Global Phenolic Resins Market - Key Trends & Drivers Summarized

Why Are Phenolic Resins Gaining Prominence Across a Wide Range of Industrial Applications?

Phenolic resins are gaining prominence across a wide range of industrial applications due to their excellent mechanical properties, high thermal stability, and superior resistance to chemicals, fire, and moisture. Phenolic resins, also known as phenol-formaldehyde resins, are synthetic polymers derived from the reaction of phenol with formaldehyde. These resins are used in a variety of industries, including automotive, construction, electronics, and aerospace, for their ability to provide strong adhesive bonds, dimensional stability, and enhanced durability under harsh environmental conditions. They are widely utilized as binding agents in composites, coatings, laminates, and adhesives, making them indispensable materials for manufacturing high-performance products.In the automotive industry, phenolic resins are used in brake pads, clutch plates, and friction materials due to their excellent heat resistance and wear properties, which ensure the reliable performance of vehicle components under high-temperature conditions. In the construction sector, phenolic resins are a key component in insulation panels, wood adhesives, and laminates, providing structural integrity, fire resistance, and moisture protection. Their use in electrical and electronic applications, such as printed circuit boards (PCBs) and electrical insulation, is driven by their high dielectric strength and resistance to electrical arcing. As industries continue to seek materials that offer both performance and reliability, the demand for phenolic resins in diverse applications is expected to grow significantly.

How Are Technological Advancements Transforming the Phenolic Resins Market?

Technological advancements are transforming the phenolic resins market by enabling the development of new formulations and production methods that enhance the performance, sustainability, and versatility of these materials. One of the most significant innovations in this space is the development of high-performance phenolic resins with improved mechanical properties, thermal stability, and flame retardancy. These advanced resins are being used to create composite materials with superior strength-to-weight ratios, making them ideal for use in the automotive and aerospace industries. For example, phenolic resin-based composites are being used to manufacture lightweight structural components that reduce the overall weight of vehicles and aircraft, leading to improved fuel efficiency and reduced emissions.Another transformative trend is the shift towards eco-friendly and low-emission phenolic resins. Traditional phenolic resins are synthesized using formaldehyde, a volatile organic compound (VOC) that poses environmental and health concerns. In response, manufacturers are developing low-VOC and formaldehyde-free phenolic resins that offer similar performance characteristics while minimizing environmental impact. The use of bio-based phenolic resins, derived from renewable raw materials such as lignin and tannin, is gaining traction as industries seek to reduce their reliance on petrochemical-based products and promote sustainability. These bio-based resins provide an environmentally friendly alternative to conventional phenolic resins and support the industry's efforts to adopt greener production practices.

The adoption of advanced curing technologies, such as microwave curing, ultraviolet (UV) curing, and electron beam curing, is further transforming the phenolic resins market by enabling faster production times, lower energy consumption, and enhanced product quality. Microwave curing, for instance, offers the advantage of uniform heat distribution and shorter curing cycles, reducing production costs and improving throughput. UV curing and electron beam curing technologies are being used to produce phenolic resin-based coatings and adhesives with superior surface properties and chemical resistance. These advanced curing methods are supporting the development of high-performance phenolic resin products for specialized applications, such as coatings for corrosion protection and adhesives for high-strength bonding.

Furthermore, the increasing use of nanotechnology in the development of phenolic resins is enhancing their properties and expanding their application scope. Nanomaterials such as carbon nanotubes, nanoclays, and graphene are being incorporated into phenolic resin formulations to improve mechanical strength, thermal conductivity, and flame retardancy. Nanocomposite phenolic resins are being used in the production of lightweight and high-strength materials for automotive, aerospace, and electronics applications. The ability to tailor the properties of phenolic resins at the nanoscale is enabling the creation of innovative products that meet the specific performance requirements of various industries. As these technological advancements continue to evolve, they are making phenolic resins more versatile, sustainable, and aligned with the needs of modern industrial applications.

What Role Do Environmental Regulations and Sustainability Goals Play in Shaping the Demand for Phenolic Resins?

Environmental regulations and sustainability goals play a pivotal role in shaping the demand for phenolic resins as industries strive to reduce their environmental impact and comply with stringent regulatory standards. The use of formaldehyde, a key component in traditional phenolic resins, has come under scrutiny due to its classification as a probable human carcinogen and its contribution to indoor air pollution through off-gassing. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have implemented strict limits on formaldehyde emissions from building materials, adhesives, and coatings. Compliance with these regulations is driving manufacturers to develop low-emission and formaldehyde-free phenolic resins that meet environmental standards while maintaining high performance.The growing emphasis on sustainability and the circular economy is also influencing the demand for phenolic resins that are derived from renewable or recycled sources. Bio-based phenolic resins, produced from natural raw materials such as lignin, tannin, and cashew nut shell liquid, are gaining popularity as they offer a sustainable alternative to petrochemical-based resins. These bio-based resins not only reduce dependency on fossil fuels but also lower the carbon footprint of the final product. The use of recycled phenolic resins, produced from reclaimed materials, is further supporting the industry's sustainability goals by promoting resource efficiency and reducing waste. As industries and consumers become more conscious of environmental issues, the demand for sustainable phenolic resins is expected to increase significantly.

The implementation of green building certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) is also driving demand for eco-friendly phenolic resins in the construction sector. These certifications require the use of low-emission materials that contribute to healthier indoor environments and support sustainable building practices. Phenolic resins used in wood adhesives, insulation panels, and coatings must comply with VOC emission limits to qualify for these certifications, creating a strong demand for low-VOC phenolic resin products. The focus on sustainable construction and green building initiatives is expected to boost the adoption of phenolic resins that meet these environmental criteria.

Additionally, the growing trend towards lightweight materials and energy-efficient solutions in the automotive and aerospace industries is influencing the demand for phenolic resins that offer high performance with reduced environmental impact. Phenolic resin-based composites are being used to produce lightweight structural components that reduce fuel consumption and emissions, supporting the industry's efforts to meet regulatory standards and sustainability targets. The development of bio-based phenolic resins with comparable properties to conventional resins is enabling manufacturers to create environmentally friendly composite materials that meet the stringent performance requirements of these industries. As regulatory pressures and sustainability goals continue to shape the future of material selection, the demand for eco-friendly and high-performance phenolic resins is expected to grow.

What Factors Are Driving the Growth of the Global Phenolic Resins Market?

The growth in the global phenolic resins market is driven by several factors, including the expanding applications of phenolic resins in various end-use industries, the rising demand for high-performance and durable materials, and the ongoing development of eco-friendly and advanced resin formulations. One of the primary growth drivers is the increasing use of phenolic resins in the automotive and transportation sectors. Phenolic resins are widely used in the production of brake linings, clutch facings, and friction materials due to their excellent heat resistance, wear resistance, and mechanical strength. The growing demand for lightweight and high-performance materials in the automotive industry, driven by the need to improve fuel efficiency and reduce emissions, is boosting the use of phenolic resin-based composites in vehicle components.The expansion of the construction industry is another key factor contributing to market growth. Phenolic resins are used in wood adhesives, laminates, and insulation materials due to their strong bonding properties, fire resistance, and moisture stability. The rising demand for durable and fire-resistant building materials is driving the adoption of phenolic resins in both residential and commercial construction projects. The increasing focus on fire safety regulations and building codes that mandate the use of fire-resistant materials is further supporting the growth of the phenolic resins market in the construction sector. The use of phenolic resins in insulation panels and laminates that contribute to energy-efficient building solutions is also boosting demand.

The growing use of phenolic resins in electrical and electronic applications is further supporting market growth. Phenolic resins are used as binders in electrical laminates and as insulating materials in transformers and electrical appliances due to their excellent dielectric properties and resistance to electrical arcing. The expansion of the electronics industry, driven by the increasing demand for consumer electronics, industrial automation, and renewable energy technologies, is creating new opportunities for phenolic resins. The use of phenolic resin-based composites in printed circuit boards (PCBs) and electrical components is expected to increase as the electronics industry continues to grow and evolve.

Moreover, the development of advanced phenolic resin formulations with enhanced properties is driving the growth of the market. Manufacturers are investing in research and development (R&D) to create phenolic resins that offer superior thermal stability, mechanical strength, and chemical resistance. The development of specialty phenolic resins that meet the specific requirements of industries such as aerospace, marine, and oil & gas is expanding the application scope of these materials. The use of nanotechnology and hybrid materials in phenolic resin formulations is enabling the creation of innovative products with improved performance characteristics, supporting the growth of the market.

Additionally, the increasing adoption of phenolic resins in the production of engineered wood products, such as oriented strand board (OSB), plywood, and particleboard, is contributing to market growth. Phenolic resins provide strong adhesive bonds and moisture resistance, making them ideal for use in structural wood products. The growth of the furniture and construction industries is driving demand for engineered wood products, supporting the expansion of the phenolic resins market. The development of phenolic resins that meet environmental standards for low formaldehyde emissions is further enhancing their appeal in the engineered wood industry.

Furthermore, the impact of the COVID-19 pandemic has highlighted the importance of phenolic resins in critical applications such as healthcare, safety equipment, and building materials. The increased demand for personal protective equipment (PPE), including face shields and protective barriers, has boosted the use of phenolic resin-based materials due to their durability and chemical resistance. The need for fire-resistant building materials and insulation panels in healthcare facilities and public infrastructure projects is also supporting demand. As industries recover from the impact of the pandemic and invest in infrastructure development and safety solutions, the demand for phenolic resins in these applications is expected to grow. As these factors converge, the global phenolic resins market is poised for robust growth, supported by technological advancements, expanding applications, and the increasing emphasis on sustainability and performance across various industries.

Report Scope

The report analyzes the Phenolic Resins market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Insulation, Paper Impegration, Wood Adhesives, Laminates, Molding, Other Applications); End-Use (Electrical & Electronics, Building & Construction, Furniture, Automotive, Other End-Uses); Product Type (Resol Resin, Novolac Resin, Other Types).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Resol Resin segment, which is expected to reach US$10.4 Billion by 2030 with a CAGR of a 5%. The Novolac Resin segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.2 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $4.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Phenolic Resins Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Phenolic Resins Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Phenolic Resins Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AICA Kogyo Co., Ltd, BASF SE, Chang Chun Plastics Co., Ltd., DIC Corporation, Fenolit d.d. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 31 companies featured in this Phenolic Resins market report include:

- AICA Kogyo Co., Ltd

- BASF SE

- Chang Chun Plastics Co., Ltd.

- DIC Corporation

- Fenolit d.d.

- Georgia-Pacific Chemicals LLC

- Hexion Inc.

- Hitachi Chemical Co., Ltd.

- Kolon Industries, Inc.

- Lerg SA

- Mansoura For Resins & Chemical Industries Co.

- Mitsui Chemicals, Inc.

- Red Avenue Group Co., Ltd.

- Saluc SA

- Shandong Laiwu Runda New Material Co., Ltd.

- Shengquan Group Co., Ltd.

- SI Group, Inc.

- Sprea Misr

- Sumitomo Bakelite Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AICA Kogyo Co., Ltd

- BASF SE

- Chang Chun Plastics Co., Ltd.

- DIC Corporation

- Fenolit d.d.

- Georgia-Pacific Chemicals LLC

- Hexion Inc.

- Hitachi Chemical Co., Ltd.

- Kolon Industries, Inc.

- Lerg SA

- Mansoura For Resins & Chemical Industries Co.

- Mitsui Chemicals, Inc.

- Red Avenue Group Co., Ltd.

- Saluc SA

- Shandong Laiwu Runda New Material Co., Ltd.

- Shengquan Group Co., Ltd.

- SI Group, Inc.

- Sprea Misr

- Sumitomo Bakelite Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

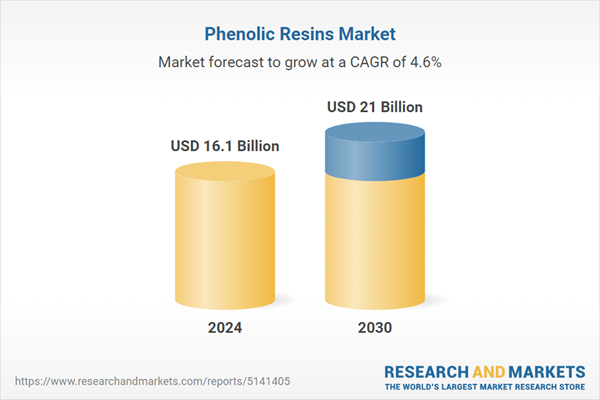

| Estimated Market Value ( USD | $ 16.1 Billion |

| Forecasted Market Value ( USD | $ 21 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |