Global Legionella Testing Market - Key Trends & Drivers Summarized

Why Is Legionella Testing Gaining Importance Across Industries?

Legionella testing has become increasingly important as global awareness around public health and water safety intensifies. Legionella bacteria, primarily found in water systems, can cause Legionnaires' disease, a potentially severe form of pneumonia. Given the prevalence of large-scale water distribution systems in facilities like hospitals, hotels, and public buildings, regular testing for Legionella is essential to prevent outbreaks and ensure the safety of occupants. This rising focus on health and safety regulations, driven by government standards and public health guidelines, has elevated the need for proactive Legionella testing, particularly in regions with strict water safety policies.How Is Technology Advancing in the Legionella Testing Market?

Technological advancements have transformed Legionella testing, making it faster, more accurate, and easier to conduct across various water systems. Traditional culture methods, which require extensive lab time, are being supplemented or replaced by advanced techniques like polymerase chain reaction (PCR) testing, rapid immunoassays, and enzyme-linked immunosorbent assay (ELISA) tests. These methods offer high sensitivity and specificity, allowing for faster detection and quantification of Legionella bacteria. Portable testing kits and automated sampling systems are now available, making it feasible to conduct on-site testing. With real-time monitoring and early detection capabilities, these technological innovations have made Legionella testing more reliable, allowing industries to adopt more stringent water management protocols.Which Industries Are Embracing Legionella Testing?

The healthcare, hospitality, and water management industries are leading adopters of Legionella testing, driven by regulatory compliance and a heightened focus on public health. Hospitals and nursing homes rely on frequent Legionella testing to protect vulnerable populations, while the hospitality sector uses it to safeguard guests. Additionally, industrial facilities, educational institutions, and municipal water systems have integrated Legionella testing into their water safety plans to maintain compliance with environmental health regulations. The global push for sustainable water management practices has further encouraged industries to incorporate Legionella testing as part of comprehensive water risk assessments.The Growth in the Legionella Testing Market Is Driven by Several Factors

The growth in the Legionella testing market is driven by several factors, including rising health awareness, regulatory requirements, and technological advancements in testing methodologies. Increased regulations around water quality in developed and emerging economies have spurred organizations to prioritize Legionella control programs. The growing number of healthcare facilities, hotels, and other high-risk environments that require regular testing is also a key driver. Additionally, innovations in rapid testing and on-site diagnostic tools have broadened access to Legionella testing, making it easier and more cost-effective for various sectors to implement routine testing. These factors collectively underscore the market's upward trajectory.Report Scope

The report analyzes the Legionella Testing market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Clinical Testing Methods, Environmental Testing Methods); End-Use (Hospitals, Diagnostic Laboratories, Clinics, Other End-Uses); Test Type (Culture Methods, Urinary Antigen Test (UAT), Serology, Direct Fluorescence Antibody Test (DFA), Nucleic Acid-based Detection).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Culture Methods segment, which is expected to reach US$122.4 Million by 2030 with a CAGR of a 8.5%. The Urinary Antigen Test (UAT) segment is also set to grow at 8.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $88.4 Million in 2024, and China, forecasted to grow at an impressive 12.1% CAGR to reach $138.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Legionella Testing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Legionella Testing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Legionella Testing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

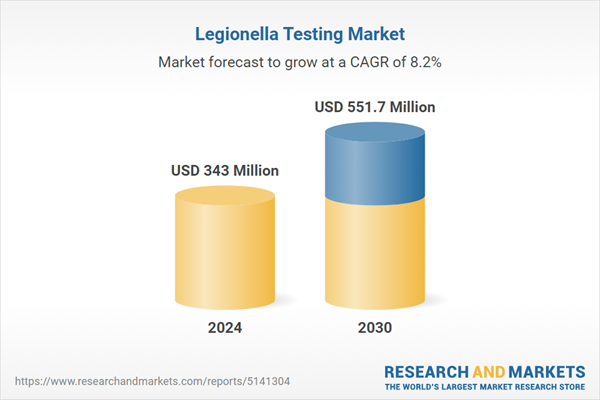

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alere, Inc., Aquacert Ltd, Beckman Coulter, Inc., Becton, Dickinson and Company (BD), BioMérieux SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Legionella Testing market report include:

- Alere, Inc.

- Aquacert Ltd

- Beckman Coulter, Inc.

- Becton, Dickinson and Company (BD)

- BioMérieux SA

- Bio-Rad Laboratories, Inc.

- Eiken Chemical Co., Ltd.

- Hologic, Inc.

- Idexx Laboratories Inc.

- Roche Diagnostics

- Thermo Fischer Scientific, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alere, Inc.

- Aquacert Ltd

- Beckman Coulter, Inc.

- Becton, Dickinson and Company (BD)

- BioMérieux SA

- Bio-Rad Laboratories, Inc.

- Eiken Chemical Co., Ltd.

- Hologic, Inc.

- Idexx Laboratories Inc.

- Roche Diagnostics

- Thermo Fischer Scientific, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 173 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 343 Million |

| Forecasted Market Value ( USD | $ 551.7 Million |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |