Global Textiles Market - Key Trends & Growth Drivers Explored

Why Is the Textiles Industry Essential for Global Economic Development and Innovation?

The global textiles industry has long been a fundamental component of economic development, playing a vital role in the production of clothing, home furnishings, industrial materials, and technical fabrics. But what makes textiles so critical across diverse sectors? Textiles encompass a wide range of materials, including natural fibers like cotton, wool, and silk, as well as synthetic fibers such as polyester, nylon, and acrylic. These materials are woven, knitted, or otherwise processed into fabrics used in countless applications - from everyday apparel and home décor to high-performance sportswear and industrial uses. The versatility and adaptability of textiles have made them indispensable in modern life, influencing everything from fashion trends to technological advancements in fields such as automotive manufacturing, healthcare, and construction.The demand for textiles is driven by the rising global population, increasing disposable income, and evolving consumer preferences. As people's lifestyles change and economies grow, the need for textiles in clothing, home goods, and technical applications continues to expand. The rise of fast fashion and e-commerce has further accelerated demand for a wide variety of fabrics, prompting manufacturers to innovate and produce textiles that meet the rapidly changing trends and preferences of consumers. Additionally, the increasing focus on sustainable and eco-friendly products is driving the development of textiles made from recycled materials, organic fibers, and renewable resources, aligning with consumer demand for environmentally responsible products. As a result, the textiles industry is not only a major economic contributor but also a hub for innovation, continually evolving to meet the needs of global markets and emerging technologies.

How Are Technological Advancements Transforming the Global Textiles Industry?

The textiles industry has undergone significant technological advancements that have enhanced the efficiency, sustainability, and performance of fabrics and production processes. But what are the key innovations driving these developments? One of the most impactful advancements is the rise of smart textiles, also known as e-textiles or intelligent fabrics. Smart textiles are designed to interact with their environment or respond to external stimuli, such as temperature, humidity, and mechanical pressure. These fabrics can be embedded with sensors, conductive threads, and electronic components that enable functionalities such as body monitoring, temperature regulation, and even communication capabilities. Smart textiles are gaining traction in various fields, including sportswear, healthcare, and military applications, where they are used to create garments that can track physiological data, enhance comfort, and provide additional safety features.Another critical innovation is the use of automation and digital technology in textile manufacturing. The adoption of Industry 4.0 principles, such as automation, robotics, and artificial intelligence (AI), has revolutionized textile production by reducing manual labor, minimizing waste, and improving precision. Advanced manufacturing techniques like 3D knitting and digital printing enable the creation of complex patterns, customized designs, and seamless garments with greater efficiency and less material usage. These technologies have made it possible for manufacturers to produce textiles on-demand, reducing inventory costs and enabling a more sustainable approach to production. AI-powered software and data analytics are also being used to optimize supply chain management, forecast demand, and monitor quality, allowing manufacturers to respond more quickly to market changes and consumer preferences.

The development of sustainable textiles and eco-friendly production methods has also transformed the global textiles industry. Innovations such as bio-based fibers, recycled materials, and waterless dyeing technologies are being adopted to reduce the environmental impact of textile manufacturing. For example, recycled polyester made from post-consumer plastic bottles and bio-based fibers derived from renewable resources like bamboo and hemp are being used to create textiles with a lower carbon footprint. Waterless dyeing techniques, such as supercritical CO2 dyeing, eliminate the need for large volumes of water and reduce chemical use, addressing one of the most pressing environmental challenges in textile production. These technological advancements are not only improving the sustainability of textiles but also expanding the range of applications for innovative and environmentally friendly fabrics.

What Market Trends Are Driving the Adoption of Advanced Textiles Across Various Sectors?

Several key market trends are shaping the adoption of advanced textiles across various sectors, reflecting the evolving needs and priorities of consumers, manufacturers, and industries. One of the most prominent trends is the growing demand for sustainable and eco-friendly textiles. Consumers are becoming increasingly aware of the environmental impact of the textile industry, including issues related to water usage, chemical pollution, and textile waste. This has led to a surge in demand for textiles made from organic, biodegradable, and recycled materials. Brands and manufacturers are responding by adopting sustainable production practices and sourcing eco-friendly materials, such as organic cotton, Tencel, and recycled nylon. The rise of circular fashion models, where products are designed for durability, reuse, and recyclability, is further driving the adoption of sustainable textiles and creating new business opportunities within the industry.Another key trend driving the adoption of advanced textiles is the increasing focus on performance and functionality in fabrics. The demand for high-performance textiles is particularly strong in sectors such as sportswear, outdoor apparel, and technical textiles for industrial applications. These fabrics offer features such as moisture-wicking, UV protection, thermal insulation, and antimicrobial properties, enhancing comfort and performance for users. The healthcare industry is also adopting advanced textiles for applications such as wound care, compression garments, and wearable health monitors. The automotive and aerospace sectors are using technical textiles for lightweight composites, sound insulation, and flame-resistant materials, contributing to improved fuel efficiency and safety. These trends highlight the growing importance of functionality and innovation in textile applications, driving the development of new fabrics that meet the specific requirements of different industries.

The adoption of digital technologies in the textiles industry is also being influenced by the rise of mass customization and on-demand production. As consumers seek more personalized products that reflect their individual preferences, manufacturers are adopting digital printing, 3D knitting, and other advanced manufacturing techniques to create customized garments and home textiles. The ability to produce made-to-order items with minimal lead times is enabling brands to cater to niche markets and reduce excess inventory. The increasing use of digital design tools and virtual prototyping is also streamlining product development, allowing designers to visualize and modify textiles in a virtual environment before committing to production. This trend towards customization and digitalization is reshaping the textiles industry, making it more agile and responsive to consumer demands.

What Factors Are Driving the Growth of the Global Textiles Market?

The growth in the global textiles market is driven by several factors, including increasing consumer demand for clothing and home furnishings, advancements in textile technology, and the expansion of industrial and technical textile applications. One of the primary growth drivers is the rising disposable income and urbanization in developing regions such as Asia-Pacific and Latin America. As living standards improve and consumer spending increases, the demand for textiles used in clothing, home goods, and accessories is rising. The expansion of the middle class in these regions is also contributing to the growth of the fashion and home textiles segments, where consumers are seeking high-quality, fashionable, and functional products.Another key growth driver is the increasing demand for industrial and technical textiles in sectors such as automotive, construction, healthcare, and agriculture. Technical textiles, which include nonwovens, composites, and geotextiles, are used in a wide range of applications, from automotive interiors and building materials to medical devices and protective clothing. The growing use of technical textiles in infrastructure projects, environmental protection, and advanced manufacturing processes is creating new opportunities for textile manufacturers. The development of high-performance textiles with properties such as fire resistance, chemical protection, and durability is also driving demand in specialized industries where safety and performance are critical.

The global textiles market is also benefiting from the rise of e-commerce and digital marketing, which have transformed how textiles are sold and marketed to consumers. The increasing adoption of online retail channels has made it easier for consumers to access a wide variety of textile products, including customized and niche offerings. E-commerce platforms enable textile manufacturers to reach a global audience, expand their customer base, and optimize supply chain management. Digital marketing tools, such as social media and influencer marketing, are being used to promote textile products and engage with consumers in new and interactive ways. As technology continues to shape the textiles industry, the global market is poised for sustained growth, driven by a dynamic interplay of consumer demand, innovation, and industry expansion.

The ongoing advancements in textile technology, the growing emphasis on sustainability, and the increasing integration of digital tools are set to transform the global textiles market. As manufacturers continue to innovate and adapt to changing consumer preferences and environmental considerations, the textiles industry is expected to experience robust growth, offering new possibilities for product development and market expansion. The dynamic evolution of the textiles market presents exciting opportunities for businesses and stakeholders across the value chain, positioning textiles as a cornerstone of global economic development and technological progress.

Report Scope

The report analyzes the Textiles market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Household, Technical, Fashion & Clothing, Other Applications); Type (Natural Fibers, Polyester, Nylon, Other Types); .

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Natural Fibers segment, which is expected to reach US$507.9 Billion by 2030 with a CAGR of a 3.1%. The Polyester segment is also set to grow at 2.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $275.6 Billion in 2024, and China, forecasted to grow at an impressive 5.1% CAGR to reach $269.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Textiles Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Textiles Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Textiles Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Asahi Kasei Fibers Corporation, B.C. Corporation, Beaulieu International Group, China Textile (Shenzhen) Co. Ltd, Honeywell International and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Textiles market report include:

- Asahi Kasei Fibers Corporation

- B.C. Corporation

- Beaulieu International Group

- China Textile (Shenzhen) Co. Ltd

- Honeywell International

- Inditex SA

- Indorama Corporation Pte Ltd

- INVISTA

- Mohawk Industries

- Nisshinbo Holdings Inc.

- Shandong Jining Woolen Textile Co. Ltd

- Shandong Weiqiao Pioneering Group Company Limited

- Sinopec Yizheng Chemical Fiber Company.

- Toray Industries Inc

- Weiqiao Textile Company Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Asahi Kasei Fibers Corporation

- B.C. Corporation

- Beaulieu International Group

- China Textile (Shenzhen) Co. Ltd

- Honeywell International

- Inditex SA

- Indorama Corporation Pte Ltd

- INVISTA

- Mohawk Industries

- Nisshinbo Holdings Inc.

- Shandong Jining Woolen Textile Co. Ltd

- Shandong Weiqiao Pioneering Group Company Limited

- Sinopec Yizheng Chemical Fiber Company.

- Toray Industries Inc

- Weiqiao Textile Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

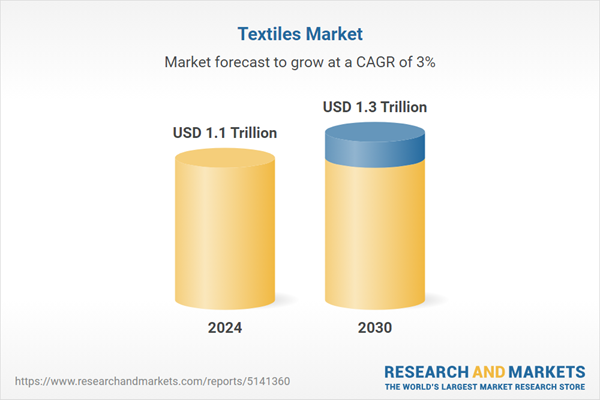

| Estimated Market Value ( USD | $ 1.1 Trillion |

| Forecasted Market Value ( USD | $ 1.3 Trillion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |