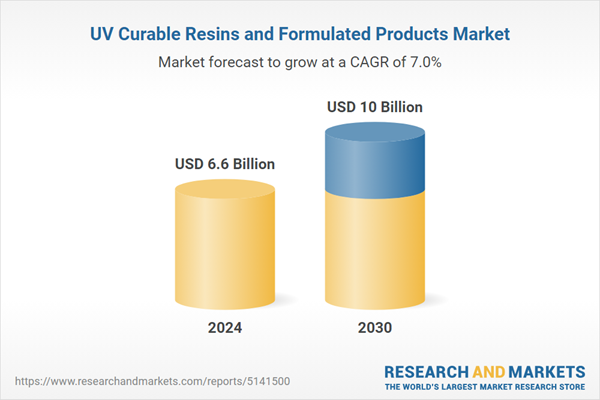

Global UV Curable Resins and Formulated Products Market - Key Trends & Drivers Summarized

Why Are UV Curable Resins Gaining Popularity Across Industries?

UV curable resins are rapidly gaining popularity across various industries due to their fast curing times, environmental benefits, and superior performance characteristics. These resins, which harden when exposed to ultraviolet (UV) light, are used in applications ranging from coatings and adhesives to inks and 3D printing materials. The ability of UV curable resins to cure almost instantly under UV light makes them ideal for high-speed production processes, significantly reducing manufacturing times and energy consumption compared to traditional curing methods. Additionally, UV curable resins are typically solvent-free, resulting in lower volatile organic compound (VOC) emissions and a reduced environmental impact. This combination of speed, efficiency, and eco-friendliness is driving their adoption in industries such as automotive, electronics, packaging, and medical devices, where there is a growing demand for high-performance materials that can be processed quickly and sustainably.How Are Technological Advancements Enhancing the Performance of UV Curable Resins?

Technological advancements are playing a critical role in enhancing the performance and versatility of UV curable resins, enabling their use in a wider range of applications. Innovations in resin formulation are leading to the development of UV curable resins with improved properties, such as higher chemical resistance, better adhesion to a variety of substrates, and greater flexibility. The introduction of dual-cure systems, which combine UV curing with thermal or moisture curing, is expanding the application possibilities of these resins, particularly in areas where traditional UV curing is challenging. Additionally, advances in photoinitiators - the compounds that trigger the curing process - are improving the efficiency and depth of cure, allowing for thicker and more complex parts to be cured quickly and effectively. These technological improvements are making UV curable resins more attractive to manufacturers looking for high-performance, environmentally friendly materials that can meet the demanding requirements of modern production processes.Why Are Manufacturers Embracing UV Curable Resins in Their Production Processes?

Manufacturers are increasingly embracing UV curable resins in their production processes due to the significant benefits they offer in terms of speed, cost savings, and environmental impact. The rapid curing times of UV curable resins enable manufacturers to increase production throughput, reduce energy consumption, and minimize work-in-progress inventory. This efficiency is particularly valuable in industries with high production volumes and tight timelines, such as automotive, electronics, and packaging. The low VOC emissions associated with UV curable resins also help manufacturers meet stringent environmental regulations and reduce their overall carbon footprint. Furthermore, the ability to achieve high-quality finishes with UV curable coatings and adhesives, along with their durability and resistance to environmental factors, makes them an attractive option for products that require long-lasting performance and aesthetic appeal. As sustainability and efficiency become increasingly important in manufacturing, the adoption of UV curable resins is expected to continue to grow.What Factors Are Driving the Growth in the UV Curable Resins and Formulated Products Market?

The growth in the UV Curable Resins and Formulated Products market is driven by several factors, including the increasing demand for environmentally friendly and high-performance materials, advancements in UV curing technology, and the expanding applications of UV curable resins across various industries. The growing emphasis on sustainability and the need to reduce VOC emissions are pushing manufacturers to adopt UV curable resins, which offer significant environmental benefits compared to traditional solvent-based resins. Technological advancements, such as the development of more efficient photoinitiators and dual-cure systems, are also driving market growth by expanding the range of applications and improving the performance of UV curable resins. Additionally, the increasing use of UV curable resins in emerging applications, such as 3D printing and medical devices, is further fueling market expansion as these industries continue to grow and evolve. The rising demand for fast-curing, high-quality materials in industries like automotive, electronics, and packaging is also contributing to the market`s growth, as manufacturers seek to improve production efficiency and meet the stringent performance requirements of modern products.SCOPE OF STUDY:

The report analyzes the UV Curable Resins and Formulated Products market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Composition (Oligomers, Monomers, Additives, Photoinitiators); Application (Coatings, Adhesives, 3D Printing, Overprint Varnishes, Printing Inks, Other Applications)

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oligomers segment, which is expected to reach US$3.4 Billion by 2030 with a CAGR of a 8.0%. The Monomers segment is also set to grow at 6.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 11.7% CAGR to reach $2.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global UV Curable Resins and Formulated Products Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global UV Curable Resins and Formulated Products Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global UV Curable Resins and Formulated Products Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alberdingk Boley GmbH, Arakawa Chemical Industries Ltd., BASF SE, CBC Co., Ltd., Covestro AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this UV Curable Resins and Formulated Products market report include:

- Alberdingk Boley GmbH

- Arakawa Chemical Industries Ltd.

- BASF SE

- CBC Co., Ltd.

- Covestro AG

- DIC Corporation

- D-MEC

- Double Bond Chemical Ind., Co., Ltd.

- Elementis Specialties, Inc.

- Hitachi Ltd.

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alberdingk Boley GmbH

- Arakawa Chemical Industries Ltd.

- BASF SE

- CBC Co., Ltd.

- Covestro AG

- DIC Corporation

- D-MEC

- Double Bond Chemical Ind., Co., Ltd.

- Elementis Specialties, Inc.

- Hitachi Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.6 Billion |

| Forecasted Market Value ( USD | $ 10 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |