Global Engineering Services Outsourcing Market - Key Trends and Drivers Summarized

Engineering Services Outsourcing (ESO) refers to the practice of contracting various engineering tasks, such as design, prototyping, testing, and product development, to external specialists or firms. These services are commonly utilized in industries such as automotive, aerospace, electronics, and construction, which require high levels of expertise in specific engineering domains that may not be available in-house. By outsourcing these services, companies aim to leverage global talent, reduce costs, accelerate time to market for new products, and focus on their core competencies. ESO providers offer a range of solutions, from complete project management to specific engineering functions, using their expertise to ensure quality and innovation.The ESO market has evolved significantly with advances in communication and project management technologies. These improvements have facilitated smoother collaboration between companies and their outsourcing partners, regardless of geographical distances. Integration of sophisticated software tools such as CAD (Computer-Aided Design), CAM (Computer-Aided Manufacturing), and CAE (Computer-Aided Engineering) within the outsourcing framework has further enhanced the ability of service providers to deliver precise and innovative solutions efficiently. Moreover, as industries increasingly adopt cutting-edge technologies like IoT (Internet of Things) and AI (Artificial Intelligence), ESO firms are also incorporating these tech trends into their offerings to provide more comprehensive, predictive, and adaptive engineering solutions. This shift not only improves the product development cycle but also enhances operational efficiencies and the overall quality of the output.

The growth in the engineering services outsourcing market is driven by several factors, including the increasing complexity of technology, cost pressures faced by businesses, and the need for rapid adaptability in the competitive market. Technological advancements, particularly in digital transformation and automation, necessitate specialized skills that are often more feasible to access through outsourcing than internal development. Economic factors such as cost optimization and access to a global talent pool also play crucial roles in this trend. Companies are keen to capitalize on the strategic advantages offered by outsourcing to mitigate risks associated with the rapidly changing technology landscape. Furthermore, changing consumer expectations demand faster innovation cycles, which outsourcing can help achieve by providing scalable resources and specialized expertise. These dynamics ensure that ESO remains a vital strategy for companies looking to maintain a competitive edge in their respective markets

Report Scope

The report analyzes the Engineering Services Outsourcing market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Services (Testing, Designing, Prototyping, System Integration, Other Services); Application (Industrial, Healthcare, Telecom, Automotive, Aerospace, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Testing Services segment, which is expected to reach US$1.5 Trillion by 2030 with a CAGR of 17.8%. The Designing Services segment is also set to grow at 18.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $322.9 Billion in 2024, and China, forecasted to grow at an impressive 22.1% CAGR to reach $607.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Engineering Services Outsourcing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Engineering Services Outsourcing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Engineering Services Outsourcing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as GlobalLogic, Inc., Altair Engineering, Inc., Edison Welding Institute, Inc., L&T Technology Services Ltd., EPAM Systems, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 55 companies featured in this Engineering Services Outsourcing market report include:

- GlobalLogic, Inc.

- Altair Engineering, Inc.

- Edison Welding Institute, Inc.

- L&T Technology Services Ltd.

- EPAM Systems, Inc.

- Flatworld Solutions Pvt., Ltd.

- DXC Luxoft

- HARMAN Connected Services

- PM Group

- Alten SA

- Cybage Software Pvt. Ltd.

- Cyient Ltd.

- Backoffice Pro

- Capgemini Engineering (France)

- Kevin Technologies Pvt Ltd

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- GlobalLogic, Inc.

- Altair Engineering, Inc.

- Edison Welding Institute, Inc.

- L&T Technology Services Ltd.

- EPAM Systems, Inc.

- Flatworld Solutions Pvt., Ltd.

- DXC Luxoft

- HARMAN Connected Services

- PM Group

- Alten SA

- Cybage Software Pvt. Ltd.

- Cyient Ltd.

- Backoffice Pro

- Capgemini Engineering (France)

- Kevin Technologies Pvt Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 306 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

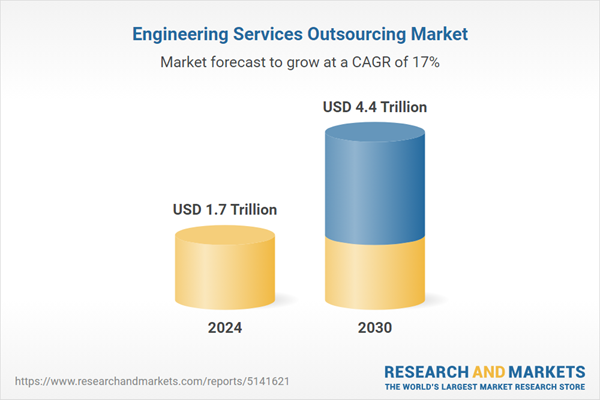

| Estimated Market Value ( USD | $ 1.7 Trillion |

| Forecasted Market Value ( USD | $ 4.4 Trillion |

| Compound Annual Growth Rate | 17.0% |

| Regions Covered | Global |