Global Continuous Glucose Monitoring Systems Market - Key Trends & Drivers Summarized

How Are Continuous Glucose Monitoring Systems Revolutionizing Diabetes Management?

Continuous Glucose Monitoring (CGM) systems are revolutionizing the management of diabetes by providing real-time insights into glucose levels, allowing for better glycemic control and more informed treatment decisions. Unlike traditional finger-prick methods, CGM devices continuously measure glucose levels through a sensor inserted under the skin, offering data that can be accessed via smartphones or dedicated readers. This technological advancement significantly enhances the ability to track blood glucose patterns and trends, enabling patients and healthcare providers to tailor treatment plans more effectively. The convenience and accuracy provided by CGM systems are especially crucial for patients with Type 1 diabetes, who require precise insulin dosing. Furthermore, the increasing prevalence of diabetes globally, driven by factors such as aging populations, sedentary lifestyles, and rising obesity rates, is amplifying the demand for these advanced monitoring systems.What Technological Innovations Are Shaping The Future Of CGM Devices?

The Continuous Glucose Monitoring systems market is being propelled by several technological innovations that are enhancing device accuracy, user experience, and data analytics capabilities. The development of smaller, more comfortable sensors that provide longer wear times and require fewer calibrations is significantly improving patient adherence and satisfaction. Next-generation CGM systems are integrating with insulin pumps, creating closed-loop systems or “artificial pancreas” setups that automate insulin delivery based on real-time glucose readings. Advances in Bluetooth technology and smartphone app integrations are allowing users to easily share their glucose data with caregivers and healthcare providers, promoting better diabetes management. Furthermore, predictive analytics and AI-based algorithms are being employed to forecast potential glucose level trends, providing alerts to prevent hyperglycemia or hypoglycemia. These technological advancements are not only enhancing the effectiveness of CGM systems but are also making diabetes management more proactive and personalized.How Are Regulatory Approvals And Reimbursement Policies Impacting The CGM Market?

Regulatory approvals and favorable reimbursement policies are crucial factors driving the expansion of the Continuous Glucose Monitoring systems market. In recent years, regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have fast-tracked approvals for new CGM devices, recognizing their potential to improve patient outcomes and reduce healthcare costs. These regulatory endorsements have instilled greater confidence among healthcare providers and patients regarding the safety and efficacy of CGM systems. Additionally, insurance companies and government healthcare programs in several countries are expanding their coverage for CGM devices, making them more accessible to a larger segment of the diabetic population. The increasing inclusion of CGM systems in health insurance reimbursement plans is a key factor enabling broader adoption and use, particularly among the elderly and those with Type 1 diabetes who require constant monitoring.What Factors Are Driving The Growth Of The Continuous Glucose Monitoring Systems Market?

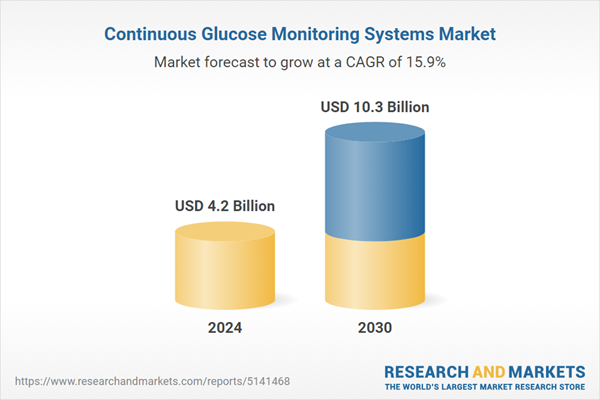

The growth in the Continuous Glucose Monitoring systems market is driven by several factors, including rising diabetes prevalence, technological advancements, and supportive regulatory and reimbursement frameworks. One of the key drivers is the increasing awareness among patients and healthcare providers about the benefits of real-time glucose monitoring for achieving better glycemic control. The growing adoption of CGM systems is also being fueled by their integration with digital health platforms and mobile applications, which offer enhanced user engagement and data-driven insights. Additionally, the shift toward value-based care in the healthcare industry is promoting the use of CGM systems as a means to reduce diabetes-related complications and overall healthcare costs. Further driving the market are strategic partnerships between CGM device manufacturers and digital health companies, which are expanding the capabilities of these devices through data analytics and artificial intelligence. These factors collectively contribute to the robust growth outlook for the CGM market worldwide.Report Scope

The report analyzes the Continuous Glucose Monitoring Systems market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Sensors, Transmitters & Receivers, Integrated Insulin Pumps); End-Use (Clinics & Diagnostic Centers, Home Healthcare, ICUs).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sensors Component segment, which is expected to reach US$5.4 Billion by 2030 with a CAGR of a 14.6%. The Transmitters & Receivers Component segment is also set to grow at 16.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 22.5% CAGR to reach $2.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Continuous Glucose Monitoring Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Continuous Glucose Monitoring Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Continuous Glucose Monitoring Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Biorasis, Carbometrics, Dexcom, Inc., GlySens, Inc., Medtronic PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 53 companies featured in this Continuous Glucose Monitoring Systems market report include:

- Biorasis

- Carbometrics

- Dexcom, Inc.

- GlySens, Inc.

- Medtronic PLC

- Metronom Health

- Nemaura Medical, Inc.

- PharmaSens

- Quin Technology

- Senseonics Holdings, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Biorasis

- Carbometrics

- Dexcom, Inc.

- GlySens, Inc.

- Medtronic PLC

- Metronom Health

- Nemaura Medical, Inc.

- PharmaSens

- Quin Technology

- Senseonics Holdings, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 202 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 10.3 Billion |

| Compound Annual Growth Rate | 15.9% |

| Regions Covered | Global |