Global Automotive Braking Components Market - Key Trends & Drivers Summarized

Why Are Braking Components Critical in Modern Vehicles?

Automotive braking components, including brake pads, rotors, calipers, and sensors, are essential for ensuring vehicle safety by providing precise and reliable stopping power. As vehicles become faster and more powerful, the need for high-performance braking systems has increased significantly. Modern braking systems must be responsive, durable, and able to perform under a wide range of conditions, from high-speed highways to congested urban environments. The growing focus on safety and regulatory requirements, such as the mandatory inclusion of anti-lock braking systems (ABS) in many countries, has made braking components a central feature in vehicle design and development.How Are Technological Innovations Enhancing Automotive Braking Components?

Technological advancements in braking systems are leading to more efficient, safer, and lighter components. Developments in materials science, such as the use of carbon-ceramic materials for rotors and pads, are providing higher heat resistance and longer lifespan, particularly for high-performance and electric vehicles. Additionally, electronic braking systems, including brake-by-wire technology, are being integrated into modern vehicles, offering more precise braking control and reduced mechanical wear. The rise of regenerative braking in electric vehicles is also transforming the market, as braking components are being designed to recover and store energy, enhancing both efficiency and performance.What Regulatory Standards Affect the Automotive Braking Components Market?

Regulatory standards play a critical role in the development and adoption of automotive braking components, with safety regulations requiring that all vehicles be equipped with reliable and high-performing brakes. In Europe and North America, regulations like the Federal Motor Vehicle Safety Standards (FMVSS) and UNECE regulations mandate stringent testing and performance criteria for braking systems, including ABS and electronic stability control (ESC). These standards are continually evolving, with new requirements being added for features such as automatic emergency braking (AEB), which relies on high-quality braking components. Compliance with these regulations is essential for automakers to maintain safety standards and avoid penalties.What Factors Are Driving the Growth of the Automotive Braking Components Market?

The growth in the automotive braking components market is driven by several factors, including increasing vehicle production, advancements in braking technology, and regulatory pressure to enhance vehicle safety. The rise of electric and hybrid vehicles, which require specialized braking components to handle regenerative braking, is contributing to the demand for advanced braking systems. Additionally, the growing popularity of high-performance vehicles is driving demand for premium braking materials such as carbon-ceramic. The implementation of new safety standards, including mandatory ABS and AEB systems, is further fueling the growth of the braking components market, as automakers look to comply with regulations and improve vehicle safety.Report Scope

The report analyzes the Automotive Braking Components market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Brake Caliper Type (Floating, Fixed); Brake Line Material (Stainless Steel, Rubber); Brake Rotor Material (Carbon Ceramic, Cast Iron); End-Use (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Floating Brake Caliper segment, which is expected to reach US$69.1 Billion by 2030 with a CAGR of a 2.4%. The Fixed Brake Caliper segment is also set to grow at 5.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $24.7 Billion in 2024, and China, forecasted to grow at an impressive 5.4% CAGR to reach $23.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Braking Components Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Braking Components Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Braking Components Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACDelco, Akebono Brake Industry Co., Ltd., Aptiv PLC, Brake Parts, Inc., Brembo SpA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Automotive Braking Components market report include:

- ACDelco

- Akebono Brake Industry Co., Ltd.

- Aptiv PLC

- Brake Parts, Inc.

- Brembo SpA

- Cardone Industries, Inc.

- Centric Parts

- Continental AG

- EBC Brakes

- Honeywell International, Inc.

- Japan Brake Industrial Co., Ltd.

- Mando Corp.

- MAT Holdings, Inc.

- Nisshinbo Holdings, Inc.

- Power Stop LLC

- Robert Bosch GmbH

- Tenneco, Inc.

- TMD Friction Holding GmbH

- ZF Friedrichshafen AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACDelco

- Akebono Brake Industry Co., Ltd.

- Aptiv PLC

- Brake Parts, Inc.

- Brembo SpA

- Cardone Industries, Inc.

- Centric Parts

- Continental AG

- EBC Brakes

- Honeywell International, Inc.

- Japan Brake Industrial Co., Ltd.

- Mando Corp.

- MAT Holdings, Inc.

- Nisshinbo Holdings, Inc.

- Power Stop LLC

- Robert Bosch GmbH

- Tenneco, Inc.

- TMD Friction Holding GmbH

- ZF Friedrichshafen AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 244 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

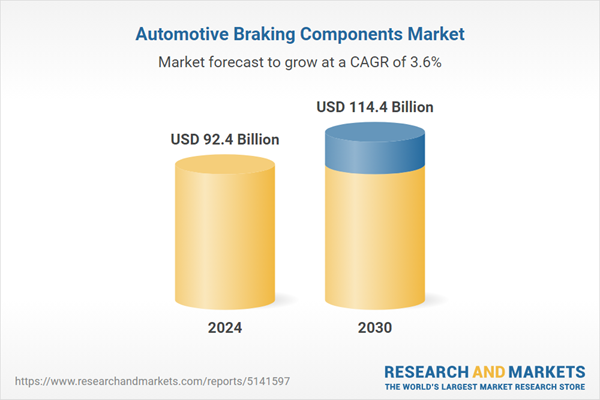

| Estimated Market Value ( USD | $ 92.4 Billion |

| Forecasted Market Value ( USD | $ 114.4 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |