Global Physiotherapy Devices Market - Key Trends & Drivers Summarized

Why Are Physiotherapy Devices Gaining Prominence as Essential Tools for Rehabilitation and Pain Management?

Physiotherapy devices are gaining prominence as essential tools for rehabilitation and pain management due to their effectiveness in restoring mobility, enhancing physical function, and alleviating pain in patients suffering from musculoskeletal disorders, neurological conditions, and sports injuries. Physiotherapy, or physical therapy, involves various treatment modalities such as exercise therapy, manual therapy, and the use of specialized devices to promote healing, improve movement, and prevent future injuries. Physiotherapy devices, including electrotherapy equipment, ultrasound therapy devices, laser therapy units, and therapeutic exercise machines, play a critical role in facilitating the rehabilitation process by accelerating recovery, reducing pain, and restoring functionality in patients with physical impairments.The increasing prevalence of chronic conditions such as arthritis, osteoporosis, and lower back pain, combined with the rising incidence of neurological disorders such as stroke and Parkinson's disease, is driving demand for physiotherapy devices. These devices are also widely used in sports medicine to treat injuries such as ligament tears, sprains, and muscle strains, making them indispensable in sports rehabilitation settings. The growing awareness of the benefits of physiotherapy in managing pain and improving quality of life is encouraging more patients to seek physiotherapy services, further boosting the demand for advanced physiotherapy devices. As the global population ages and the prevalence of chronic diseases continues to rise, the need for effective physiotherapy solutions is expected to increase significantly.

How Are Technological Advancements Transforming the Physiotherapy Devices Market?

Technological advancements are transforming the physiotherapy devices market by enabling the development of more sophisticated, user-friendly, and effective devices that cater to a broad spectrum of therapeutic needs. One of the most significant innovations in this space is the use of robotics and wearable technologies in physiotherapy devices. Robotic rehabilitation devices, such as robotic exoskeletons and assistive robots, are being used to support patients with limited mobility in regaining movement and performing rehabilitation exercises. These devices provide precise and controlled assistance during movement therapy, enabling patients to perform exercises with greater intensity and accuracy. Robotic devices are particularly beneficial for patients recovering from stroke or spinal cord injuries, as they facilitate repetitive and task-specific training, which is essential for neural recovery and motor function improvement.The integration of wearable sensors and motion-tracking technologies is also revolutionizing the physiotherapy landscape. Wearable devices equipped with accelerometers, gyroscopes, and pressure sensors are being used to monitor patients' movements in real-time, track rehabilitation progress, and provide biofeedback during exercise sessions. These devices enable physiotherapists to assess a patient's range of motion, muscle activity, and gait patterns, allowing for more personalized and data-driven treatment plans. The use of biofeedback helps patients perform exercises correctly and encourages active participation in their rehabilitation process. The adoption of wearable technology in physiotherapy is enhancing patient engagement, improving adherence to exercise regimens, and supporting more effective rehabilitation outcomes.

Another transformative trend is the development of portable and home-use physiotherapy devices, which are making therapy more accessible and convenient for patients. Portable devices such as handheld ultrasound units, electrical muscle stimulators, and compact laser therapy devices allow patients to receive treatment in the comfort of their homes, reducing the need for frequent clinic visits. These devices are designed to be user-friendly, with intuitive interfaces and pre-set treatment protocols, enabling patients to manage their therapy independently or under remote guidance from a healthcare professional. The availability of home-use devices is particularly beneficial for patients with chronic conditions or mobility limitations, as it enables continuous therapy and supports long-term management of pain and disability.

The increasing use of digital platforms and telehealth solutions in physiotherapy is further transforming the market. Tele-physiotherapy platforms allow patients to connect with physiotherapists remotely, receive guided exercise sessions, and access educational content on managing their conditions. These platforms often incorporate virtual reality (VR) and augmented reality (AR) technologies to create immersive rehabilitation environments that motivate patients and make therapy sessions more engaging. VR-based rehabilitation tools are being used to treat conditions such as chronic pain and post-stroke motor impairment by providing interactive and stimulating exercise experiences. The use of digital and telehealth technologies is enhancing access to physiotherapy services, supporting patient adherence, and enabling continuous monitoring of rehabilitation progress.

Furthermore, advancements in electrotherapy and ultrasound therapy are improving the efficacy of physiotherapy treatments. Modern electrotherapy devices, such as transcutaneous electrical nerve stimulation (TENS) units and neuromuscular electrical stimulation (NMES) devices, offer customizable treatment parameters, ensuring that therapy is tailored to the specific needs of each patient. Ultrasound therapy devices are being designed with enhanced frequency control and ergonomic applicators, providing deeper penetration of therapeutic ultrasound waves and more effective tissue healing. These technological advancements are making physiotherapy devices more effective, versatile, and aligned with the diverse therapeutic needs of patients across various clinical settings.

What Role Do Market Dynamics and Industry Trends Play in Shaping the Adoption of Physiotherapy Devices?

Market dynamics and industry trends are playing a pivotal role in shaping the adoption of physiotherapy devices as healthcare providers and patients respond to changing healthcare needs, demographic shifts, and evolving treatment paradigms. The increasing prevalence of chronic musculoskeletal and neurological disorders, driven by factors such as aging populations, sedentary lifestyles, and rising obesity rates, is a key driver of demand for physiotherapy devices. Chronic conditions such as osteoarthritis, rheumatoid arthritis, and lower back pain are major causes of disability and reduced quality of life, prompting patients to seek non-pharmacological and non-surgical interventions such as physiotherapy to manage pain and improve physical function. Physiotherapy devices provide an effective means of delivering targeted therapy that helps alleviate pain, reduce inflammation, and enhance mobility, making them essential tools in the management of chronic conditions.The emphasis on early intervention and preventive care is another trend influencing the adoption of physiotherapy devices. Healthcare providers are increasingly focusing on preventive strategies to reduce the burden of chronic diseases and improve long-term health outcomes. Physiotherapy plays a crucial role in preventing the progression of conditions such as joint degeneration, muscle weakness, and postural abnormalities. The use of physiotherapy devices in early intervention programs helps prevent the need for invasive treatments such as surgery and supports faster recovery from injuries. The growing awareness of the benefits of physiotherapy in preventing disability and promoting healthy aging is driving the adoption of these devices in both clinical and home settings.

The increasing investment in sports and fitness is also contributing to the growth of the physiotherapy devices market. The rise in sports participation, coupled with the growing focus on fitness and wellness, is leading to a higher incidence of sports-related injuries such as ligament tears, tendonitis, and muscle strains. Physiotherapy devices are widely used in sports rehabilitation to promote tissue healing, reduce pain, and restore function. The adoption of advanced physiotherapy equipment in sports medicine clinics, rehabilitation centers, and fitness facilities is supporting the recovery and performance optimization of athletes and fitness enthusiasts. The use of physiotherapy devices in sports rehabilitation is enhancing the effectiveness of injury management and supporting faster return-to-sport outcomes.

Moreover, the trend towards home-based and remote physiotherapy is shaping the adoption of physiotherapy devices. The COVID-19 pandemic has accelerated the shift towards home-based healthcare, as patients seek to minimize exposure to healthcare settings and continue their rehabilitation from home. The demand for portable, easy-to-use physiotherapy devices that enable patients to perform exercises and receive treatment at home has increased significantly. Tele-physiotherapy solutions that support remote consultations and monitoring are also gaining popularity, allowing physiotherapists to guide patients through exercises and track their progress virtually. The focus on home-based care and remote rehabilitation is driving the adoption of physiotherapy devices that offer flexibility, convenience, and continuity of care.

The growing emphasis on evidence-based practice and the integration of physiotherapy devices into clinical guidelines is further influencing market dynamics. Clinical guidelines for the management of conditions such as stroke, osteoarthritis, and chronic pain increasingly recommend the use of physiotherapy devices as part of a comprehensive rehabilitation program. The inclusion of these devices in treatment protocols is supporting their widespread adoption in clinical practice. Healthcare providers are recognizing the value of physiotherapy devices in achieving better patient outcomes, reducing healthcare costs, and enhancing patient satisfaction. As the role of physiotherapy in healthcare continues to expand, the demand for advanced physiotherapy devices is expected to grow.

What Factors Are Driving the Growth of the Global Physiotherapy Devices Market?

The growth in the global physiotherapy devices market is driven by several factors, including the rising prevalence of chronic diseases and injuries, the increasing adoption of non-invasive therapies, and the expanding geriatric population. One of the primary growth drivers is the growing incidence of musculoskeletal disorders, such as arthritis, lower back pain, and osteoporosis, which are major causes of disability and reduced quality of life. Physiotherapy devices play a critical role in managing these conditions by providing targeted pain relief, promoting tissue healing, and restoring physical function. The rising prevalence of chronic pain and disability is creating a strong demand for physiotherapy devices that support effective management and rehabilitation.The increasing adoption of non-invasive and non-pharmacological therapies is another key factor contributing to market growth. Many patients and healthcare providers are seeking alternatives to surgery and medication for managing chronic conditions and injuries. Physiotherapy devices, such as ultrasound therapy units, electrotherapy devices, and laser therapy equipment, offer effective treatment options that are less invasive and associated with fewer side effects compared to pharmacological and surgical interventions. The growing preference for non-invasive therapies is driving the adoption of physiotherapy devices across various healthcare settings, including hospitals, rehabilitation centers, and home care.

The expanding geriatric population is also supporting the growth of the physiotherapy devices market. The aging population is more susceptible to conditions such as osteoarthritis, osteoporosis, and neurological disorders, which require long-term management and rehabilitation. Physiotherapy plays a crucial role in maintaining mobility, preventing falls, and improving quality of life in elderly patients. The use of physiotherapy devices in geriatric care helps alleviate pain, strengthen muscles, and enhance balance and coordination. As the global population ages, the demand for physiotherapy devices that support the health and well-being of elderly patients is expected to increase significantly.

Moreover, the increasing investment in healthcare infrastructure and rehabilitation services is contributing to market growth. Many countries are expanding their healthcare facilities and rehabilitation centers to meet the growing demand for physical therapy services. The development of specialized rehabilitation centers, sports medicine clinics, and wellness centers is creating new opportunities for the deployment of advanced physiotherapy devices. The integration of physiotherapy services into hospitals, outpatient clinics, and community health centers is further enhancing access to these therapies, driving the adoption of physiotherapy devices.

Additionally, the rising awareness of the benefits of physiotherapy in managing chronic conditions and promoting overall health is influencing market growth. Public health initiatives and educational campaigns are increasing awareness of the role of physiotherapy in preventing and managing disability, reducing pain, and improving functional outcomes. The increasing emphasis on preventive care and healthy aging is encouraging more patients to seek physiotherapy services, supporting the growth of the physiotherapy devices market.

Furthermore, the impact of the COVID-19 pandemic has highlighted the importance of rehabilitation services in managing post-COVID conditions such as fatigue, respiratory issues, and muscle weakness. Physiotherapy has emerged as a key component of post-COVID rehabilitation, helping patients recover from the physical and functional impairments associated with the virus. The increased focus on rehabilitation during and after the pandemic has raised awareness of the value of physiotherapy and accelerated the adoption of physiotherapy devices. As these factors converge, the global physiotherapy devices market is poised for robust growth, driven by technological advancements, expanding applications, and the increasing emphasis on non-invasive therapies and rehabilitation across various healthcare settings.

Report Scope

The report analyzes the Physiotherapy Devices market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Musculoskeletal, Neurology, Cardiovascular, Other Applications); End-Use (Hospital, Physiotherapy Clinic, Rehabilitation Center, Other End-Uses); Product Type (Equipment, Kit, Accessories).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

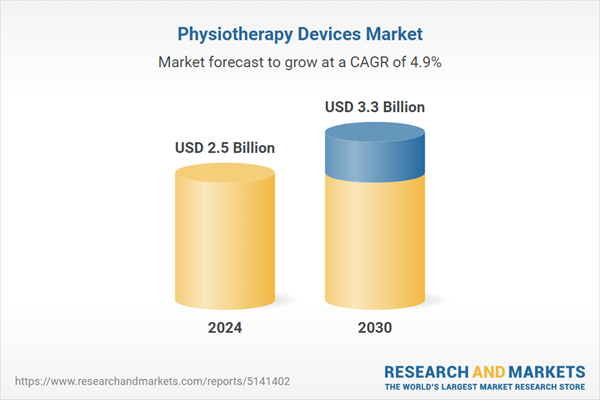

- Market Growth: Understand the significant growth trajectory of the Physiotherapy Equipment segment, which is expected to reach US$2.2 Billion by 2030 with a CAGR of a 4.7%. The Physiotherapy Kit segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $658.2 Million in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $729.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Physiotherapy Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Physiotherapy Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Physiotherapy Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A. Algeo Ltd., BTL Medical Technologies Pty Ltd., DJO Global, Inc., Dynatronics Corporation, Ems Physio Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 31 companies featured in this Physiotherapy Devices market report include:

- A. Algeo Ltd.

- BTL Medical Technologies Pty Ltd.

- DJO Global, Inc.

- Dynatronics Corporation

- Ems Physio Ltd.

- Enraf-Nonius BV

- HMS Medical Systems

- Ossur

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A. Algeo Ltd.

- BTL Medical Technologies Pty Ltd.

- DJO Global, Inc.

- Dynatronics Corporation

- Ems Physio Ltd.

- Enraf-Nonius BV

- HMS Medical Systems

- Ossur

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.5 Billion |

| Forecasted Market Value ( USD | $ 3.3 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |