk, and vegan yogurt, to enhance sweetness without adding calories. In the health and wellness sector, natural sweeteners are included in protein bars, meal replacement shakes, and dietary supplements. They not only add sweetness but also align with consumer demand for clean-label, functional foods that support weight management, keto diets, and overall health goals.

In the pharmaceutical and nutraceutical industries, natural sweeteners are used to improve the taste of medicines, syrups, and chewable supplements. They help make products more palatable, especially for children and patients requiring long-term medication. Additionally, natural sweeteners are used in oral hygiene products like toothpaste and mouthwash, providing sweetness without contributing to tooth decay. The expanding applications of natural sweeteners across these sectors highlight their critical role in supporting sugar reduction, enhancing taste, and improving product appeal while maintaining health benefits.

What Drives Growth in the Natural Sweeteners Market?

The growth in the natural sweeteners market is driven by several factors, including increasing consumer awareness of health issues related to high sugar consumption, rising demand for clean-label products, and advancements in sweetener formulations. One of the primary growth drivers is the global shift toward healthier diets, with consumers actively seeking low-sugar and low-calorie alternatives. As the prevalence of obesity, diabetes, and other lifestyle-related diseases continues to rise, the demand for natural sweeteners has surged as part of broader sugar reduction strategies in foods and beverages.The growing demand for clean-label products has further fueled the adoption of natural sweeteners. Consumers are increasingly interested in products with transparent ingredient lists and minimally processed ingredients. Natural sweeteners, derived from plants, align with these preferences and offer a natural alternative to artificial sweeteners, which are often viewed with skepticism. This trend has driven food and beverage manufacturers to reformulate their products using natural sweeteners, creating healthier options without compromising on taste.

Advancements in natural sweetener formulations, extraction techniques, and blending methods have also contributed to market growth. Improved formulations that offer better taste profiles and lower aftertaste have made natural sweeteners more appealing to consumers and manufacturers alike. The development of sweetener blends and fermentation-based production has increased the versatility and scalability of natural sweeteners, making them suitable for a wider range of applications and supporting larger production volumes.

Regulatory support and public health initiatives aimed at reducing sugar consumption have also driven demand for natural sweeteners. Governments and health organizations have introduced guidelines and campaigns encouraging lower sugar intake, prompting food and beverage companies to adopt natural sweeteners in their products. This has further increased the presence of natural sweeteners in supermarkets, health food stores, and online retail platforms, expanding consumer access and awareness.

With ongoing innovations in sweetener production, sustainable sourcing, and personalized nutrition, the natural sweeteners market is poised for continued growth. These trends, combined with increasing demand for healthier, low-sugar, and clean-label products, make natural sweeteners a vital component of modern food, beverage, and wellness strategies across various sectors.

Report Scope

The report analyzes the Natural Sweeteners market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Sweet Spreads, Confectionery and Chewing Gums, Beverages, Other Applications, Bakery Goods); End-Use (Food and Beverages, Pharmaceuticals, Other End-Uses); Product Type (High Intensity, Low Intensity).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the High Intensity Sweeteners segment, which is expected to reach US$22.2 Billion by 2030 with a CAGR of a 4.9%. The Low Intensity Sweeteners segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.1 Billion in 2024, and China, forecasted to grow at an impressive 7.6% CAGR to reach $8.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Natural Sweeteners Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Natural Sweeteners Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Natural Sweeteners Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ajinomoto Co., Inc., Archer Daniels Midland Company, ASR Group International, Inc., Associated British Foods PLC, Cargill, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 11 companies featured in this Natural Sweeteners market report include:

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company

- ASR Group International, Inc.

- Associated British Foods PLC

- Cargill, Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Ingredion, Inc.

- MacAndrews & Forbes, Inc.

- Nestle SA

- Roquette Freres S.A.

- Symrise AG

- Tate & Lyle PLC

- Wilmar International Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company

- ASR Group International, Inc.

- Associated British Foods PLC

- Cargill, Inc.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Ingredion, Inc.

- MacAndrews & Forbes, Inc.

- Nestle SA

- Roquette Freres S.A.

- Symrise AG

- Tate & Lyle PLC

- Wilmar International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 308 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

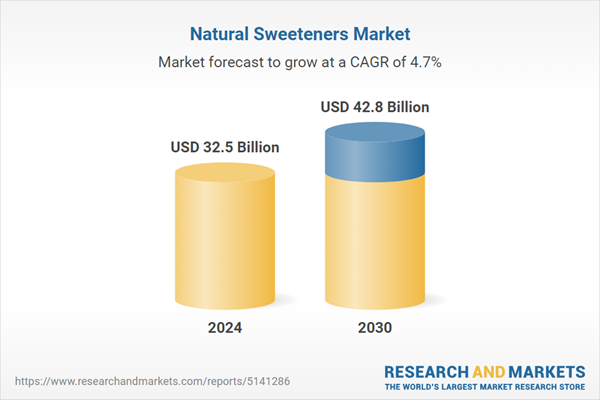

| Estimated Market Value ( USD | $ 32.5 Billion |

| Forecasted Market Value ( USD | $ 42.8 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |