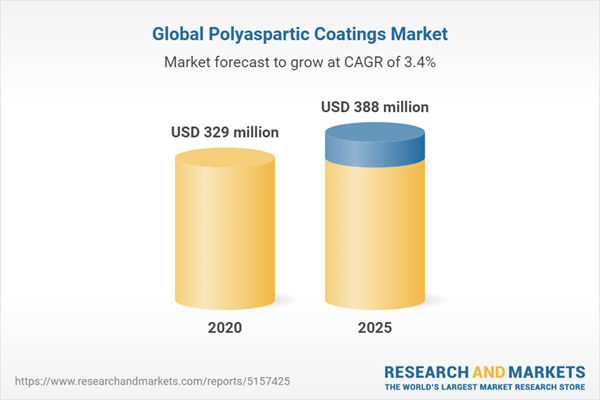

The global polyaspartic coatings market is estimated at USD 329 million in 2020 and is projected to reach USD 388 million by 2025, at a CAGR of 3.4% between 2020 and 2025.

Polyaspartic coatings are more expensive than their substitutes such as epoxy and polyurethane coatings. This increased cost is due to the high prices of raw materials, the cost involved in developing aliphatic polyurea systems, and high investments made by manufacturers in R&D to develop the product. Also, the need for skilled workforce during formulation and operation increases the cost of its application. Thus, the high cost acts as a major restraint to the demand for polyaspartic coatings. However, increasing awareness about polyaspartic coatings is a major opportunity for various market players.

“Building & construction end-use industry holds the largest share in the global polyaspartic coatings market.”

Polyaspartic coatings are widely used in the building & construction industry. Their application areas include bridge construction, commercial architecture, floor & roof coating, caulks, joint fill, parking decks, concrete repair, and structural bonds. Polyaspartic coatings are used as topcoats, stone carpets, sealants, and waterproofing. The use of polyaspartic coatings in infrastructure is increasing because they have good wear, abrasion, and weather resistance. Polyaspartics are available in high-solid formulations. In order to meet VOC regulations, improve aesthetic appeal and corrosion control, they are used as topcoats. The slow growth of building & construction sector in addition to the impact of COVID-19 is expected to slow down the demand of polyaspartic coating during the forecast period.

“100% solids polyaspartic segment is expected to register the highest CAGR in the global polyaspartic coatings market during the forecast period.”

100% solids polyaspartic coating is a result of the chemical reaction of isocyanates and amine-terminated resins. 100% solids polyaspartic plays a vital role in determining the properties of the final coated surface. These systems serve a wide variety of applications including coating or lining applications over substrates such as concrete or metals to protect them from corrosion. The main advantages of 100% solids polyaspartic over hybrid polyaspartic are rapid reactivity, better chemical & mechanical resistance, high resistance to tearing, better abrasion & impact resistance, and resistance to water.

“APAC is projected to record the highest growth rate during the forecast period.”

There is an increase in the consumption of polyaspartic coatings in the building & construction, transportation, industrial, and power generation industries in APAC due to industrialization and growth in the building & construction sector of the region. Growing innovation & development and rising demand from the industrial sector for improved products are driving the use of polyaspartic coatings. China is investing in commercial and residential construction in order to meet the infrastructure demand of the growing population which in turn plays a vital role in driving the market for polyaspartic coatings in the country.

The growing offshore wind energy sector in China is also anticipated to drive the polyaspartic coatings market during the forecast period.

Research Coverage

This research report categorizes the global polyaspartic coatings market on the basis of type, system, end-use industry, and region. The report includes detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, and opportunities. Detailed analysis of the key market players provides insights into business overviews, services, key strategies, and recent developments associated with the market.

The leading players in the polyaspartic coatings market are The Sherwin-Williams Company (US), PPG Industries (US), BASF SE (Germany), AkzoNobel (Netherlands), Hempel (Denmark), Carboline (US), Rust-Oleum (US), Laticrete International (US), SIKA AG (Switzerland), Feiyang Protech (China), Indmar Coatings (US), Satyen Polymers (India), and VIP Coatings (Germany).

Extensive primary interviews were conducted to determine and verify the market size for several segments and subsegments and information gathered through secondary research.

The breakup of primary interviews is given below:

- By Company Type - Tier 1 - 25%, Tier 2 - 42%, and Tier 3 - 33%

- By Designation - C level - 20%, Director level - 30%, and Others - 50%

- By Region - Europe - 20%, APAC - 50%, North America - 10%, South America - 10%, and Middle East & Africa - 10%

Reasons to Buy the Report

The report will help market leaders/new entrants in this market in the following ways:

1. This report segments the global polyaspartic coatings market comprehensively and provides the closest approximations of market sizes for the overall market and subsegments across verticals and regions with the impact of COVID-19

2. The report will help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, and opportunities.

This report will help stakeholders understand the major competitors and gain insights to enhance their position in the business. The competitive landscape section includes expansions, acquisitions, & agreements, company evaluation matrix and market share analysis.

Table of Contents

Companies Mentioned

- Advantage Chemical Coatings

- AkzoNobel

- BASF SE

- Carboline

- Chromaflo Technologies Corporation

- Duraamen Engineered Products Inc.

- Flexmar Polyaspartics

- Hempel

- Indmar Coatings

- Iron Man Coatings

- Laticrete International

- Lifetime Flooring Systems

- Nippon Paint

- Polyset

- PPG Industries

- Prokem Speciality Chemicals

- Rhino Lining Corporation

- Rust-Oleum

- Satyen Polymers

- Shorecrete Coatings LLC

- Sika AG

- The Floor Company

- The Sherwin-Williams Company

- US Coatings

- VIP Coatings Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | September 2020 |

| Forecast Period | 2020 - 2025 |

| Estimated Market Value ( USD | $ 329 million |

| Forecasted Market Value ( USD | $ 388 million |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |