Global Fiber-Reinforced Composites Market - Key Trends & Drivers Summarized

Why Are Fiber-Reinforced Composites Revolutionizing Modern Engineering?

Fiber-reinforced composites (FRCs) are materials composed of a polymer matrix embedded with high-strength fibers like carbon, glass, or aramid, offering an ideal blend of strength, durability, and lightweight properties. These composites are instrumental in industries such as automotive, aerospace, construction, and sports equipment, where reducing weight while maintaining structural integrity is critical. FRCs have become essential for applications requiring high-performance materials that offer superior strength-to-weight ratios compared to traditional metals. The automotive and aerospace sectors, in particular, benefit from FRCs, as they contribute to fuel efficiency and reduced emissions by lowering the weight of vehicles and aircraft.How Are Technological Advancements Enhancing Fiber-Reinforced Composites?

Innovations in FRC technology are significantly expanding the applications and performance of these materials. Advanced fiber types such as carbon and hybrid fibers are being integrated into composites to enhance stiffness, reduce weight, and improve impact resistance. Manufacturing techniques like resin transfer molding (RTM) and automated fiber placement (AFP) are becoming increasingly sophisticated, allowing for greater precision and efficiency in composite production. Furthermore, developments in smart composites, which integrate sensors and monitoring capabilities directly into the materials, are opening up new possibilities in sectors like infrastructure, where real-time monitoring of structural health is critical. These advancements are enhancing the versatility, functionality, and competitiveness of FRCs across a broad spectrum of industries.What Are the Emerging Applications and Trends in the FRC Market?

The fiber-reinforced composites market is seeing a surge in demand due to the growing trend of lightweighting, particularly in transportation industries like automotive, aviation, and rail. The push for electric vehicles (EVs) has further accelerated the demand for FRCs, as they are used to develop lightweight battery enclosures and structural components that maximize efficiency and range. In the construction sector, FRCs are being adopted for retrofitting and reinforcing existing structures, as they provide high tensile strength and durability without adding significant weight. Additionally, the sports and leisure industry is incorporating these composites into products like bicycles, tennis rackets, and other high-performance equipment, leveraging their lightweight and flexible properties to improve athletic performance.What Factors Are Driving the Growth of the Fiber-Reinforced Composites Market?

The growth in the fiber-reinforced composites market is driven by several factors, including the increasing emphasis on lightweight materials to improve fuel efficiency and reduce carbon emissions, particularly in the automotive and aerospace sectors. The rise of electric vehicles and the demand for lightweight structural components are further boosting the use of FRCs in automotive manufacturing. Technological advancements in manufacturing processes and the development of new fiber materials are enhancing the performance capabilities and expanding the applications of FRCs, making them more appealing for industries like construction and infrastructure. Additionally, growing environmental awareness and the push for sustainable construction materials are encouraging the adoption of FRCs, which offer longevity and reduced maintenance costs compared to traditional materials.Report Scope

The report analyzes the Fiber-Reinforced Composites market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Fiber (Glass, Carbon, Aramid, Other Fibers); Resin (Thermoset Composites, Thermoplastic Composites); End-Use (Automotive, Aerospace & Defense, Building & Construction, Electrical & Electronics, Wind Energy, Sporting Goods, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Glass Fiber segment, which is expected to reach US$85.1 Billion by 2030 with a CAGR of a 5.8%. The Carbon Fiber segment is also set to grow at 7.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $28.5 Billion in 2024, and China, forecasted to grow at an impressive 9.4% CAGR to reach $34.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fiber-Reinforced Composites Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fiber-Reinforced Composites Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fiber-Reinforced Composites Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

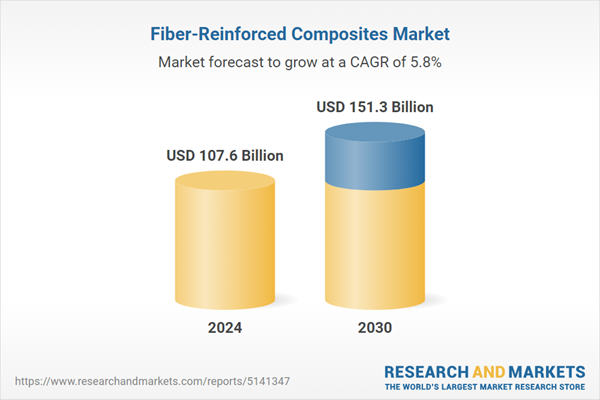

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, COTESA GmbH, Hexcel Corporation, Toray Industries, Inc., RTP Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Fiber-Reinforced Composites market report include:

- BASF SE

- COTESA GmbH

- Hexcel Corporation

- Toray Industries, Inc.

- RTP Company

- Nippon Electric Glass Co., Ltd.

- Huntsman International LLC

- Enduro Composites

- Owens Corning

- TPI Composites Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BASF SE

- COTESA GmbH

- Hexcel Corporation

- Toray Industries, Inc.

- RTP Company

- Nippon Electric Glass Co., Ltd.

- Huntsman International LLC

- Enduro Composites

- Owens Corning

- TPI Composites Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 107.6 Billion |

| Forecasted Market Value ( USD | $ 151.3 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |