Global Bonded Magnets Market - Key Trends & Drivers Summarized

Why Are Bonded Magnets Becoming Essential in Modern Industries?

Bonded magnets are becoming increasingly essential in modern industries due to their unique properties, such as high precision, flexibility in design, and ease of mass production. These magnets are used across various industries, including automotive, electronics, and healthcare, where they provide critical functionality in motors, sensors, and actuators. Unlike traditional magnets, bonded magnets can be molded into complex shapes and customized to meet specific performance requirements, making them ideal for high-tech applications. The growing demand for electric vehicles (EVs) and renewable energy technologies, which rely on efficient and lightweight magnetic components, is significantly driving the adoption of bonded magnets.How Are Technological Innovations Enhancing Bonded Magnet Production?

Technological advancements are revolutionizing the production of bonded magnets, improving their performance and expanding their applications. Innovations in materials, such as the development of rare-earth compounds and advanced polymer bonding techniques, are enhancing the magnetic properties of these magnets while reducing production costs. Additionally, the advent of 3D printing technology allows for the creation of complex, high-performance magnetic components with precise geometries, further increasing the versatility of bonded magnets. These technological breakthroughs are making bonded magnets more suitable for use in cutting-edge applications such as robotics, consumer electronics, and medical devices.What Role Do Sustainability and Efficiency Play in the Bonded Magnet Market?

Sustainability and efficiency are playing an increasingly important role in the bonded magnet market as industries strive to reduce their environmental impact. The use of recycled materials and eco-friendly production processes is gaining traction in magnet manufacturing, aligning with broader sustainability goals. In industries like automotive and renewable energy, where energy efficiency is paramount, bonded magnets are preferred for their lightweight and high-performance characteristics, which contribute to the overall efficiency of electric motors and generators. As sustainability becomes a key consideration for manufacturers and consumers alike, the demand for environmentally responsible magnetic materials is expected to rise.The Growth in the Bonded Magnets Market Is Driven by Several Factors

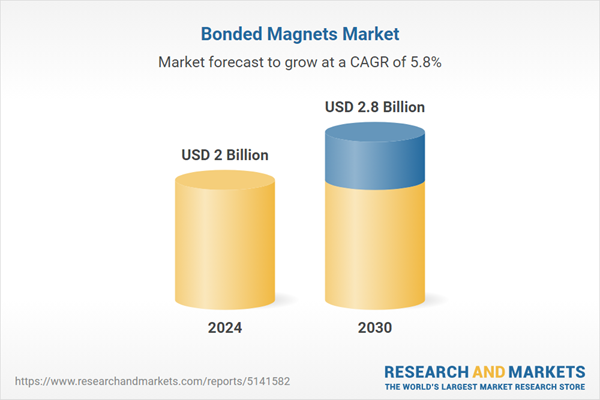

The growth in the bonded magnets market is driven by several factors, including the rising demand for electric vehicles, advancements in electronic devices, and the increasing focus on energy efficiency. The automotive industry's shift toward electrification is a major driver, as bonded magnets are critical components in EV motors and sensors. Additionally, the expanding consumer electronics market, with its need for compact, high-performance magnetic components, is contributing to the demand for bonded magnets. Technological advancements in material science and production techniques, along with the push for sustainable manufacturing processes, are also fueling market growth. As industries continue to innovate and prioritize efficiency, the bonded magnets market is poised for continued expansion.Report Scope

The report analyzes the Bonded Magnets market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Automotive, Electronics & Electrical, Industrial, Other Applications); Product (Rare Earth Bonded Magnets, Ferrite Bonded Magnets, Hybrid).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rare Earth Bonded Magnets segment, which is expected to reach US$1.3 Billion by 2030 with a CAGR of a 5.6%. The Ferrite Bonded Magnets segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $518.8 Million in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $632.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bonded Magnets Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bonded Magnets Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bonded Magnets Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alliance LLC, Allstar Magnetics, Arnold Magnetic Technologies, Daido Steel Co., Ltd., Dexter Magnetic Technologies, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Bonded Magnets market report include:

- Alliance LLC

- Allstar Magnetics

- Arnold Magnetic Technologies

- Daido Steel Co., Ltd.

- Dexter Magnetic Technologies, Inc.

- DMEGC Germany GmbH

- Engrenages Hpc Sarl

- KR TECH

- Magnequench International, LLC

- Ningbo Yunsheng Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alliance LLC

- Allstar Magnetics

- Arnold Magnetic Technologies

- Daido Steel Co., Ltd.

- Dexter Magnetic Technologies, Inc.

- DMEGC Germany GmbH

- Engrenages Hpc Sarl

- KR TECH

- Magnequench International, LLC

- Ningbo Yunsheng Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 243 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.8 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |