Global Reclosable Films Market - Key Trends & Drivers Summarized

What Are Reclosable Films and Why Are They Transforming the Packaging Industry?

Reclosable films are specialized packaging materials designed to provide consumers with the convenience of opening and resealing a package multiple times without compromising the freshness, quality, or integrity of the product inside. Typically made from a combination of plastic resins such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), these films feature innovative closure mechanisms like pressure-sensitive adhesives, zipper seals, or hook-and-loop closures. Reclosable films are widely used in a variety of packaging applications, including food and beverages, pharmaceuticals, personal care products, and household goods. Their primary advantage is the ability to offer both protection and easy accessibility, enabling consumers to reseal a package after each use, thus extending the product's shelf life and reducing food waste. This capability is particularly valued in the food industry, where maintaining freshness is critical to consumer satisfaction. Over the past decade, the adoption of reclosable films has surged as manufacturers seek to enhance product usability and cater to the growing demand for convenience-oriented packaging solutions.The increasing consumer preference for packaging that supports on-the-go lifestyles has been a significant driver of growth for the reclosable films market. Today's consumers are looking for packaging that not only preserves product quality but also fits seamlessly into their busy routines. Reclosable films meet these needs by allowing consumers to open and reseal packages easily, reducing spillage and ensuring that products remain protected even after multiple openings. This convenience factor has made reclosable films popular across several categories, from fresh produce and dairy products to snacks and frozen foods. Additionally, advancements in material science and packaging technology have enabled the development of high-barrier reclosable films that provide superior protection against moisture, oxygen, and contaminants, making them suitable for a broader range of applications. As consumer demand for flexible and resealable packaging continues to rise, the reclosable films market is poised to expand further, driven by innovation in closure mechanisms and growing adoption across diverse industries.

How Are Technological Innovations Shaping The Future Of Reclosable Films?

Technological advancements have significantly influenced the design and performance of reclosable films, enabling manufacturers to develop more functional, sustainable, and aesthetically pleasing packaging solutions. One of the most notable innovations in this field is the integration of multi-layer film structures with reclosable features. By combining different polymer layers, manufacturers can create films that offer high barrier properties, excellent printability, and robust resealability - all within a single material. This has been particularly beneficial for applications that require extended shelf life, such as packaged meats, cheeses, and bakery products. Multi-layer films with built-in reclosure systems like peel-and-reseal labels or zippered closures not only maintain product freshness but also enhance the visual appeal of the packaging, making it more attractive to consumers. Additionally, advancements in adhesive and sealant technologies have improved the ease of opening and resealing, ensuring that the reclosable feature functions consistently throughout the product's lifecycle.Another major trend in the reclosable films market is the shift towards sustainability and eco-friendly packaging solutions. With growing environmental concerns and increased regulatory pressure, manufacturers are exploring new materials and technologies to develop recyclable and compostable reclosable films. For instance, the use of mono-material films - composed of a single type of polymer - enables easier recycling without compromising on performance. Manufacturers are also experimenting with biodegradable adhesives and renewable resins derived from plant-based sources to reduce the environmental footprint of their products. The development of these sustainable reclosable films is being driven by consumer demand for packaging that aligns with their environmental values, as well as by corporate commitments to reduce plastic waste. Innovations in digital printing and laser scoring technologies are further enhancing the functionality of reclosable films, allowing for precise control over the opening mechanism and enabling customization based on specific product needs. As these technologies continue to evolve, they are expected to set new standards for reclosable film performance, sustainability, and versatility in the packaging industry.

What Factors Are Driving The Adoption Of Reclosable Films Across Different Industries?

The adoption of reclosable films is being propelled by a variety of industry-specific factors, ranging from changing consumer preferences to evolving packaging regulations and technological advancements. In the food and beverage industry, for instance, the growing focus on reducing food waste and enhancing product freshness has made reclosable films a preferred choice for packaging applications. Products like snacks, deli meats, and cheeses, which are often consumed in multiple sittings, benefit greatly from reclosable packaging that maintains quality and extends shelf life. As consumers become more conscious of food waste, they are increasingly opting for packaging solutions that allow them to reseal and store products conveniently, driving demand for reclosable films. Moreover, reclosable packaging is playing a crucial role in the expansion of e-commerce and online grocery shopping. With more consumers purchasing food and household items online, there is a need for packaging that can withstand the rigors of shipping while providing easy access and reclosure functionality for end-users. This trend is pushing manufacturers to develop reclosable films that are both durable and user-friendly, further boosting market adoption.In the pharmaceutical and personal care industries, the demand for reclosable films is being driven by the need for tamper-evident and child-resistant packaging solutions. Medications, supplements, and personal care products such as lotions or creams often require packaging that provides secure reclosure to prevent contamination and preserve product integrity. Reclosable films with advanced closure mechanisms, such as zippered or peel-and-reseal options, offer an ideal balance of security and accessibility, making them well-suited for these applications. Regulatory requirements mandating the use of child-resistant packaging for certain over-the-counter medications and hazardous household products are also contributing to the increased adoption of reclosable films. Additionally, the trend towards smaller, single-serve packaging in the food, beverage, and personal care sectors is creating new opportunities for reclosable films, as manufacturers seek packaging solutions that enhance convenience without sacrificing product protection. These factors, combined with innovations in material science and closure technology, are driving the widespread use of reclosable films across diverse industries.

What Is Driving The Growth Of The Global Reclosable Films Market?

The growth in the global Reclosable Films market is driven by several factors, including rising consumer demand for convenience, increasing focus on food safety, and the shift towards sustainable packaging solutions. One of the primary growth drivers is the evolving consumer lifestyle, characterized by a preference for easy-to-use, resealable packaging that supports on-the-go consumption and portion control. As more consumers prioritize convenience and functionality in packaging, there is a growing demand for reclosable films that enable multiple openings and resealings without compromising product quality. This demand is particularly strong in the food and beverage sector, where reclosable films are being used extensively for snacks, ready-to-eat meals, and fresh produce packaging. Another critical driver is the increasing emphasis on food safety and hygiene, especially in the wake of the COVID-19 pandemic. Reclosable films provide an effective barrier against contaminants and allow consumers to store products safely after initial opening, addressing the heightened focus on maintaining food hygiene and reducing waste.The market is also being driven by the growing trend towards sustainable packaging. With rising environmental concerns and the push for circular economy models, both consumers and manufacturers are seeking packaging solutions that are environmentally friendly and align with sustainable practices. Reclosable films made from recyclable materials, mono-material structures, and biodegradable components are gaining traction as companies strive to reduce their environmental footprint. Additionally, the development of innovative reclosable mechanisms such as pressure-sensitive adhesives and reclosable zippers that can be incorporated into flexible packaging is creating new growth opportunities in the market. These advancements enable manufacturers to offer high-performance reclosable films that cater to the sustainability preferences of eco-conscious consumers while maintaining the functional benefits of traditional reclosable packaging. As these factors continue to shape consumer behavior and industry practices, the global Reclosable Films market is expected to witness robust growth, supported by a strong emphasis on convenience, sustainability, and enhanced product protection.

Report Scope

The report analyzes the Reclosable Films market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Packaging Type (Trays, Pouches & Bags, Cups); Material (Polypropylene (PP), Polyethylene (PE), Polyethylene Terephthalate (PET), Pressure Sensitive Adhesives (PSA), Other Materials); Thickness (Below 100 Microns, 100 - 200 Microns, Above 200 Microns); End-Use (Food & Beverage, Personal Care & Home Care, Pharmaceuticals, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Trays segment, which is expected to reach US$105.3 Million by 2030 with a CAGR of a 6.2%. The Pouches & Bags segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $49.3 Million in 2024, and China, forecasted to grow at an impressive 9.6% CAGR to reach $62.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Reclosable Films Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Reclosable Films Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Reclosable Films Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

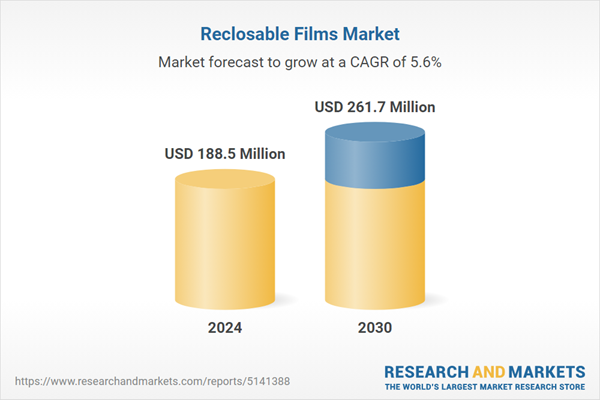

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as HFM Packaging, Ltd., Industria Termoplastica Pavese SpA (ITP), Korozo Group, Mitsui Chemicals, Inc., Parkside Flexibles Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Reclosable Films market report include:

- HFM Packaging, Ltd.

- Industria Termoplastica Pavese SpA (ITP)

- Korozo Group

- Mitsui Chemicals, Inc.

- Parkside Flexibles Ltd.

- Plastopil Hazorea Co., Ltd.

- Schur Flexibles Holding GesmbH

- Sealed Air Corporation

- Stratex

- SuDPACK Verpackungen GmbH & Co. KG

- TCL Packaging

- Termoplast Srl

- Winpak Ltd.

- Bemis Co., Inc.

- Berry Global Group, Inc.

- Buergofol GmbH

- Coveris Holdings SA

- Dow, Inc.

- DuPont de Nemours, Inc.

- Estiko-Plastar AS (Estonia)

- Folian GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- HFM Packaging, Ltd.

- Industria Termoplastica Pavese SpA (ITP)

- Korozo Group

- Mitsui Chemicals, Inc.

- Parkside Flexibles Ltd.

- Plastopil Hazorea Co., Ltd.

- Schur Flexibles Holding GesmbH

- Sealed Air Corporation

- Stratex

- SuDPACK Verpackungen GmbH & Co. KG

- TCL Packaging

- Termoplast Srl

- Winpak Ltd.

- Bemis Co., Inc.

- Berry Global Group, Inc.

- Buergofol GmbH

- Coveris Holdings SA

- Dow, Inc.

- DuPont de Nemours, Inc.

- Estiko-Plastar AS (Estonia)

- Folian GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 188.5 Million |

| Forecasted Market Value ( USD | $ 261.7 Million |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |