Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

With its profound impact, Molecular Diagnostics has emerged as an indispensable component of modern clinical practice, playing a pivotal role in disease detection, staging, and therapy monitoring, thus revolutionizing the field of healthcare. For instance, in August 2024, Siemens Healthineers received approval to manufacture the IMDX Monkeypox Detection RT-PCR Assay in India. The kit was set to be produced at the company’s molecular diagnostics unit in Vadodara, which had a production capacity of 1 million reactions. This move marked a significant boost to India’s molecular diagnostics market, enhancing local manufacturing capabilities and supporting timely, large-scale mpox detection amid rising public health preparedness efforts.

The Molecular Diagnostics Market refers to the sector of the healthcare industry that focuses on the use of molecular biology technologies for medical testing. This field employs techniques such as polymerase chain reaction (PCR), in situ hybridization, DNA sequencing, and others to analyze biological markers in the genome and proteome. These techniques are used to diagnose and monitor disease, detect risk, and decide which therapies will work best for individual patients. The market encompasses various infectious diseases, oncology, genetics, and blood screening tests and is continually growing, driven by technological advancements and the increasing prevalence of infectious diseases and various types of cancer.

Key Market Drivers

Large Outbreaks of Bacterial and Viral Epidemics

Large outbreaks of bacterial and viral epidemics are significantly increasing the demand for molecular diagnostics in India. These diagnostic techniques, which include polymerase chain reaction (PCR) tests, nucleic acid amplification tests (NAATs), and next-generation sequencing, play a pivotal role in the rapid and accurate identification of infectious pathogens, such as bacteria and viruses. Several factors contribute to the growing need for molecular diagnostics during epidemic outbreaks in India.The ability to quickly and accurately diagnose the causative agents of epidemics is essential for effective outbreak management and containment. Molecular diagnostics can provide precise information about the infectious agent's genetic material, facilitating targeted treatment, contact tracing, and quarantine measures to mitigate the spread of the disease. This is especially critical during outbreaks of highly contagious diseases, such as COVID-19.

Molecular diagnostics offer a higher degree of sensitivity and specificity compared to traditional diagnostic methods, allowing for the detection of pathogens at very low concentrations. This is particularly relevant in the early stages of an epidemic when the infection may be less widespread, and traditional tests might yield false-negative results. The versatility of molecular diagnostics allows for the detection of various pathogens from a single sample, enabling healthcare professionals to simultaneously screen for multiple infectious agents. This capability is invaluable during outbreaks where the identification of co-infections or emerging variants is crucial for appropriate patient management and public health decision-making.

The COVID-19 pandemic has underscored the importance of molecular diagnostics in India and has led to significant investments in testing infrastructure and technology. As the country continues to face challenges from both known and emerging infectious diseases, the demand for molecular diagnostics is expected to remain high. Ensuring accessibility, affordability, and the rapid deployment of these advanced diagnostic techniques is vital for effective epidemic control and public health preparedness in India.

Key Market Challenges

Limited Budgets for R&D and Economic Slowdown

Limited budgets for research and development (R&D) combined with economic slowdown are indeed impacting the demand for molecular diagnostics in India. While molecular diagnostics have proven to be invaluable in healthcare, the economic challenges in the country can hinder their widespread adoption. One of the primary factors contributing to the decreased demand for molecular diagnostics is the constrained budgets allocated for R&D in the healthcare sector. Research and development are essential for the innovation and advancement of diagnostic technologies. Limited funding for R&D can hinder the development of new diagnostic tests, improvements in existing tests, and the validation of novel applications.This can result in a slower pace of technological innovation and limit the introduction of cost-effective and accessible molecular diagnostics. The economic slowdown in India, particularly in recent years, has put financial pressure on both healthcare institutions and individuals. Healthcare budgets have been strained, leading to reduced investments in advanced diagnostic technologies. The individuals may be less inclined to seek out expensive molecular diagnostic tests due to financial constraints, especially when alternative, less costly diagnostic options are available.

The high initial capital expenditure required for setting up molecular diagnostic laboratories and the ongoing operational costs can be challenging for healthcare facilities, particularly in resource-constrained areas. This further contributes to the limited accessibility of molecular diagnostics. To address these challenges and stimulate demand for molecular diagnostics in India, there is a need for strategic investments in R&D, healthcare infrastructure, and affordable diagnostic solutions. Government initiatives, public-private partnerships, and innovative financing models can help overcome economic hurdles and facilitate broader access to molecular diagnostics. By mitigating these financial barriers, India can harness the full potential of molecular diagnostics in improving patient care and disease management.

Key Market Trends

Rapid Technological Advancements

Rapid technological advancements, characterized by their ability to deliver accurate results, portability, and cost-effectiveness, are expected to have a significant impact on India's molecular diagnostics market. As companies strive to stay ahead in this competitive landscape, they are continuously upgrading their products by implementing new techniques that enable them to achieve specific and precise results.Notably, industry leaders like Sigma Aldrich Corporation and QIAGEN are at the forefront of developing a new range of molecular diagnostic techniques. These include innovative methods such as Transcription-Mediated Amplification (TMA) and Loop-Mediated Isothermal Amplification (LAMP), which are proving instrumental in the diagnosis of various tumors. The growing utilization of multiplex PCR technologies and real-time PCR equipment, such as the EpiTect Methyl II PCR by QIAGEN for the detection of DNA methylation, is expected to further propel the market during the forecast period.

With such advancements and continuous innovation, the molecular diagnostics market in India is poised for significant growth, offering improved diagnostic capabilities and contributing to the overall advancement of healthcare in the country.

Key Market Players

- Roche Diagnostics India Pvt Ltd

- Abbott India Ltd

- Qiagen India Pvt Ltd

- BioMérieux India Pvt Ltd

- Becton Dickinson Pvt Ltd

- Bio-Techne India Pvt Ltd

- Danaher India (DHR Holding India Pvt. Ltd.)

- Bio-Rad laboratories India Pvt.Ltd

Report Scope:

In this report, the India Molecular Diagnostics Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Molecular Diagnostics Market, By Application:

- Infectious Disease

- Blood Screening

- Genetic Testing

- Oncology Testing

India Molecular Diagnostics Market, By Technology:

- PCR

- In-situ Hybridization

- Chips and Microarrays

- Mass Spectrometry

- Sequencing

- Others

India Molecular Diagnostics Market, By End User:

- Hospitals

- Academic & Reference Laboratories

India Molecular Diagnostics Market, By Region:

- North

- South

- West

- East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Molecular Diagnostics Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Roche Diagnostics India Pvt Ltd

- Abbott India Ltd

- Qiagen India Pvt Ltd

- BioMérieux India Pvt Ltd

- Becton Dickinson Pvt Ltd

- Bio-Techne India Pvt Ltd

- Danaher India (DHR Holding India Pvt. Ltd.)

- Bio-Rad laboratories India Pvt.Ltd

Table Information

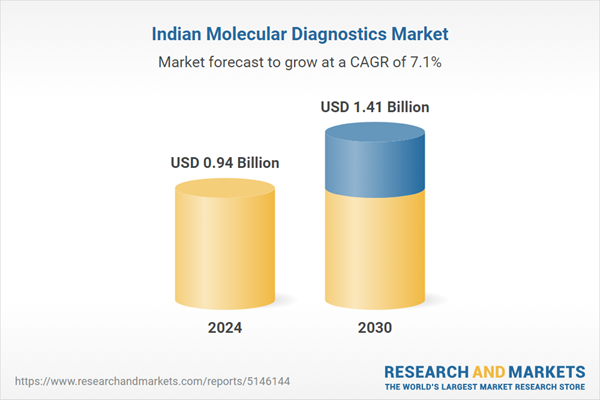

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.94 Billion |

| Forecasted Market Value ( USD | $ 1.41 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 8 |