Global Release Coatings Market - Key Trends and Drivers Summarized

Release Coatings: Enhancing Performance and Durability

Release coatings are critical in various industrial applications, serving as a protective layer that facilitates the easy separation of surfaces that need to avoid permanent bonding. These coatings are formulated using different methods to cater to diverse application needs and material compatibility. Among the primary formulations are solvent-less, solvent-based, and emulsions. Solvent-less release coatings are favored for their environmental benefits, as they eliminate the need for volatile organic compounds (VOCs), making them a more sustainable option. They are typically used in applications where rapid curing and high performance are required, such as in labels and medical applications. Solvent-based coatings, although effective and well-established, are increasingly scrutinized due to their environmental impact, primarily the emission of VOCs. They are still utilized where high resistance to temperature and chemicals is essential. Emulsions, on the other hand, offer a middle ground, combining the ease of application associated with solvent-based coatings and the lower environmental impact of solvent-less formulations. These are widely used in hygiene applications, where mild performance and safety are key considerations.The materials used in release coatings play a significant role in determining their effectiveness and suitability for specific applications. Silicone-based release coatings are the most common due to their excellent release properties, flexibility, and durability. They are particularly favored in high-performance applications, such as medical and hygiene products, where consistent performance over time is critical. Non-silicone release coatings, including those based on fluoropolymers, waxes, and certain acrylics, are also prevalent, especially where silicone contamination could be an issue, or where cost is a significant factor. Non-silicone coatings are often employed in packaging and food-related applications, as well as in situations where recyclability and environmental considerations are paramount.

What Technological Innovations Are Advancing the Release Coatings Market?

Technological innovations are playing a significant role in advancing the release coatings market, leading to the development of more durable, efficient, and environmentally friendly products. One major trend is the increasing use of fluoropolymer-based coatings, which offer superior non-stick properties, chemical resistance, and thermal stability compared to traditional coatings. These advanced materials are particularly well-suited for applications in the aerospace and automotive industries, where they enhance the performance of molds and tools used in high-temperature processes. Additionally, the development of UV-curable release coatings is gaining traction, as these products offer faster curing times, lower energy consumption, and reduced environmental impact. Innovations in nanotechnology are also contributing to the market by enabling the creation of coatings with enhanced durability, scratch resistance, and surface smoothness. These advancements are driving the adoption of release coatings in a wide range of industrial applications, supporting the demand for high-performance, sustainable solutions.What Are the Key Applications and Benefits of Release Coatings?

Applications of release coatings are broad and varied, encompassing industries such as labeling, tape manufacturing, hygiene products, and medical supplies. In the labeling industry, release coatings ensure that labels can be easily removed or repositioned without leaving residue, which is crucial for maintaining the aesthetics and integrity of the labeled surface. Tapes, particularly in industrial settings, rely on release coatings to prevent premature adhesion during storage and handling. In the hygiene sector, these coatings are used in products such as diapers and sanitary napkins, where they help maintain product integrity by preventing layers from sticking together. Medical applications include release liners for wound care products and surgical tapes, where non-adhesion is critical for patient comfort and product performance. Other applications include food packaging, automotive parts, and electronics, where specific release properties are required to meet stringent industry standards.What Factors Are Driving the Growth in the Release Coatings Market?

The growth in the release coatings market is driven by several factors, including the increasing demand for high-performance materials in the medical and hygiene industries, where silicone and non-silicone coatings provide essential functionalities. The push towards sustainability and environmental compliance is also accelerating the adoption of solvent-less and emulsion-based coatings, particularly in regions with stringent environmental regulations. Additionally, the expanding packaging and labeling sectors, fueled by e-commerce and consumer goods, are creating a surge in demand for reliable and efficient release coatings. Technological advancements in coating formulations and application methods are further enhancing the performance and versatility of release coatings, making them suitable for a wider range of applications. The growing focus on reducing waste and improving recyclability in end-use industries is also fostering innovation in non-silicone and water-based release coatings, catering to the needs of eco-conscious consumers and businesses. These factors collectively underscore the robust growth trajectory of the release coatings market, positioning it for significant expansion in the coming years.Report Scope

The report analyzes the Release Coatings market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Material (Silicone, Non-Silicone); Formulation (Solvent-Less, Solvent-Based, Emulsions); Application (Labels, Tapes, Hygiene, Medical, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Silicone Material segment, which is expected to reach US$146.9 Million by 2030 with a CAGR of 5.7%. The Non-Silicone Material segment is also set to grow at 4.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $50 Million in 2024, and China, forecasted to grow at an impressive 9% CAGR to reach $60.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Release Coatings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Release Coatings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Release Coatings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A-Line Products Corporation, E/M Coating Services, Hitac Adhesives and Coatings Inc., Maverix Solutions, Mayzo, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Release Coatings market report include:

- A-Line Products Corporation

- E/M Coating Services

- Hitac Adhesives and Coatings Inc.

- Maverix Solutions

- Mayzo, Inc.

- Momentive Performance Materials, Inc.

- OMNOVA Solutions, Inc.

- Rayven, Inc.

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A-Line Products Corporation

- E/M Coating Services

- Hitac Adhesives and Coatings Inc.

- Maverix Solutions

- Mayzo, Inc.

- Momentive Performance Materials, Inc.

- OMNOVA Solutions, Inc.

- Rayven, Inc.

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

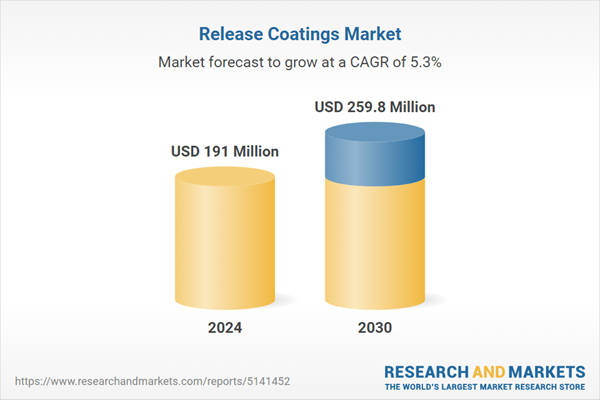

| Estimated Market Value ( USD | $ 191 Million |

| Forecasted Market Value ( USD | $ 259.8 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |